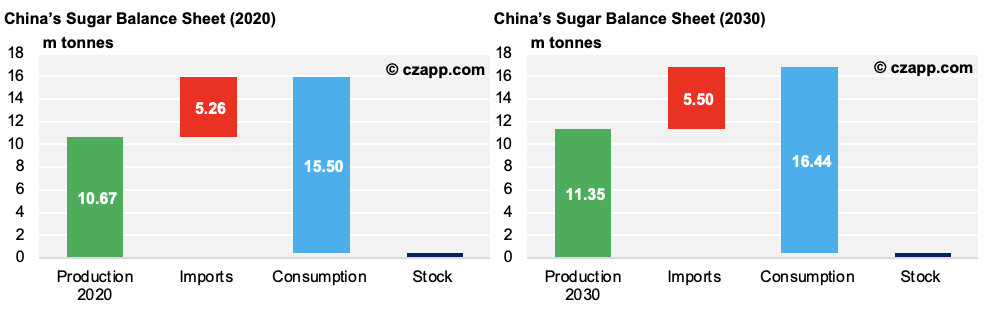

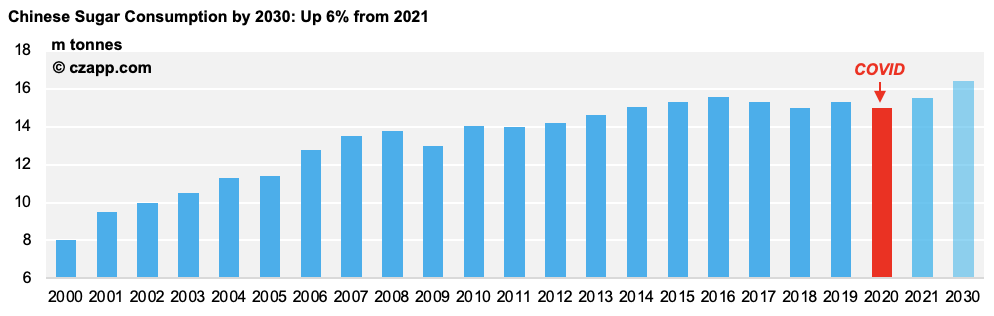

- Chinese sugar consumption could grow by just 940k tonnes between now and 2030.

- Sweetener consumption is on the rise and consumers are becoming more health conscious.

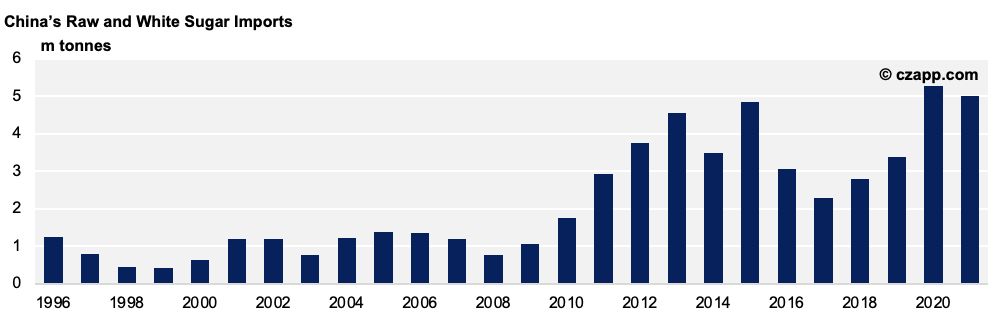

- Nevertheless, it should remain a net sugar importer.

Chinese Sugar Consumption: Hardly Growing

- According to Chinese Agriculture Outlook Committee, China will consume 16.44m tonnes of sugar in 2030, up 940k tonnes from today.

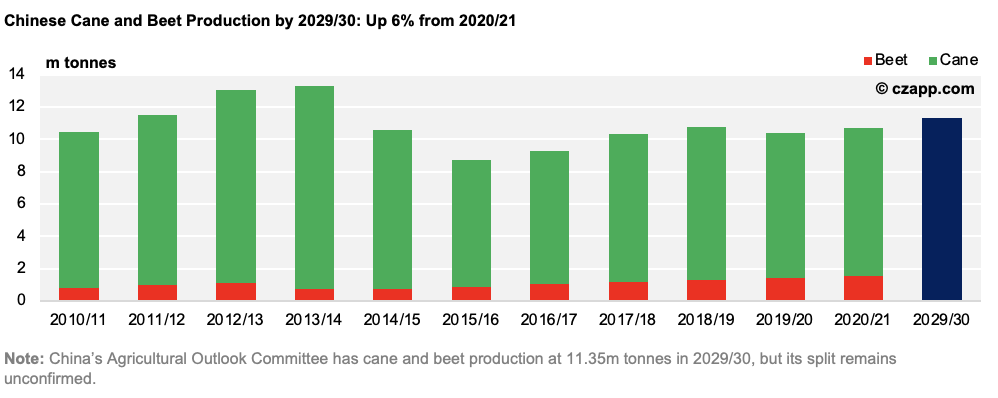

- Production is only set to climb by 650k tonnes and total 11.35m tonnes.

- With this, it’ll remain a deficit producer and need to import around 5m tonnes of sugar a year.

Why is Consumption Hardly Growing?

- We think its sugar consumption is hardly growing because:

- Consumers are becoming increasingly more aware of the link between excessive sugar consumption and poor health.

- The Government’s encouraging residents to reduce their sugar intake and advocates the use of natural sweeteners.

- China’s birth rate is slowing, and its elderly population is growing; the elderly consumes less sugar for health reasons.

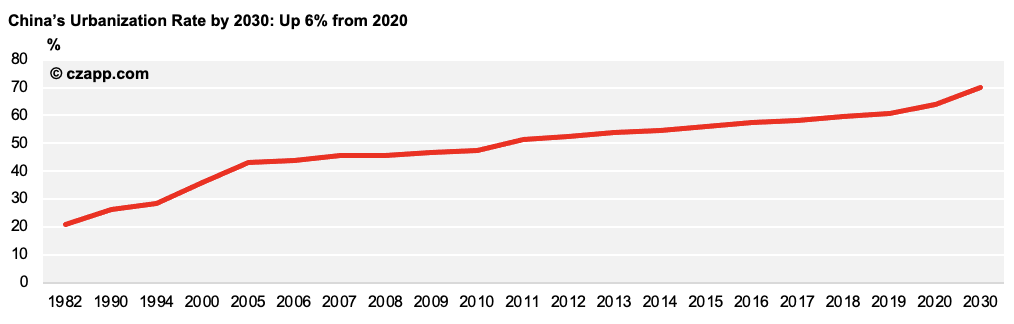

- Fortunately, this cloud has a silver lining as urbanization in China is supporting sugar consumption.

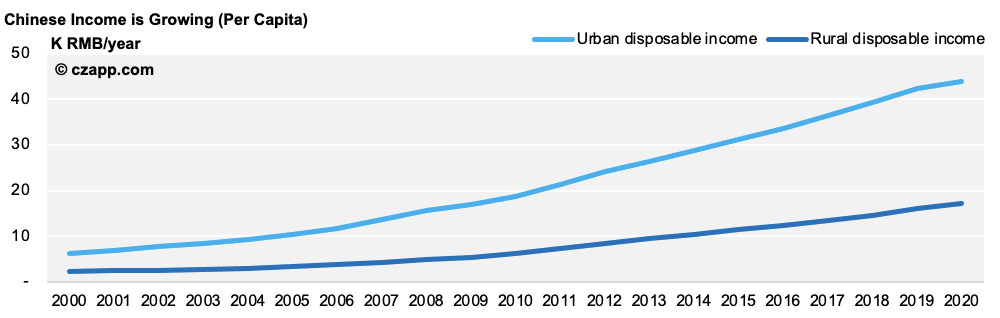

- More people are moving from rural areas to urban cities, where they earn more money and sugary food and beverages are more accessible.

- As China’s average income continues to grow, more will be able to justify buying these products.

Why is Production Hardly Growing?

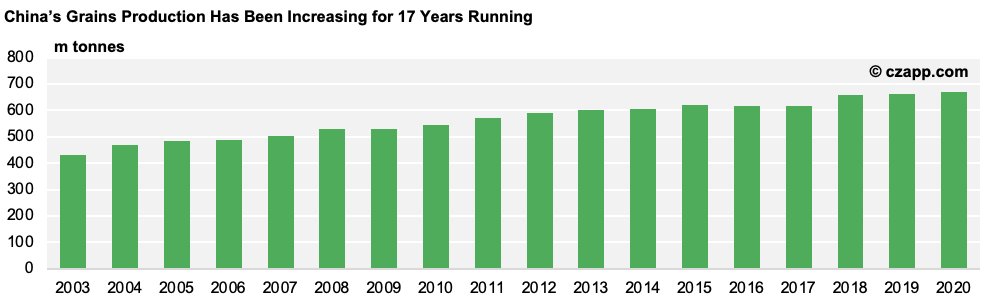

- Food security has always been a top priority for the Chinese Government.

- Production of other food staples (e.g. corn) should therefore grow going forward at the expense of sugar production.

- China’s demand for grain should also continue to grow for as long as it works to re-establish its pig herd, which was decimated by the African Swine Fever.

- By as soon as next season, we think China will produce 400k tonnes less sugar than it does today as many of its beet farmers will have likely turned to corn in search of greater returns.

What’s Does This Mean for the World Market?

- We think China will remain one of the world’s largest sugar importers across the next decade.

- It should import 5.1m tonnes sugar a year, down by around 250k tonnes from last year’s record.

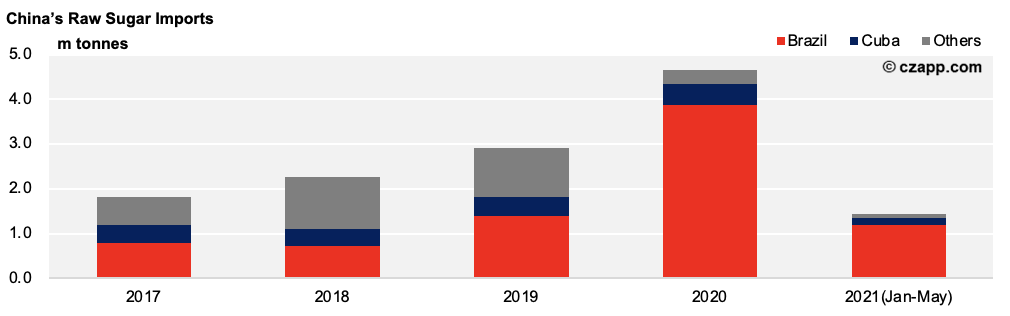

- Around 90% of this should be raw sugar, as is the case today.

- It’ll want its refineries to maximise production to prevent imported white sugar from flooding the market.

- As it stands, over 80% of its raw sugar comes from CS Brazil (the world’s largest raw sugar supplier).

- This should remain the case for the next decade, which bodes well for CS Brazilian suppliers.

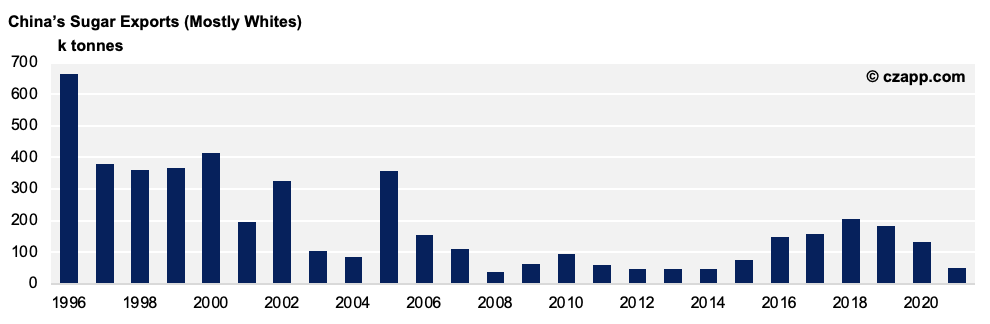

- China hardly exports any sugar, so nothing should change in that department.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…