Insight Focus

- No surprises are expected on the Wheat front.

- US Corn condition worsened 3 pts to 53% good or excellent vs. 54% last year.

- French Corn is 80% in good or excellent condition and Corn harvesting in Ukraine has started.

Forecast

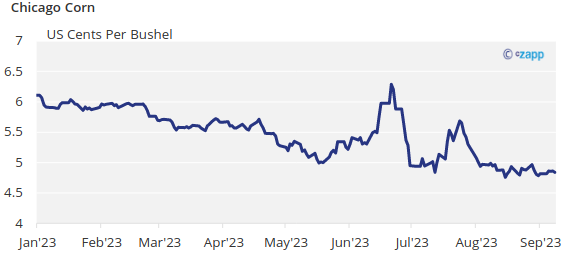

No changes to our Chicago Corn average price forecast for the 2022-2023 September-August crop in a range of USD 6 to USD 6.5 per bushel. The average price since 1 September is running at USD 6.26 per bushel.

Market Commentary

Flat to small gains for Corn, and flat to small losses for Wheat in all geographies as the market waits for the September WASDE this week Tuesday.

US grains anticipated a worsening crop condition last week and moved higher ahead of the weekly report that confirmed that worsening. Chicago Corn consolidated gains on expectations of a downward revision in this week’s WASDE while Wheat saw some selling by the end of the week.

US Corn condition worsened 3 pts to 53% good or excellent vs. 54% last year. This is the lowest rating since 2012. Corn area under drought increased by 4 points and is now 49%. French Corn is 80% in good or excellent condition down two pts week on week and vs. 44% last year. Harvesting made no progress staying at 1% of the expected planted area vs. 5% last year. Corn harvesting in Ukraine has also started.

In Brazil, Safrinha Corn is 89,2% harvested vs. 97,1% last year. Conab increased their Corn production forecast to 131.8 million tonnes vs. 129.9 before. In Argentina, BCR is forecasting 2023-2024 production at 56 million tonnes the first estimate for the new crop vs. 34 million tonnes of the old crop which finished harvesting last week.

Wheat continued to feel harvest pressure and winter Wheat planting has started already. US spring Wheat is 74% harvested vs. 68% last year. The area of US Wheat under drought was 46% unchanged from the previous week. Winter Wheat planting for the new crop has started and is 1% planted vs. 3% last year. Ukraine has also started Wheat planting with also 1% of the area planted. Russian Wheat is 69.9% harvested vs. 80.9% last year.

In the weather front, rains were confirmed in Brazil last week with the south of the country hit by record rains which are expected again this week but not with the same intensity as last week. In the US near or above normal precipitation is expected this week. In Europe heat was felt in central and western Europe but some relief and some rains are forecast this week.

All eyes are now on the September WASDE due this week. We think Corn yield will be reduced as conditions have been worsening, but we don’t expect that reduction to be significant and we think the bulk of it has been priced already. We may have seen the low in prices. No surprises are expected on the Wheat front.

Flat to small gains for Corn, and flat to small losses for Wheat in all geographies as the market waits for the September WASDE this week. We think Corn yield will be reduced as conditions have been worsening, but we don’t expect that reduction to be significant and we think the bulk of it has been priced already. We may have seen the low in prices. No surprises are expected on the Wheat front.