516 words / 2.5 minute reading time

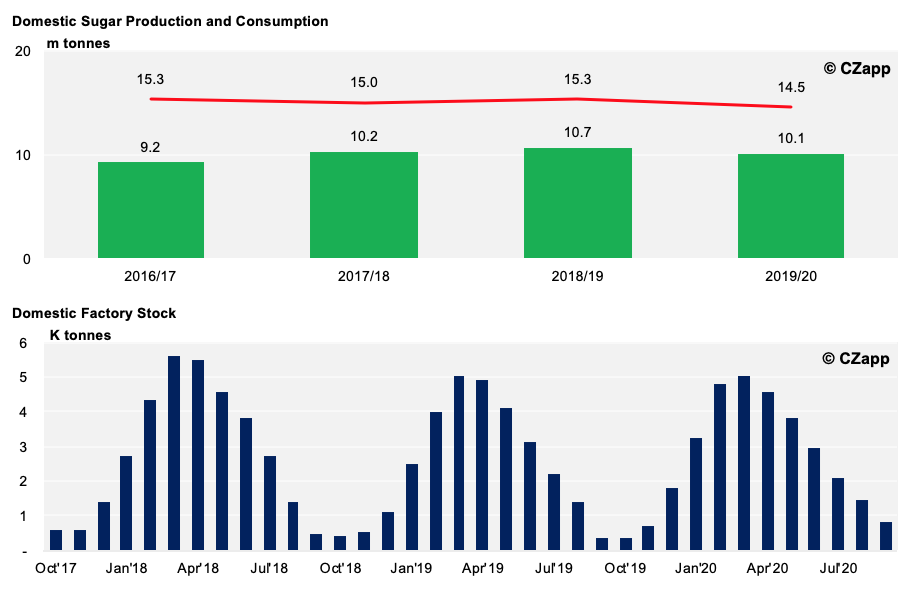

- Factory stock levels at the end of March are unchanged from last year, but the uncrushed cane will be significantly reduced year-on-year (YoY).

- The factory sales’ performance remained weak against COVID-19 and the supply competition from the refineries.

- The turning point for the ongoing pandemic is yet to be seen, which means the macro-environment is not optimistic.

Market News

Physical & Futures Prices

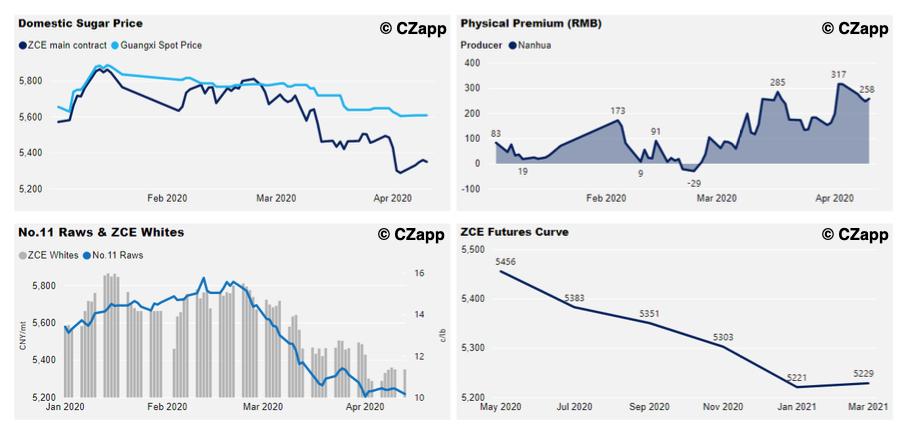

- The average price of Guangxi was 5609 yuan/mt. The price remains stable and the physical premium is down at 258 yuan/mt.

- The physical sales in Guangxi are quite weak now. The sales performed better in Yunnan, however, due to the price cut and the free highway toll fee policy. However, the highway toll fee will be recharged from May, so the sales afterwards depend on the recovery of the end-users’ demand.

- The settlement price for No.11 raws on Monday was 10.31 c/lb.

- The ZCE September contract has picked up from the previous week and settled at 5289 yuan/mt on Monday. The spread between May and September is up to 105 yuan. The price of future contract is lower because market expects the out-of-quota (AIL) import cost to reduce from 85% to 50% as of 22nd May 2020.

Domestic Supply & Demand

- The factory stock remained unchanged YoY at the end of March.

- Most of the mills have finished crushing, with just Yunnan still operating. The balanced sugar production in Yunnan is estimated to be between 300-400k tonnes and the fresh supply during same time last year was about 860k tonnes.

- As for refined sugar, the refineries in Shandong, Liaoning, Jiangsu and Guangdong have started operating and are supplying approximately 50k tonnes per week.

- In terms of sugar smuggling, the current margin is about 200 USD/mt. The actual profit could be higher. due to the free highway toll fee policy. But thanks to the control measures, the smuggling flow remains low.