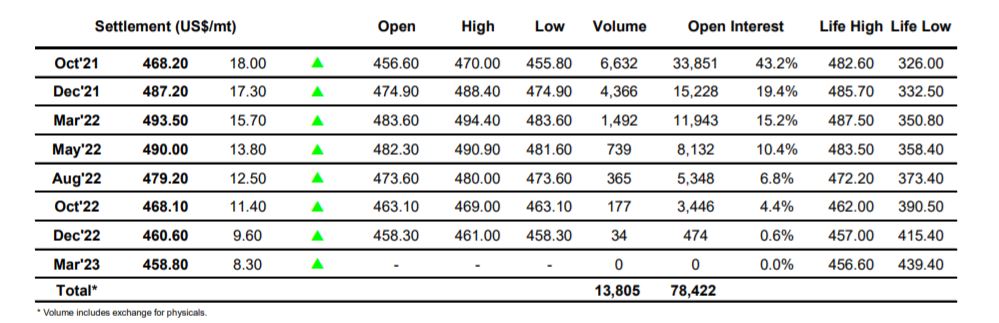

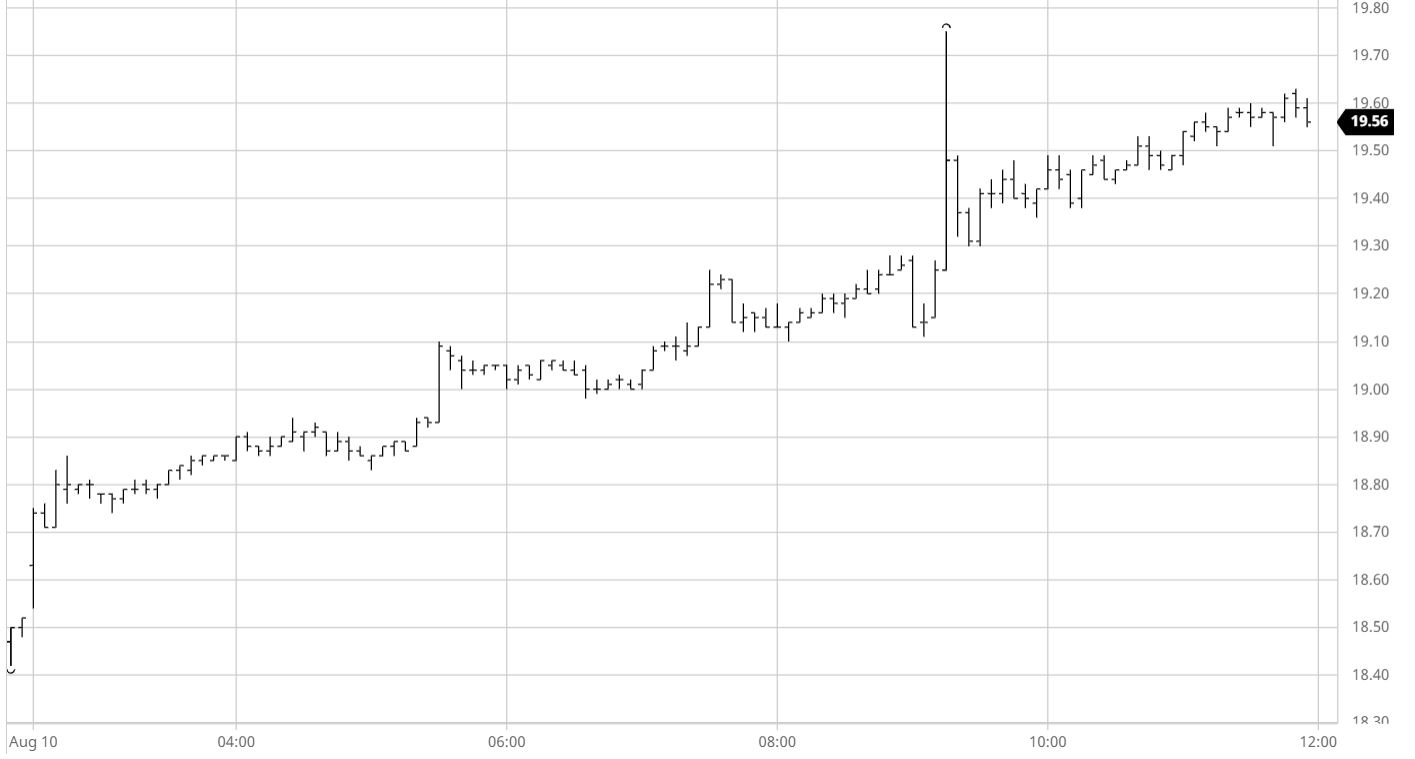

Sugar #11 Oct’21

Having shown a hint of vulnerability yesterday the market was firmly back on the front foot this morning with moderate but aggressive buying appearing from the off to send Oct’21 charging back towards the contract highs. Following the initial sharp gain a steadier rate of increase was maintained to match the 18.94 mark midway through the morning before another wave of buying soon after pushed beyond to trigger a few light buy stops on route to a new high mark of 19.10. The continuing momentum was understandable given the strong technical performance, with the origins for the move coming from expectation that today’s Unica numbers will prove to be even more positive than already factored in with the ongoing issues regarding cane damage due to frost previously well known. We awaited the US morning to see just how the market would react as the larger section of the speculative community entered the fray and their reaction was positive with continued upside extension from day trader/algo buying taking Oct’21 into the 19.20’s before Unica had hit the newswires. When the announcement did arrive shortly after 3pm it showed a crush of 46.69m tonnes, with 3.03m tonnes of sugar produced and a sugar split at 46.40%, numbers which were only a small way beneath the expected consensus but as expected a significant way beneath the same period for last year. A brief dip was quickly picked up and trading through 19.28 sparked a new round of buy stops off which sent Oct’21 all the way to 19.75 on more than 4,000 lots while alongside March’22 reached to 20.21. Prices quickly pulled back once the stops were completed but only to where we had broken from and throughout the next couple of hours we resumed the steadier rate of progress which had been prevailing since early this morning. The move also saw the nearby spreads make back ground with Oct’21/March’22 trading up to -0.38 points, its best level since the end of July. By the time we reached the close Oct’21 was trading back within 15 points of the new contract high, and a stable call ensured the technical strength remained in place with settlement made at 19.59 whole the Oct’21/March’22 was also steady at -0.35 points. The spec longs and bulls in this market will be keen to build upon the technical strength in the near term though short term overbought indicators could impact this. A front month target of 20c is bound to be enticing though consumers are not obviously paying up and should the larger funds not follow and the buying ease then we could see a pullback once more – either way it seems we have volatility on the cards

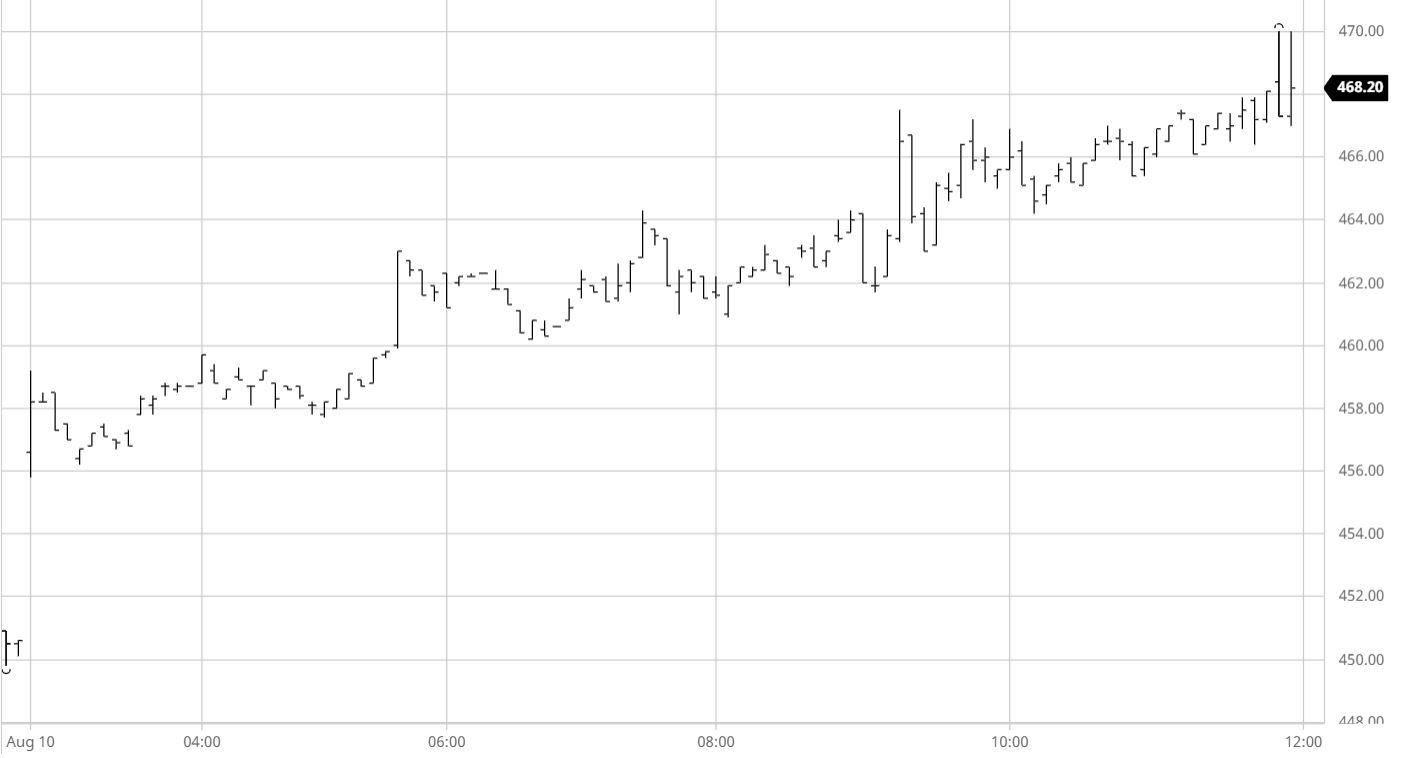

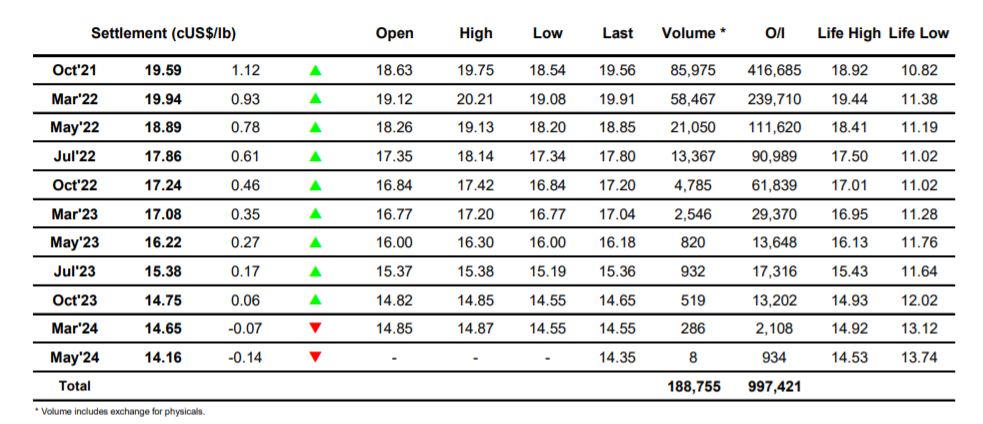

Sugar #5 Oct’21

A gap higher opening for the intra-day chart saw Oct’21 trading as high as $459.20 during the opening seconds, and though we eased back a touch during the early stages there was underlying support again being generated against No.11 where spec buying was being seen. It was not all smooth progress however as the continuing struggles for the white premium were being brought to the fore once again as despite the climbing whites prices in real terms we were continuing to fall back with the Oct/Oct’21 heading towards $40 over the course of the morning. Moving on into the early afternoon the flat price was still edging higher although volume showed that there was little resistance from sellers to halt the rise as we moved on only moderate volume. As with yesterday there was still no enthusiasm for the spread and we saw the Oct/Dec’21 continuing between -$20 and -$18 as if the emphasise that the move is no reflection on near term trade flow. The steady progress was maintained for the duration of the afternoon and despite continued white premium erosion eventually led Oct’21 to a session high $470.00 heading into the close. Settlement was made at the upper end of the range with Oct’21 at $468.20 which from a flat price perspective provides a platform to look towards last month’s $478.80 high mark. Of course the spreads and premiums continue to send contrary signals but with some strong technicals it will be interesting to see whether this can win out in the near term.

We saw yet another very low set of settlements in the white premium today despite the fact that these levels represented a late recovery with the Oct/Oct’21 having touched beneath $32 intra-day. Closing value for the Oct/Oct’21 was $36.30 with March/March’22 at $53.90 and May/May’22 at $73.50

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract