Insight Focus

- China and India have altered trade flows as they focus on food security.

- Elsewhere, some countries have too much rain, while others have too little, playing havoc with the wheat crop.

- Issues in Australia and Argentina have caused the USDA to revise production estimates downwards.

Markets are still struggling to rise from lowly values as the ‘Bears’ maintain control.

As wheat crop production numbers in the Southern Hemisphere remain in the balance, reports continue to question the roles of China and India as we head towards 2024.

The need for balance between the big exporters and the two most populous countries in the world must not be underestimated.

Weather Disrupts Wheat Crop

In the wheat baskets of Northern and Western Europe the rain continues to disrupt plantings and cast shadows over crop potential for the 2024 harvests.

As we see in France, where plantings labour to 67% complete, versus an 87% average, there are doubts as to whether some fields will be sown with wheat before the winter sets in.

Flooding has also hit large areas of Northern Europe. A waterlogged field not planted will inevitably not yield much of a crop, but even a field planted can see significant and irreparable damage if flooding rots the young plants.

Argentina and Australia have also both experienced difficult dry growing seasons for their wheat crops.

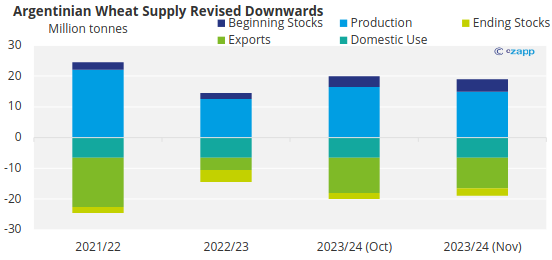

As harvests roll, production estimates are not improving, with some poor yields reported in parts of Australia and the latest USDA World Agriculture Supply and Demand Estimates (WASDE) report lowering the Argentine crop further, from 16.5 million tonnes to 15 million tonnes.

However, in the Black Sea region crops look more encouraging. Reports from Ukraine estimate nearly 90% of the winter wheat is drilled while crops are expected to fare well through the harsh winter months, despite some late planting.

Demand Pockets Emerge from China, India

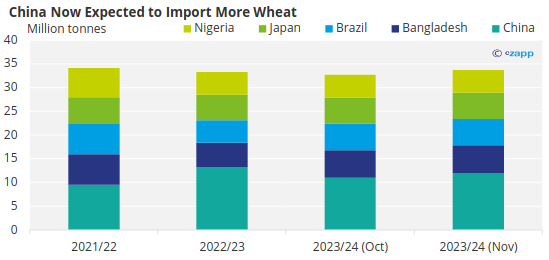

We have recently seen that China has leapt to the top of the world leading importer league as the 10 million tonnes or more purchased surpasses Egypt.

The rain impacted Chinese crop suffered from both quality and yield loss, paving the way for unprecedented global purchases this year.

India has not been idle either. Within recent months, it has discussed purchasing between 9 million and 10 million tonnes of wheat, much of which may be needed to stem food security and price concerns, with worries of domestic price inflation on the horizon. If India does import this much wheat, it would cause major waves for the market since it currently imports minimal amounts.

Concluding Thoughts

The rain keeps falling over Northern Europe, bringing gale force storms and troubles for both the planted and the yet to be planted wheat crops.

As combines roll, the lack of rain in Argentina and Australia has damaged the 2023 harvests beyond repair, as forecasts dwindle.

China has leapt to the purchasing table, scooping up what wheat has been available for many months, as its own crop distresses emerged.

India meanwhile is on a path to potentially join the buying spree with price and food security a must for the politicians.

Global wheat markets are currently being driven by the ‘Bears’, but as we head to the year end, there is precious little certainty to the supply and demand economics for 2024.