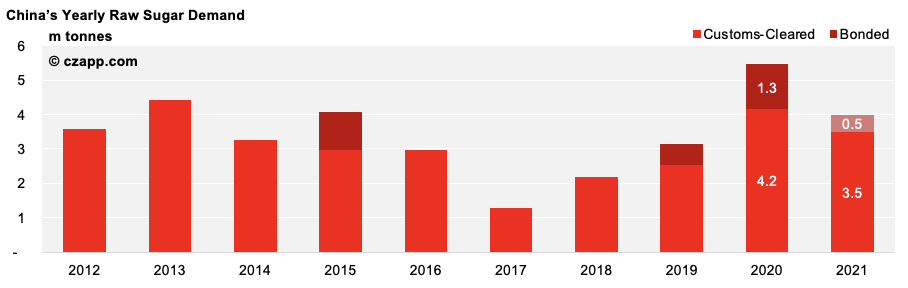

- We think China could import just 3.5m tonnes of raw sugar this year.

- This is down 2m tonnes from 2020’s record.

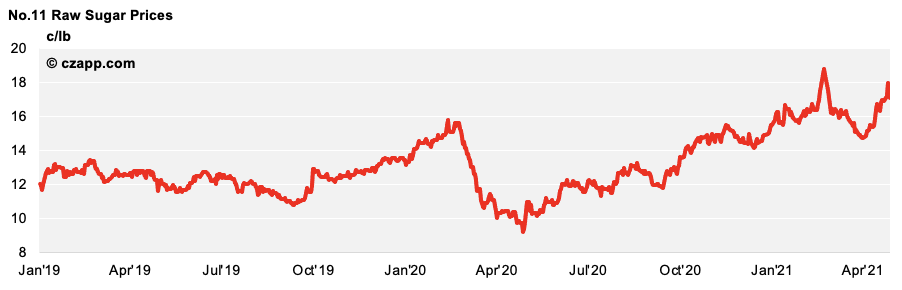

- The drop in demand comes as raw sugar prices are high at present.

Chinese Raws Demand Takes a Dive

- We think China could import 3.5m tonnes of raw sugar this year, down 1m tonnes from our previous estimate.

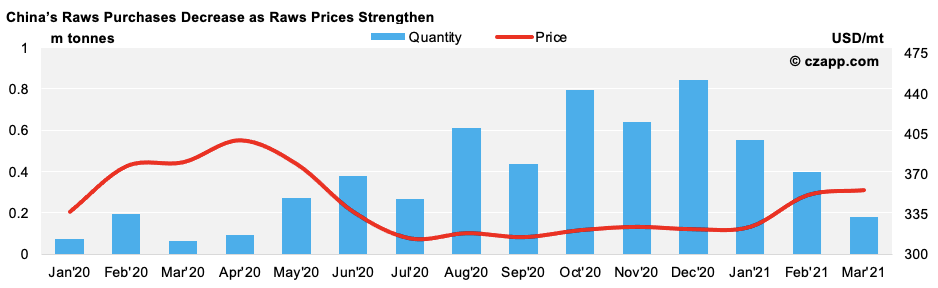

- This is because high raw sugar prices have made buying unattractive, so the refineries would rather keep stocks low.

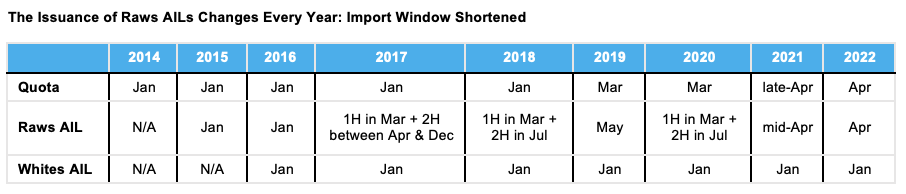

- China’s raws imports also require approval from the Ministry of Commerce, and they’re being slower than ever this year.

- The refineries are therefore being more cautious around their stock build, as it took them years to run down their 2015 build, which cost them a lot of money.

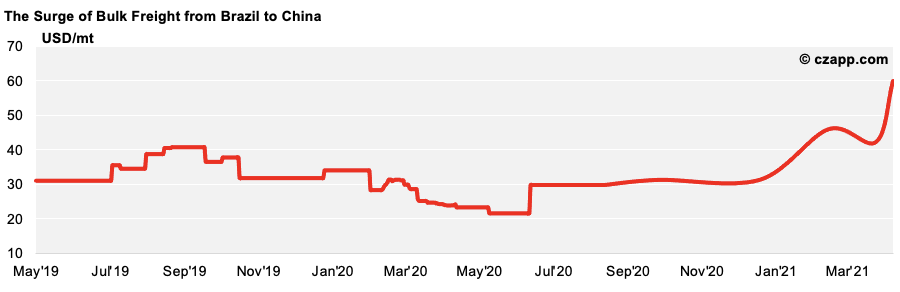

- Freight rates have also surged, which has only lessened the refineries’ import appetite.

- For context, 4.1m tonnes of China’s 2020 raw sugar was bought when it was $330 CIF China, 30% less than today’s CFR China price (476 USD/mt).

- We therefore think China’s refineries will wait for raws prices to retreat before buying.

- They mustn’t wait too long though as the Ministry of Commerce allegedly wants the refineries to import all their raws by October this year, which is significantly earlier than the usual end of December deadline.

- This is because the Ministry of Commerce plans to halt its issuance of Automatic Import Licenses (AILs) between November and April (the peak period for cane crushing).

Liquid Sugar Out of the Picture

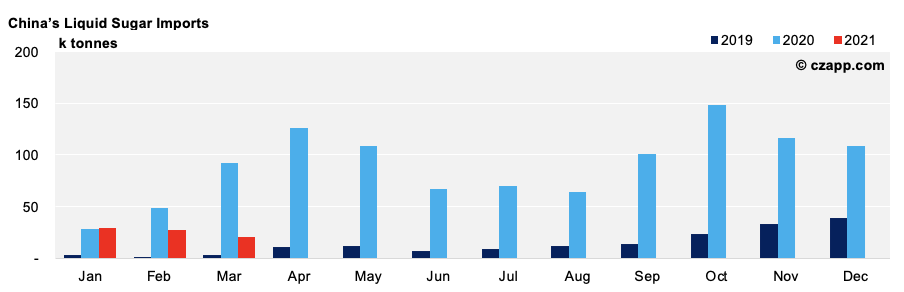

- We think China will import no more than 200k tonnes of liquid sugar this year, down from last year’s 1.08m tonnes, after strong import flows attracted negative attention from the Ministry of Commerce and China’s Customs.

- On the one hand, this is bad news for the refineries as they were a key liquid sugar importer; they mixed it with raws to up their sugar output.

- On the other hand, it’s good news, as domestic cane, beet and refined sugar will all win back market share.

Explainers You Might Be Interested In…