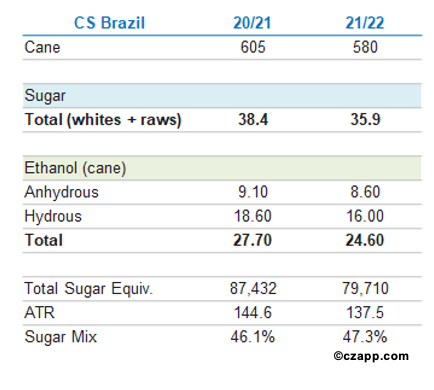

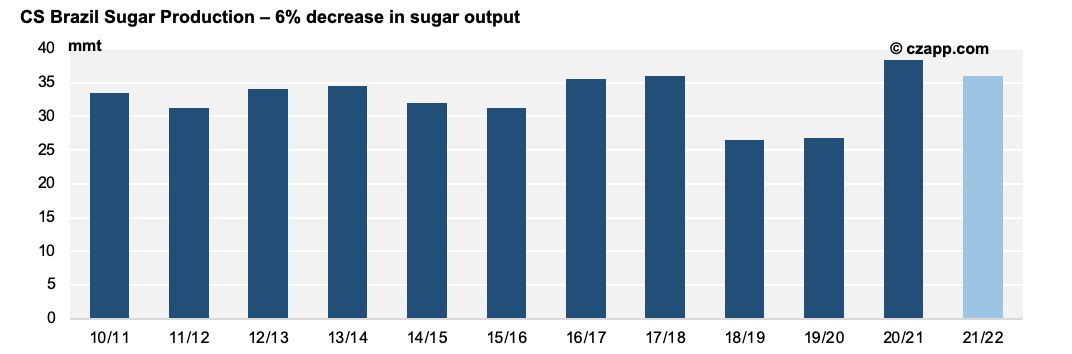

- We think CS Brazilian sugar production will fall by 6% to 36m tonnes in 2021/22.

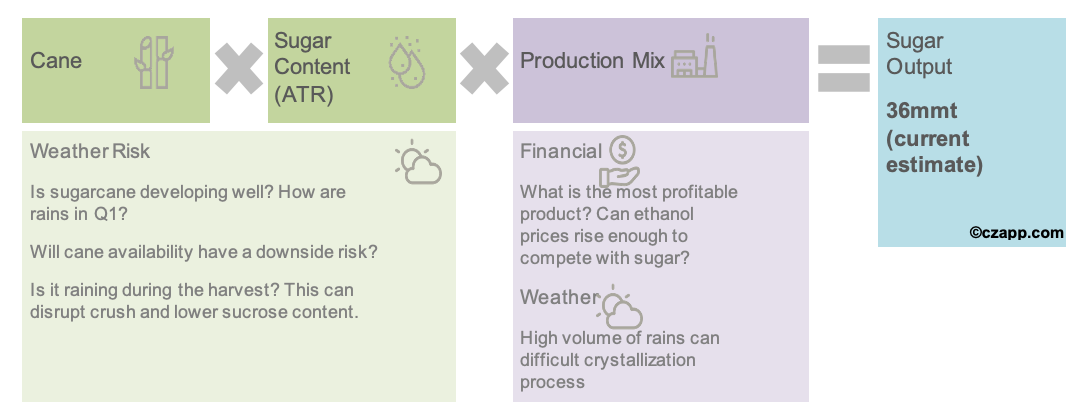

- Mills will still maximize sugar production – it is just that the amount of cane available for crushing is lower.

- The amount of rainfall in the next 3 months are critical for cane evolution; further revisions are possible.

Concerned over volume of cane available

- Cane development depends on precipitation being close to average.

- Precipitation below normal can hinder crop evolution and lead to lower cane availability.

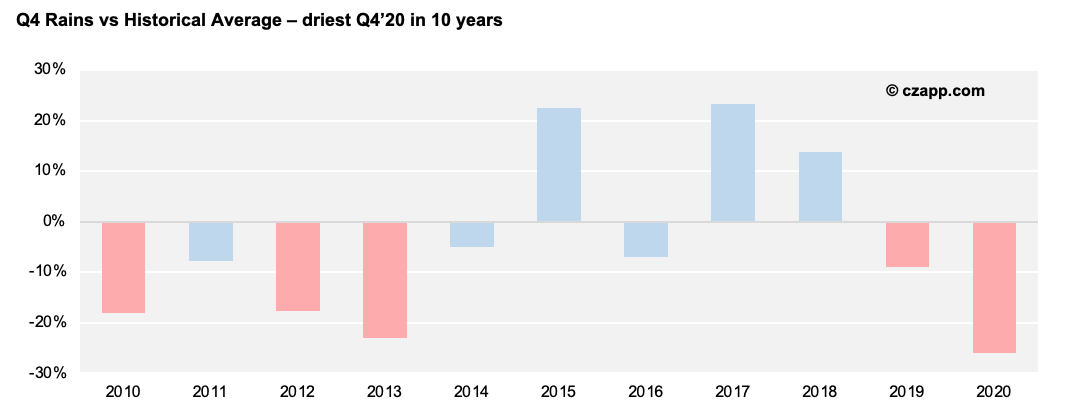

- In the previous quarter, CS registered rains 26% below average – it was the driest Q4 of the past 10 years.

- Looking at each state we see that Mato Grosso do Sul, Goias and Parana take the front seat on lower rains with some areas registering half than average precipitation.

- Not only was weather drier, but CS suffered substantially with fires in t he 2H of 2020.

- The accidental fires damaged young cane fields, with some areas being lost or expected to show significant losses in agricultural yields.

- In addition to dry weather and fires, UNICA has pointed out a potential reduction in cane area expected for 21/22 – our model also shows a potential decrease in area for next season as a result of lower cane planting.

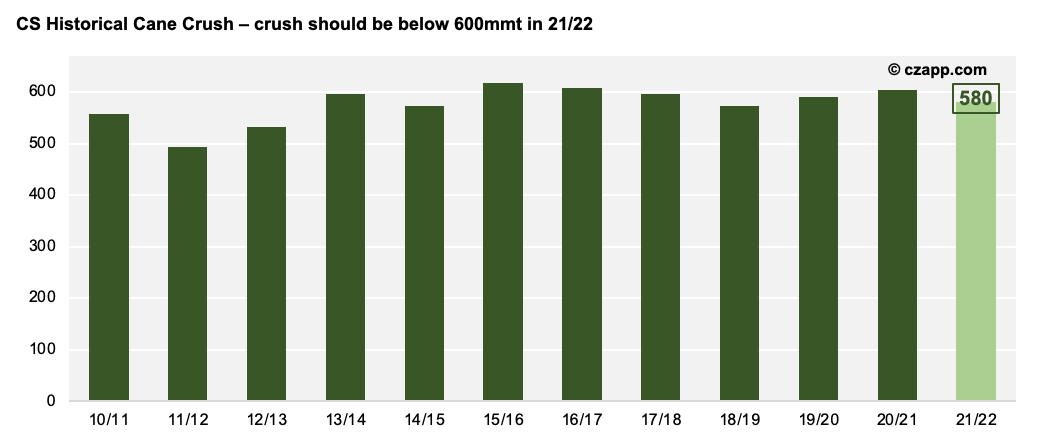

- Thus, the combination of lower ag yields and lower area should result in limited cane availability for 21/22.

- Estimated crush at this time of 580mmt.

- Nonetheless, we find it important to stress that the risks are not over.

- As we say in Brazil: there is still a lot of water to come, meaning that rains in Q1 are essential to define cane volume for better or for worse.

Sugar Mix to Max Sugar

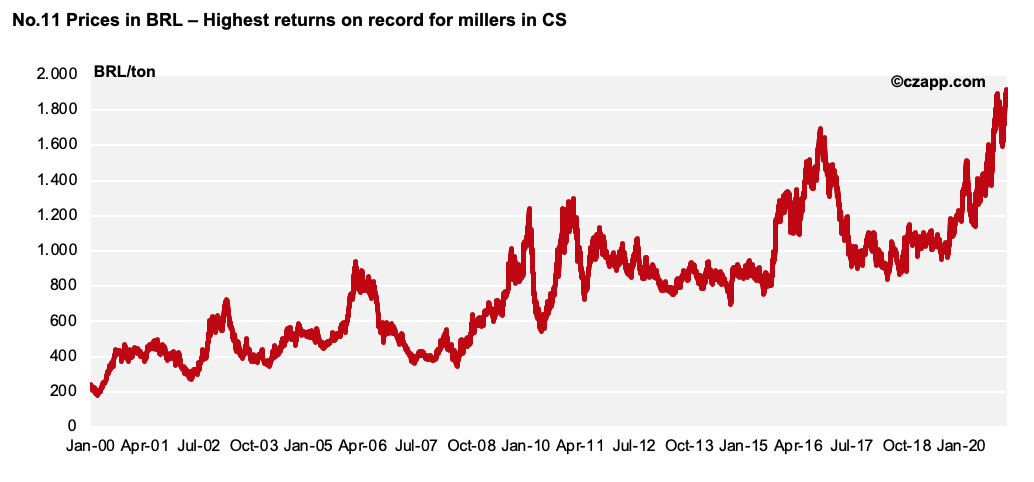

- CS millers have hedged a record amount of sugar (futures selling) for this time of the year as they have ever been.

- We reckon that at least 70% of 21/22 sugar production has been priced – just as a reminder, this time last year the view was still in favour to ethanol production.

- No wonder mills have advanced their hedges, sugar returns are the highest they have ever been on a BRL/ton basis.

- The mills’ strategy and intention are clear: maximize sugar output.

- Assuming a sugar mix of 47.3% we expect CS sugar production to reach 36mmt in 21/22 season.

Keep an eye out for these!

Summary of Estimates