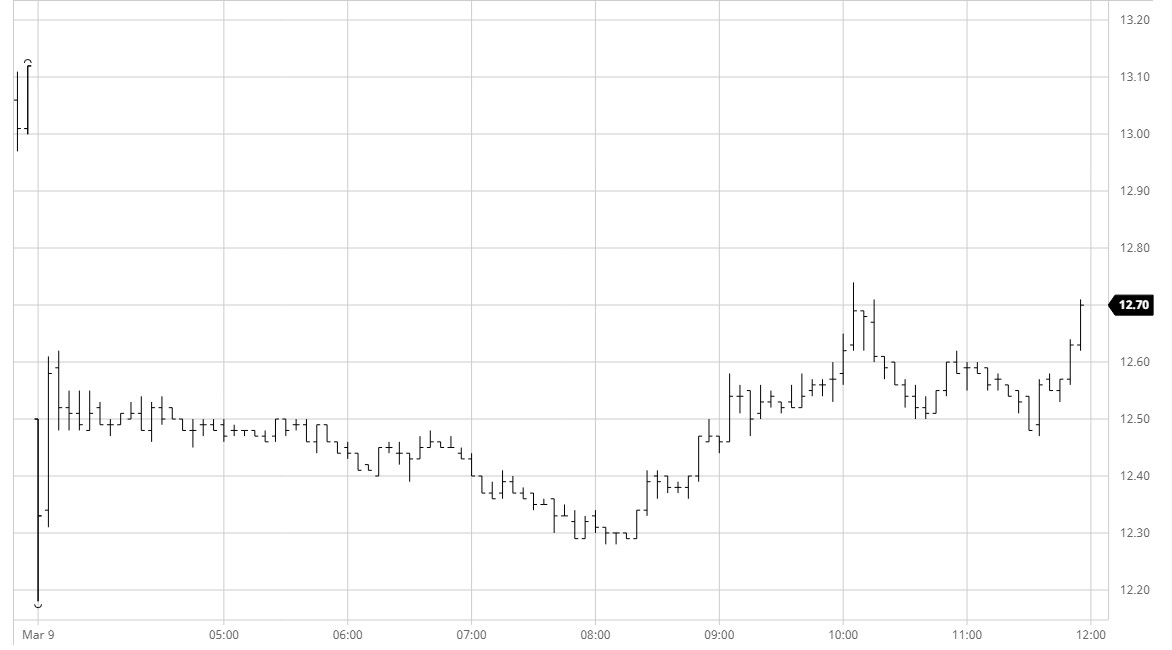

The emergence of an oil price war between Saudi Arabia and Russia at the weekend sent the signal for the macro to follow crude prices lower and sugar did not disappoint as May’20 No.11 printed all the way down to 12.18 (-0.84) on the opening. There was some consumer interest at the lower levels which alongside a host of algo and spec activity enabled the price to quickly rebound up to 12.60, though the reaction was excessive given what was happening elsewhere and prices began to ease steadily lower though the rest of the morning. A significantly weaker opening for the USDBRL saw the currency reach 4.7865 and helped to maintain pressure on the market however the afternoon then saw some marginal relief for the macro which removed the spec pressure and allowed prices to recover. New session highs were recorded at 12.74 for May’20, while May/Jul’20 traded out to 0.05 points premium which is impressive given that the outright picture remained negative. Closing values showed losses in the region of 40 points, which though weak on the surface represented a decent showing following the earlier weakness. Whites were more disappointing on the day, pushing WP values down to end around $77.50 for May/May and $78 in Aug/Jul. Late buying (possible short covering) ensured that final trades were around 10 points above settlement levels.