668 words / 3 minute reading time

- Due to coronavirus, vessels have been laid-up waiting for Chinese export demand to recover.

- Shipping lines have also extended their Blank Sailing Programmes (BSPs) in response to falling Chinese exports.

- This has resulted in a record drop in sailings from Asia to North America and Europe.

China Back in Business, Trouble Elsewhere

- Logistics operations are returning back to normal in China.

- We have heard that approximately 80% of truck drivers in China are now back at work.

- Shipping lines’ vessel calls at Chinese ports are also returning to their regular seasonal levels.

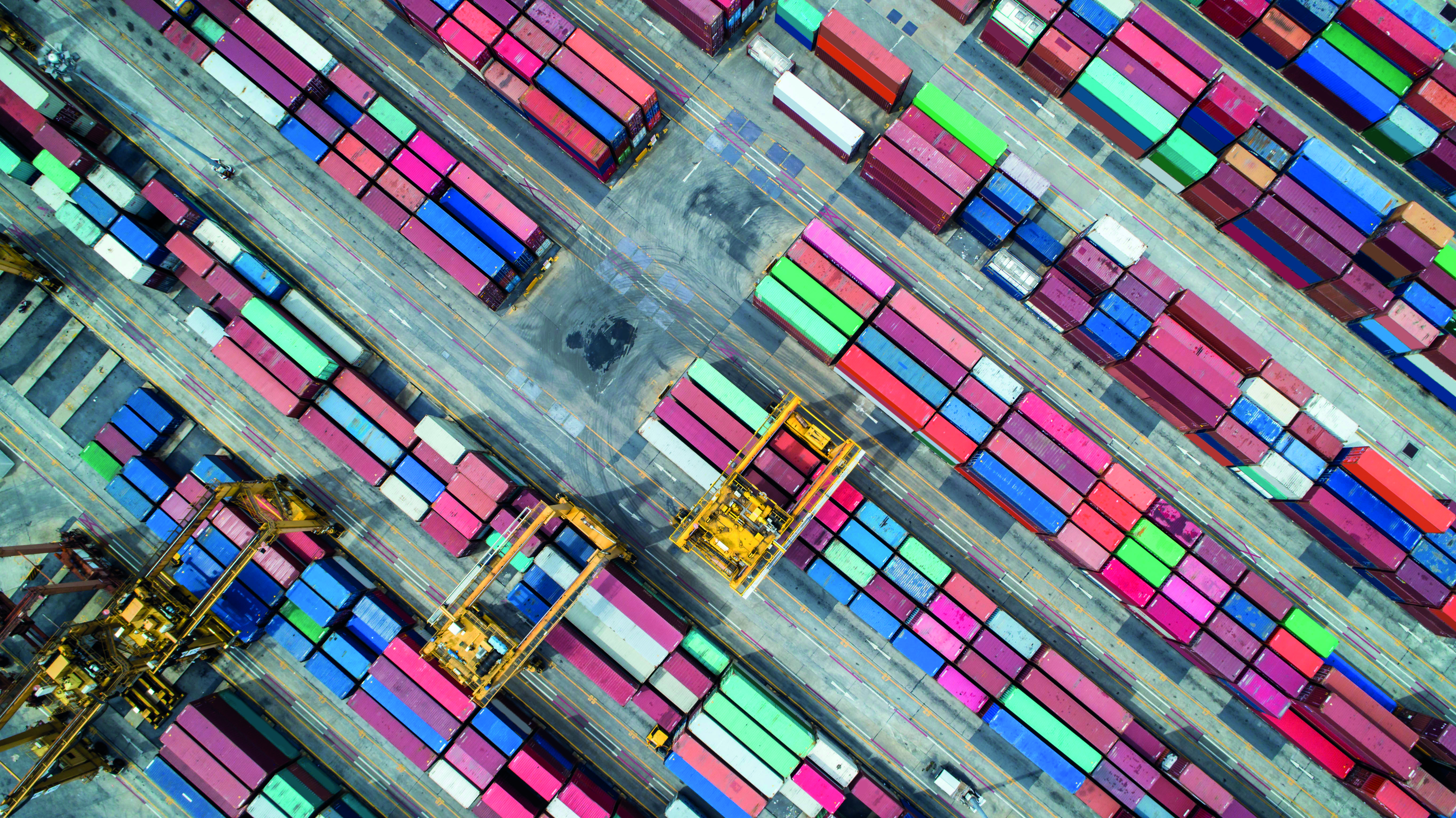

- However, there are not enough containers at ports in Asia to accommodate increasing export demand.

- Many shipping lines are therefore increasing the size of the vessels calling at US West Coast ports, in an effort to maximise the volume of equipment returning to Asia.

- With export demand out of China increasing and limited equipment supply, outbound rates from Asia are likely to continue increasing for the coming month or so.

What Does the Future Hold?

Trade to be Impacted in Lockdown Zones

- As the situation in China improves, the focus shifts to the pandemic in Europe and North America.

- The scale of the pandemic in these regions will determine whether Asian rates continue to rise.

- Both import and export demand could be impacted if countries implement stringent lockdowns.

Airfreight Demand and Rates Increasing

- In order to maintain supply chain stability, many shippers have had to seek alternative methods of moving their goods.

- Cancelled passenger flights, which supplement commercial supply of air freight cargo space, are further limiting supply of air freight and pushing up rates even further.

Export Demand in Asia Surging

- Shippers are looking to diversify their supply chains and move away from single-origin sourcing, resulting in demand in many Asian ports surging.

- Equipment Imbalances Continue to Hike Rates in Shortage Regions

- Large volumes of Reefers (refrigerated containers) remain stuck in Asian ports, resulting in a global shortage of refrigerated equipment and a spike in Reefer rates.

- The global container equipment balance is reliant on a consistent movement of vessels back and forth on the key east/west arteries, with containers being repositioned back to Asia via backhaul.

- The drop in vessels returning from Europe and North America to Asia has led to a significant equipment imbalance with a surplus of containers in places such as the US West Coast and a shortage of equipment in many Asian ports.

- As the virus spreads, limiting imports, exports and cross border movements of containers, equipment imbalances are likely to remain an issue in many regions.

Shipments out of India Face Increased Risk of Rollover and Rate Increases

- A sharp increase in exports and limited equipment supply in India has resulted in shipping lines implementing peak season surcharges and offering limited capacity.

Decreased Volumes Impact Revenue

- Shipping lines are looking to other sources beyond ocean freight as means for recovering the drop in revenues seen over the past couple months. One of which ways is by reverting to tariff free time agreements and levying additional charges for any additional free time offered.

- This is causing issues in virus-hit regions where delays are being faced in the clearance of cargo.

Bunker Costs Fall

- With oil prices dropping, the bunker portion of freight rates can be expected to fall in the coming months, the exact timing of which will depend on the formula being used however many shipping lines have announced reduced values for April shipment.

We will provide updates on all of the above in Czapp’s biweekly Freight Update.