Insight Focus

- The container shipping industry has become extremely consolidated since 2014.

- Recently, MSC and Maersk announced the end of their 2M partnership in 2025.

- For other shipping partnerships, does this spell a new era?

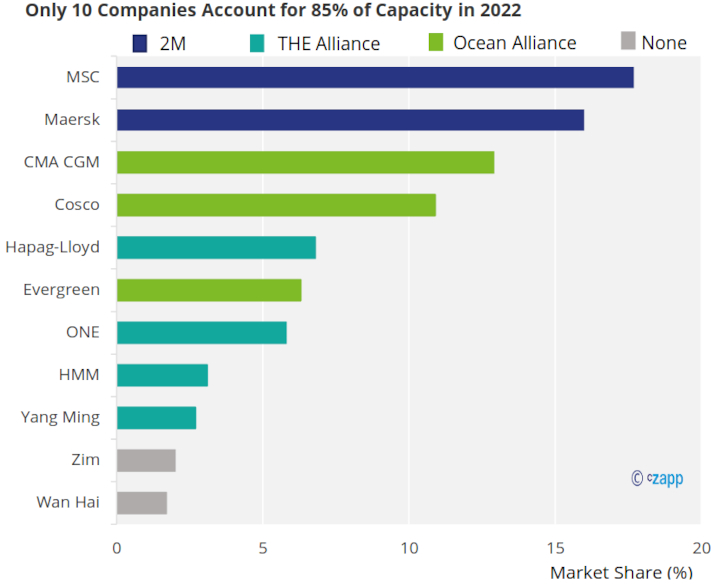

Container shipping firms Maersk and MSC recently announced they would end their 10-year 2M partnership in 2025. While several independent shipping firms still exist, three large alliances – including 2M – account for 80% of global trade. Given that it is the biggest partnership by far, Czapp takes a look at what this decision mean for the other players in the industry.

Shipping Consolidation Begins

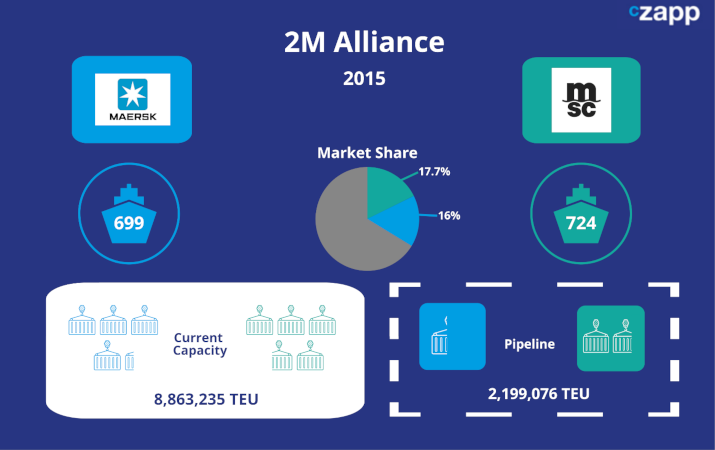

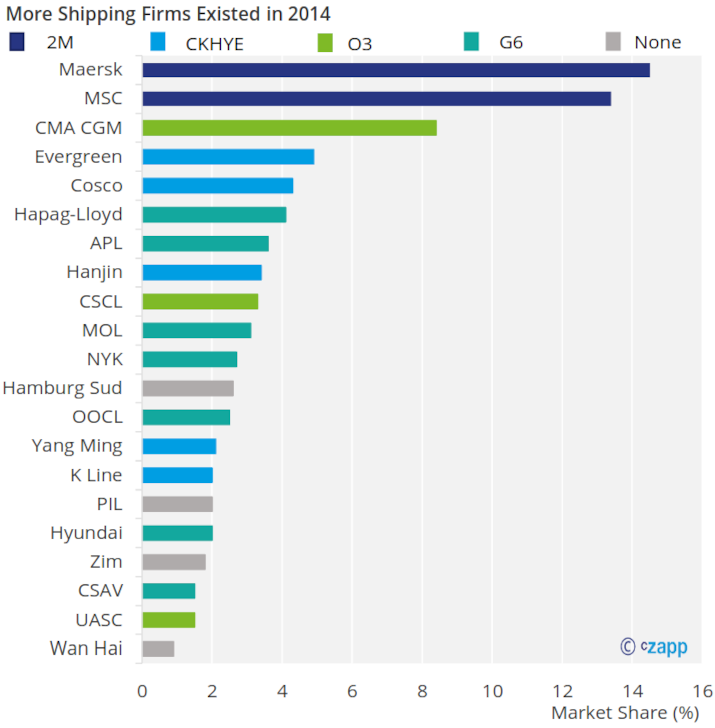

In 2014, the first move toward consolidation in the shipping industry took place when MSC and Maersk announced their 2M partnership. Just a few years later, French carrier CMA CGM teamed up with Asian firms COSCO, OOCL and Evergreen to create the Ocean Alliance.

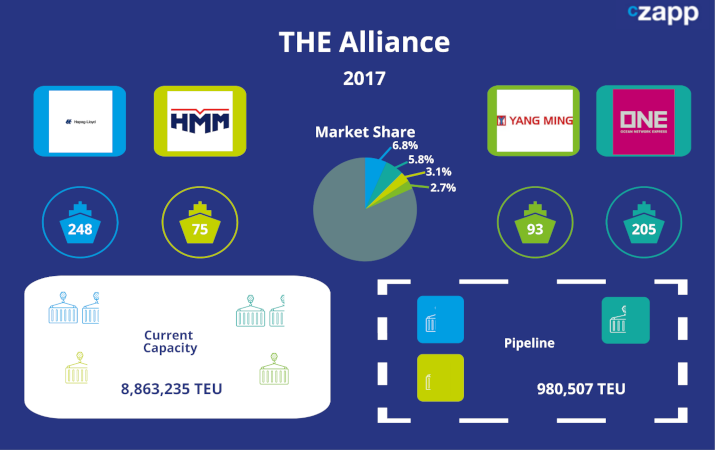

That same year, NYK Line, Hapag-Lloyd, K-Line, MOL and Yang Ming partnered up to form THE Alliance. Each alliance specializes in a particular route or region.

Source: St Louis Fed

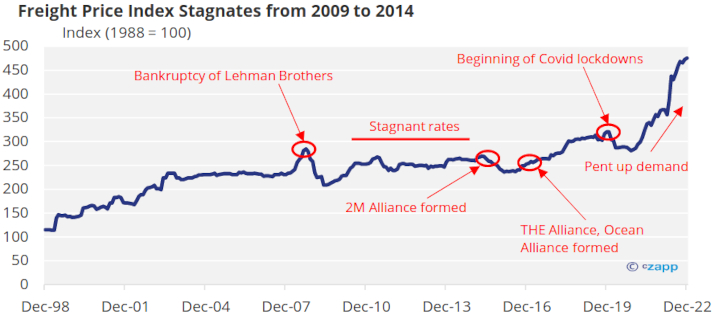

At the point these alliances were formed, container shipping firms had struggled with stagnating rates in the wake of the Great Recession of 2008.

After 2017, freight prices did begin to rise as new efficiencies were generated and the industry consolidated. In 2022, 10 companies accounted for about 85% of global container shipping capacity, versus 21 companies in 2014.

Source: Alphaliner

After a small blip at the beginning of the Covid-19 pandemic, pent up demand drove up prices. This even caught the attention of US President Joe Biden, who criticized the industry’s consolidation and signed the Ocean Shipping Reform Act in a bid to lower fees charged.

2M Decides to Separate

Now as recession looms, storm clouds are gathering. Despite a lower price environment looming, MSC and Maersk recently announced their partnership would come to an end in 2025.

Source: Alphaliner

Maersk has said the decision not to renew the alliance is “a consequence of Maersk accelerating [its] integrator strategy” and cites operational control as a key factor. It said it wants its fleet to remain the same size – about 4.1 million to 4.3 million TEU – while it grows through efficiencies.

There has been speculation over whether Maersk will embark on a new partnership. Some believe CMA CGM would be a good fit if it leaves Ocean Alliance since both companies share similar LNG and methanol fuel strategies. Zim has also been floated as a potential ally given that it already provides North American services for 2M.

THE Alliance

THE Alliance has undergone several reshuffles since its formation in 2017. South Korea’s Hanjin collapsed and later that year, Japanese firms K-Line, MOL and NYK banded together to form ONE. Later, South Korean company Hyundai Merchant Marine (HMM) joined THE Alliance.

Source: Alphaliner

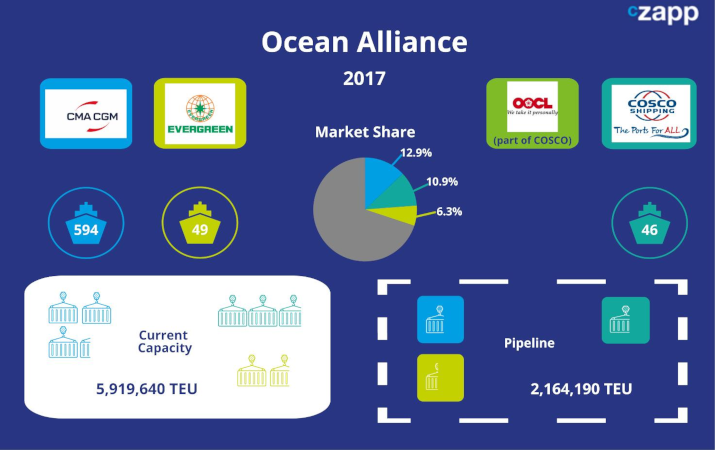

Ocean Alliance

The Ocean Alliance is the second-largest alliance behind 2M. It is formed by French firm CMA CGM, Taiwanese company Evergreen and Chinese shipping giant COSCO, along with its OOCL subsidiary.

Source: Alphaliner

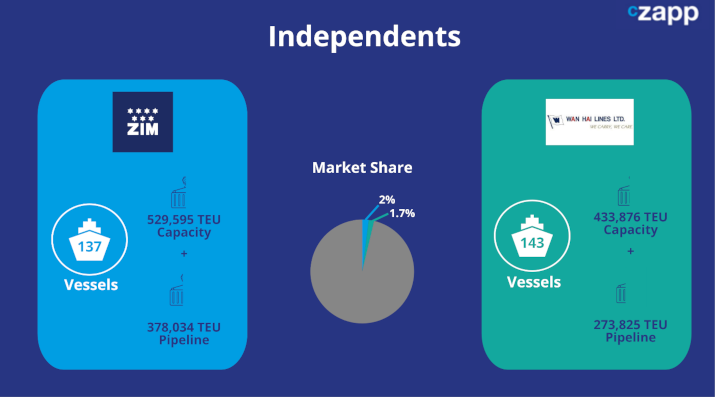

The Biggest Independents

Independent firms are few and far between as of 2023 but by far the largest is Israeli company Zim, which has struck up synergies with some of the major alliances without fully joining. Another notable name is Wan Hai, a Taiwanese firm with almost 500,000 TEU of capacity.

Source: Alphaliner

Concluding Thoughts

Shipping alliances have always been and will always be useful. They not only help to drive efficiencies in rates but also drive compliance with environmental and emissions standards.

And they’re nothing new – G6 Alliance ran from 2012 to 2016, while CKHYE was discontinued in 2017 after three years. The O3 Alliance likewise no longer exists.

Source: Maersk

If other alliances separate, there could be much more competition, but it seems that the Maersk/MSC move does not indicate a new era for the container industry.

We know the others will continue to operate through to at least 2027 and any separation is unlikely due to freight rates already dropping. However, as global demand picks up beyond 2025 and emissions standards kick into high gear, by 2027 the picture could be far different.

If you’d like to know more about the freight market, check out our series of freight explainers by clicking the link below:

Czapp Explains – Freight series: Types of Freight