Opinions Focus

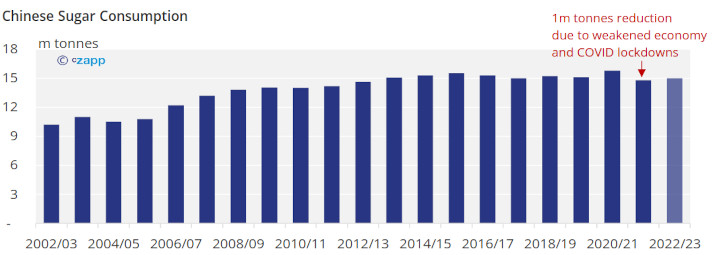

- Chinese sugar consumption in 2022 might have been the lowest in 9 years.

- 2023’s outlook isn’t much better: zero-covid and a weaker economy are hitting consumption.

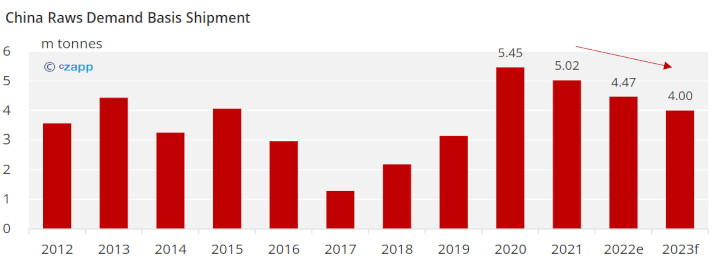

- This could lead to reduced raw sugar import demand in 2023 too.

Lockdowns and Gloomy Economy Hurt China’s Sugar Consumption

We think Chinese sugar consumption will be only 15m tonnes in 2023. This is a little less than it was in 2014. In other words sugar consumption hasn’t grown in nearly a decade and has fallen on a per capita basis.

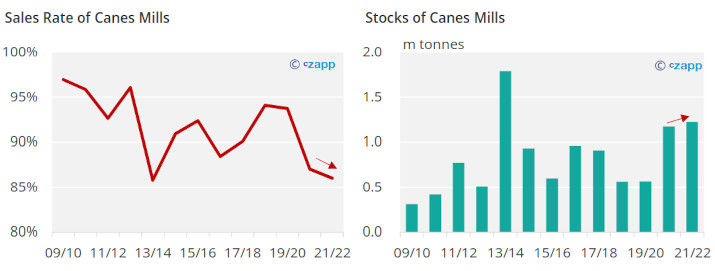

It is already clear that Chinese sugar consumption was less than 15m tonnes in 2022: sugar production and imports combined were 2.1m tonnes lower than in 2021 yet cane mills’ sugar stocks have increased.

Cane mills’ sugar sales were the slowest in 7 seasons with 1.2m tonnes of sugar unsold by the end of September. We think the sluggish sugar consumption is due to covid lockdowns and the weaker economy.

Zero-COVID To Continue?

We had wondered if China’s zero-covid policy might be relaxed in the future, but the 20th National Congress of the Chinese Communist Party concluded last Sunday and it looks as though the policy will continue. During lockdowns, out of home food and drink consumption is curtailed, and this tends to reduce sugar consumption.

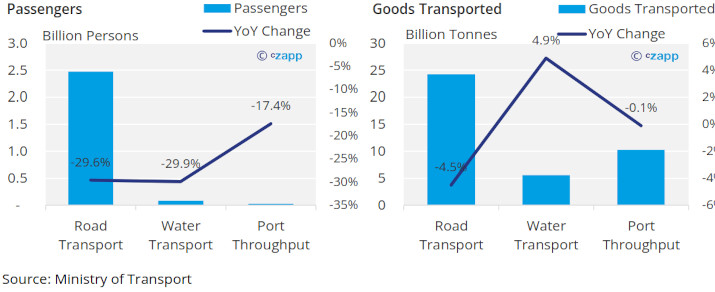

Food production can also be affected. Lockdowns interrupt the flow of labour and raw materials, and therefore food production. Chinese road and water passenger movements in Jan-Aug 2022 were 30% lower year-on-year. The volume of goods transported in this time was also lower. Worse, there was a heatwave in the Yangtze River area in 2022 and some food and beverage factories were affected by power rationing.

Consumers Worry about Food Inflation

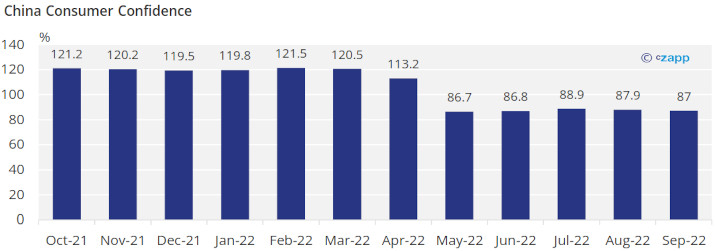

In many countries, we think sugar is a cheap source of calories and is enjoyable to eat, and is therefore recession-proof. However, in other countries this may not be the case. China could fall into the latter category.

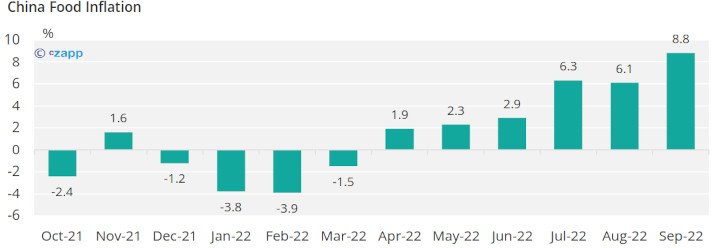

A particular problem is domestic price inflation. Food prices in China increased by 8.8% on an annualized basis in September 2022.

This was the 6th consecutive month of rising food prices. Household food budgets are being squeezed. Consumers will probably accept price inflation of necessities but could cut back on more discretionary food and drinks.

For example, one of China’s best-known bubble teas, Heytea, is now cutting prices to try to tempt consumers back; consumers seem to be buying less or moving to cheaper brands. Mixue Bingcheng, another brand of bubble tea, is 70% cheaper than Heytea and is now also launching coffee drinks at RMB 5 to compete with Luckin Coffee, which typically charges RMB 20.

Source: NBSC

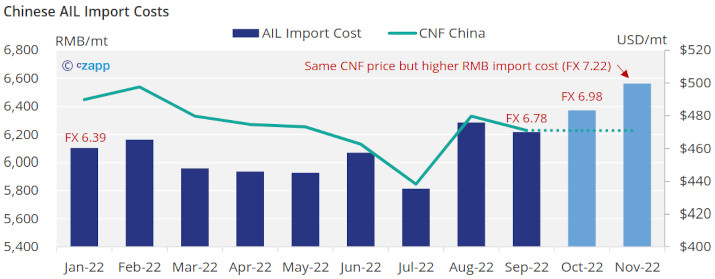

Food inflation may get worse before it gets better. The RMB has fallen sharply against the US Dollar, making imports more expensive. Look at the cost of sugar imports:

- The CNF cost of raw sugar imported in September 2022 was $471/mt, $19 less than in January, but the AIL cost increased by RMB 111/tonne due to RMB depreciation.

- Today’s RMB/USD exchange rate is over 7.2, which means that even if import prices for the next two months remain at $471/tonne, sugar costs in Yuan will increase by extra RMB 347/tonne.

Source: China Customs

Raw Sugar Imports to Suffer?

If we are right with our forecast, weak local demand could depress sugar prices in 2023. This might mean another year where China’s sugar refiners struggle with negative import margins. China is usually one of the largest importers of raw sugar in the world each year, but its demand in 2023 might be low for a third year running.