Insight Focus

- Sugar cane prices have risen in 2023/24 and the secondary settlement is re-activated.

- This should result in a recovery of cane area and higher output in 2024/25 season.

- China still faces a shortage of sugar due to competing crops, infrastructure and energy.

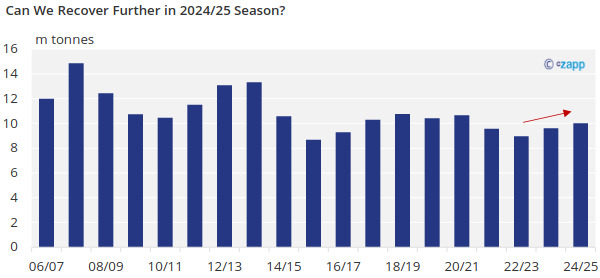

China is a sugar deficit country. Sugar production has trended downward since it peaked at 14.84m tonnes in 2007/08.

Source: CSA, Czapp

Sugar prices have been high for the past 3 years, but cane mills haven’t really responded. Even if mills have been willing to provide more support to cane farmers, the industry has been hit by the covid pandemic and poor weather. In 2022/23 sugar production fell below 9 million tonnes for only the second time in 17 years.

But now China’s benchmark sugar cane price has finally risen.

Guangxi Raises Cane Price for 2023/24

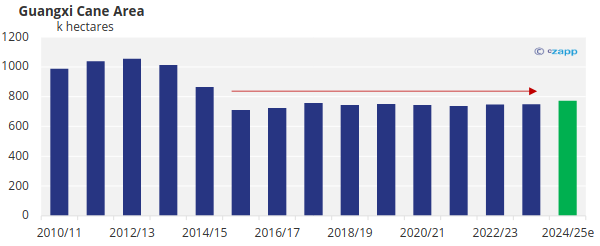

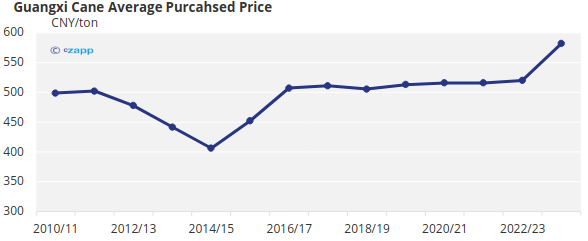

Guangxi is China’s largest sugarcane and sugar producing region, accounting for 60 percent of the country’s sugar production. Over the past 16 years, the purchase price of sugar cane in Guangxi has barely risen (if not the other way around). In recent seasons, subsidies have been carried out to renovate cane land and encourage farmers to switch back to cane, but these only kept the area from falling.

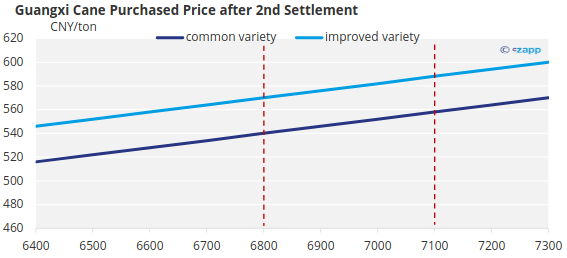

But after three years of high sugar prices, the industry is finally moving. The provisional cane price for the 2023/24 season has been increased by 30 yuan/tonne, and the secondary settlement mechanism has also been reactivated.

This means that if the sugar price stays in range of 6,800 to 7,000 yuan/tonne next year, farmers can get 570 to 582 yuan/tonne for improved-variety cane, an increase of 10% to 12% on 2022/23 levels.

According to the Guangxi Sugar Industry Development Office, the coverage rate of improved varieties has reached 98%. We think this may be due to subsidies for improved varieties to farmers in the past few seasons, but the actual coverage rate may be lower than the official level.

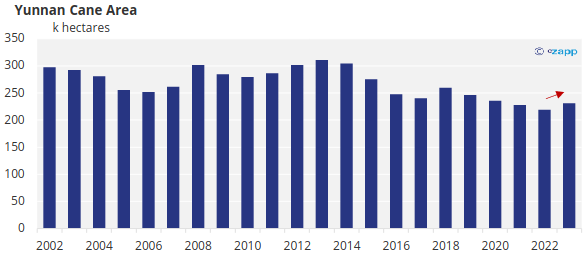

Yunnan Also Saw Cane Prices Rise and Area Recover

Yunnan’s cane price is one step ahead: the secondary settlement was implemented in the 2022/23 season. The purchase price has therefore risen from 450 yuan/tonne to about 470 yuan/tonne. This is the first time since implementation that the mechanism has actually realized additional benefits for farmers.

The provisional price of sugar cane for the 2023/24 season has also been raised by 20 yuan to 470 yuan/tonne, before secondary settlement.

For the 2023/24 season, Lincang City, the largest producing area in Yunnan province (accounting for 1/3 of the total are in Yunnan), has responded. Sugarcane planting area reached 1.12 million mu (74.7 thousand hectares), an increase of 5.53% over the previous year.

Let’s Have Modest Expectations for The Future

This may lead to an increase in cane area, but we should be calm about it. The cane acreage will probably fluctuate around the government’s red line of 1m hectares of sugarcane protected areas drawn in 2018.

Because the change in sugarcane area is like a classic math problem: How long does it take to fill the pool with water and drain it at the same time?

Aging Population and The Workforce

China’s population has reached a turning point in 2022, with the first negative population growth in nearly 61 years. Now, the effects of the labour shortage in agriculture are slow but not negligible.

Sugar cane is far less profitable than fruit and vegetables. But fruit and vegetable yields are volatile, risky and dependent on stable logistics (fruit and vegetable farmers experienced huge losses during the COVID lockdown period).

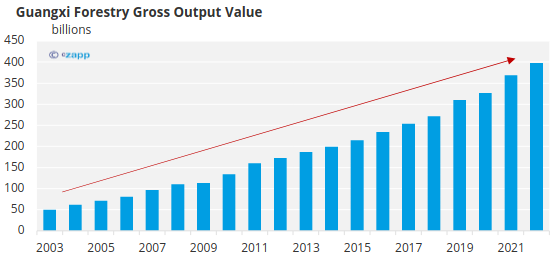

The eucalyptus industry has seen huge growth in the past 20 years. The total output value of Guangxi’s forestry industry has increased eightfold in the past 20 years. Eucalyptus plantations have also grown from 1.7 million hectares in 2000 to 3 million now.

Including subsidies, sugarcane’s planting return is better than eucalyptus. However, eucalyptus has the advantage of requiring very little labour.

Eucalyptus is usually planted on a five-year cycle, and little labour is required after planting. Farmers can then work in cities to earn a second income.

In a previous report, we mentioned Guangxi’s efforts to switch eucalyptus land back to sugar cane. But in other areas, eucalyptus trees are slowly encroaching on cane land. Remember the pool calculation problem from above?

Grain Competes with Sugar Cane for Land

Since 2014, Guangxi has implemented the “dryland to paddy fields” farmland quality improvement project, to form a stable grain production capacity. By the end of 2021, the region had approved and reported 940 projects, and 405,200 mu (27k ha) of new paddy fields (for grains) had been added.

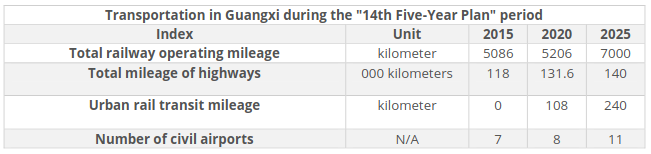

Infrastructure Is Also Competing with Agriculture for Land

From 2019 to 2021, the annual construction and occupation of arable land in Guangxi was about 6,000 hectares to 8,000 hectares, of which paddy fields accounted for 50%.

During the “14th Five-Year Plan” period, Guangxi should implement national development strategies such as the Belt and Road, new western land-sea corridor, and the construction of an international major channel for ASEAN. Therefore, it will take up more farmland. In order to ensure the cultivated land area, Guangxi must replenishment to balance the arable land.

The goal is to increase the area of paddy fields by 230,000 mu by 2023. This means that the space for sugarcane area growth is subject to many constraints and may even have to make concessions for food.

Green Energy, Another Competitor

With the promotion of the “carbon peak & carbon neutral” goal and the “14th Five-Year Plan” new energy development plan, Guangxi photovoltaic industry has ushered in a new period of development.

In 2022, the region’s newly installed photovoltaic capacity of 2.083GW, an increase of 95.4%; In the list of major projects in Guangxi in 2023, more than 50 photovoltaic power plant projects are involved, with a scale of 9.363GW.

This also means that the crowding out of farmland will become a long-time problem.

Is Improved Seed the Future of Cane Industry?

In 2023, the average sucrose yield in Yunnan reaches 13.28%, ranking first in the country and reaching a record high. Among them, a sugarcane variety stood out.

“Yun-cane 0551” passed the national identification of new sugarcane varieties in 2013, obtained the right of new plant varieties in 2016, and passed the national registration of non-major crop varieties in 2020. The variety has the features of early maturity, high yield, high sugar content, strong drought resistance and wide adaptability.

In a hundred-mu consecutive plots of dry land in Yunnan, this cane variety achieved an average yield per mu of 9.2 tonnes (138 mt/ha), a new record in the country. In 2022, its planting area reached 501,200 mu, ranking first in Yunnan province.

In the case of limited area growth, the improvement of varieties may have more room for future growth. Both require sustained high sugar prices to stimulate investment.