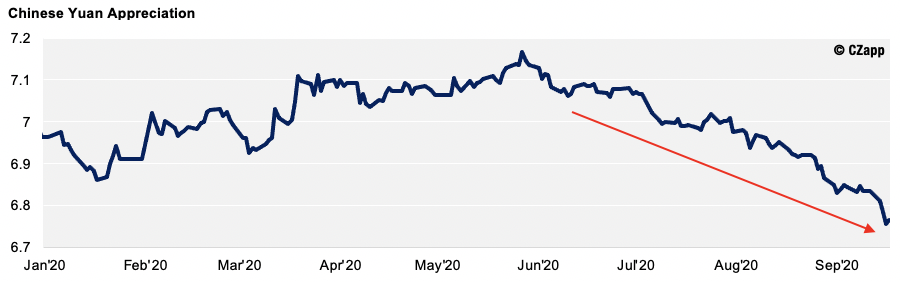

- The Chinese Yuan has strengthened 6% in the past four months, increasing the attractiveness of raw sugar imports.

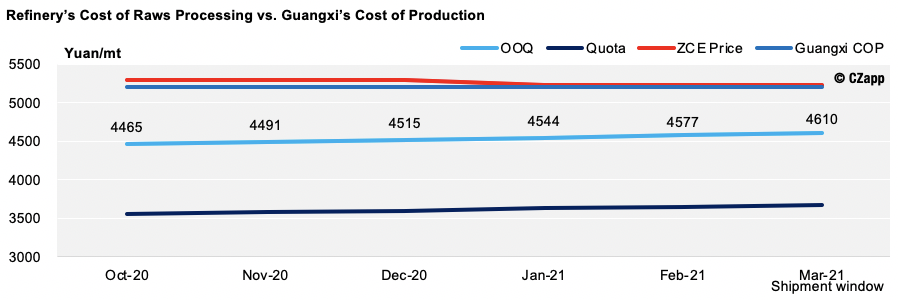

- With this, China’s refineries are keen to import more raw sugar whilst the import parity is appealing.

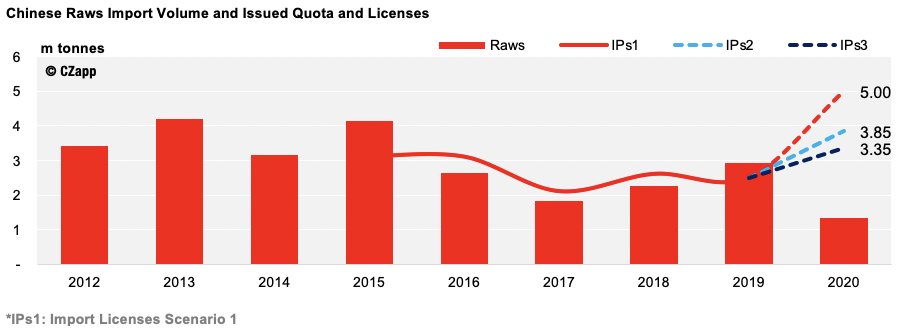

- However, the Ministry of Commerce continues to delay the issuance of the additional import licenses, meaning they are unable to do this.

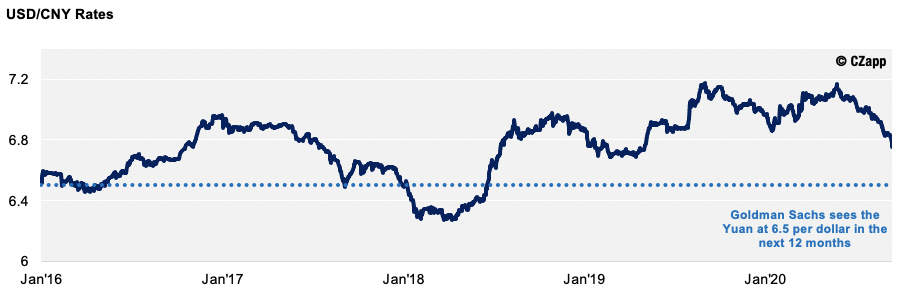

The Chinese Yuan Appreciates, Incentivising Raws Imports

- The Chinese Yuan has strengthened 6% in the past four months, meaning raw sugar imports are now more viable.

- Import parity currently sits at $123/mt (USD) and should stay positive until the No.11 breaks above 15c/lb, as sugar prices are supported above 5200 Yuan (the mills’ cost of production).

- With these healthy margins, China’s refineries are now looking to buy more raw sugar.

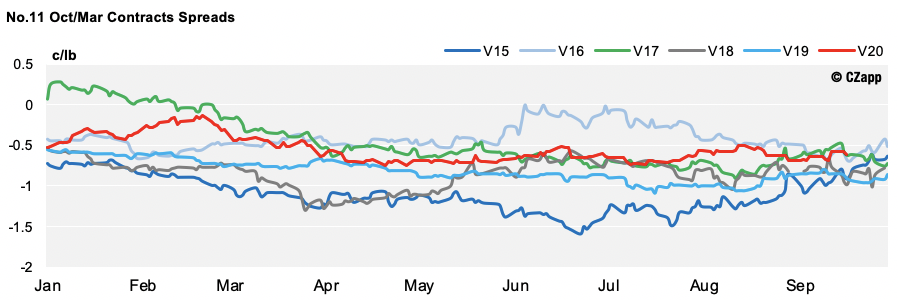

- This is because many chose not to build stocks for 2021 when the spreads for the Oct’20 and Mar’21 contracts were near the cost of carry at -70pts.

But Importing is Proving Difficult…

- China’s refineries want to import more sugar whilst prices incentivise it but are unable to do so until more licenses are issued.

- However, the Ministry of Commerce is taking it slow, meaning we are unsure how much more they will be able to import.

- So far, 16 refineries and four trade houses have had their annual processing capacity of 6.9m tonnes registered, meaning 3.45m tonnes of additional imports could be granted for 2H’20.

- However, we suspect that somewhere between 0.5-1m tonnes will actually be issued between now and the end of the year.

- If so, China’s refineries will have received somewhere in between 3.35-3.85m tonnes of additional import licenses in 2020, down from our previous 5m tonne estimate.

- That being said, China’s raws demand could remain firm in Q4’20 with 0.5m tonnes raws nominated so far; some Chinese trade houses think this volume to increase to 1m tonnes.

- This means the annual raws demand could be 4.2m tonnes and over 1m tonnes of bonded raws will be carried into 2021.

The Yuan Could Strengthen Further

- The Chinese Yuan has seen a sizeable appreciation since Jun’20, from 7.18 to 6.75 (up 6%).

- Goldman Sachs thinks the Yuan will reach 6.50 per dollar in the next 12 months.

- This means the raw sugar import parity will remain supported.

Other Opinions You Might Be Interested In…