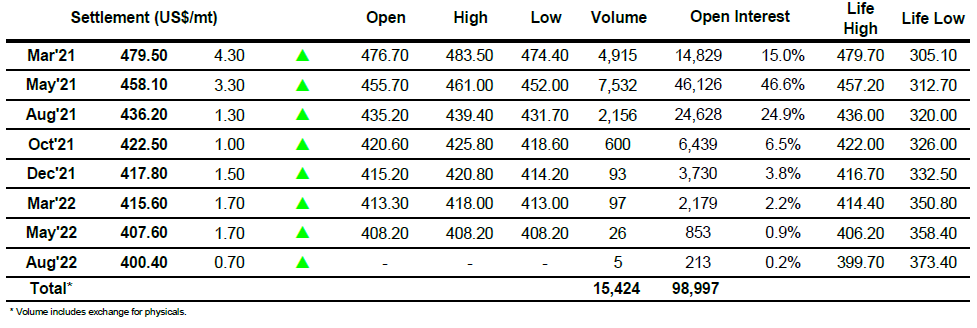

Sugar #11 Mar ’21

The morning could best be described as comatose and at times it felt hard to believe that we were in the fourth day of the index fund roll and that the March’21 expiry is only two and a half weeks away given the complete lack of interest. Nudging sideways until a call dip to 16.37 during the early afternoon it seemed there may be no excitement though specs did begin to show some enthusiasm soon after by pulling the front month up into the 16.50’s to record new daily highs. Out of the blue this set the platform for a sudden spike upwards with March’21 finding some light buy stops as it broke above the former contract highs in pushing rapidly from 16.61 to 16.84, and then on through 17c to reach 17.05 just a short while afterwards. Maybe surprisingly the move saw a very sharp rise in the March/May’21 spread which reached a session widest 0.93 points, suggesting that trade buyers were being forced to pay up for the spread into the fund selling and also that maybe there was proportionately greater buying for the March’21 rather than May’21 from specs and algo’s despite the approaching expiration. For a while there were attempts to try and consolidate the 17c area however the lack of underlying buying meant that when some profit taking emerged we duly retreated back into the range, attempting to hold the 16.70 are as we moved into the final hour. The close saw some volatility with March’21 ranging between 16.63 and 16.76 as defensive buying looked to dress the price higher and maintain a strong technical picture, with settlement at 16.71 just a small way beneath the former contract high. While longs would no doubt have liked to have ended above this mark the day still represented a strong performance and illustrated that with very limited selling above there is potential for funds and specs to continue to push upwards, the question for them now is just how much longer do they want to take their position.

Sugar #5 May ’21

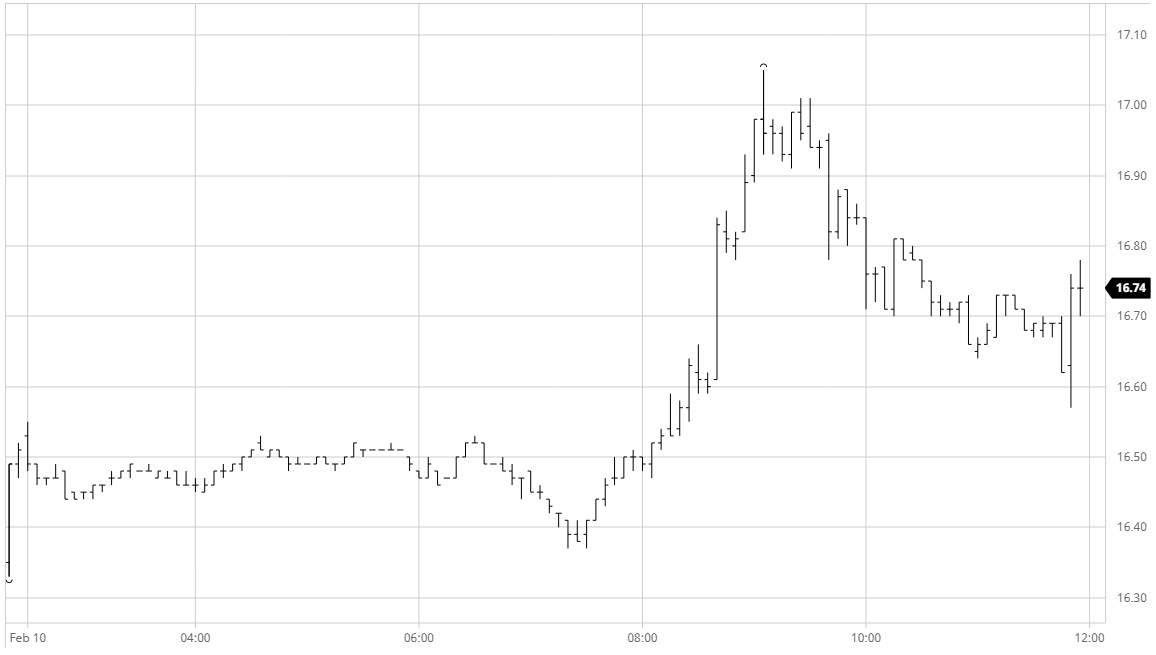

There was little to say for the market this morning with prices drifting sideways and a lack of any fresh news meaning the only thing to follow was the approaching March’21 expiry. Here we were again seeing some stability for the March/May’21 spread value that was being held in the $21 area, and with open interest falling to 14,829 lots and suggestions that we may see around 500,000mt tendered it seems that the bulk of the rolling is now completed with fine tuning from the trade over the final two days more likely before details are finalised. The situation remained very quiet for the flat price for many hours until what is becoming a customary mid afternoon push upwards sent the market back into more positive ground. Values worked their way up to be within a dollar or so of the recent contract high and then quickly burst through to reach yet another new high market at $461.00 before an equally quick retreat back to $456.00. This movement saw some volatility for the white premiums due to an even sharper rise for March’21 No.11 that saw March/March’21 fall from a morning high of $114 to $107 before levelling out in the $110 area soon afterwards. May/May’21 saw less volatility but still slipped to the $105 area on this move before quickly returning back to hold quietly around $108. The final couple of hours then saw prices chop around towards the centre of the days range until the now usual MOC buying arrived to bid prices back upward and send us out steadily, settling at $479.50 for March’21 and $458.10 for May’21.

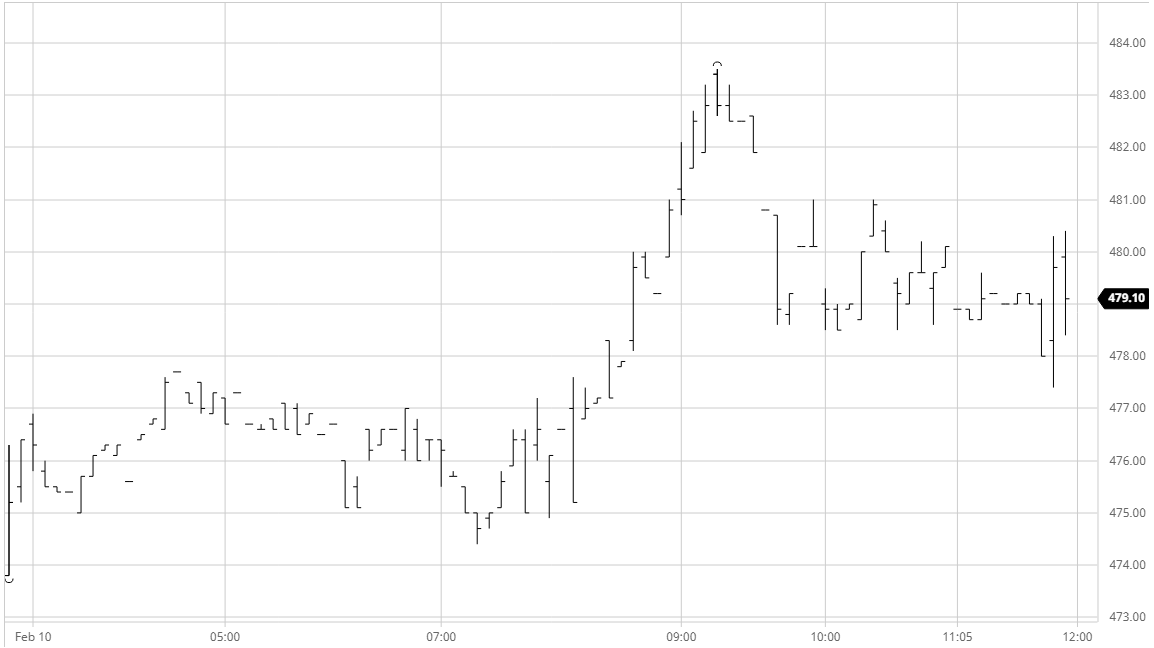

ICE Futures U.S. Sugar No.11 Contract

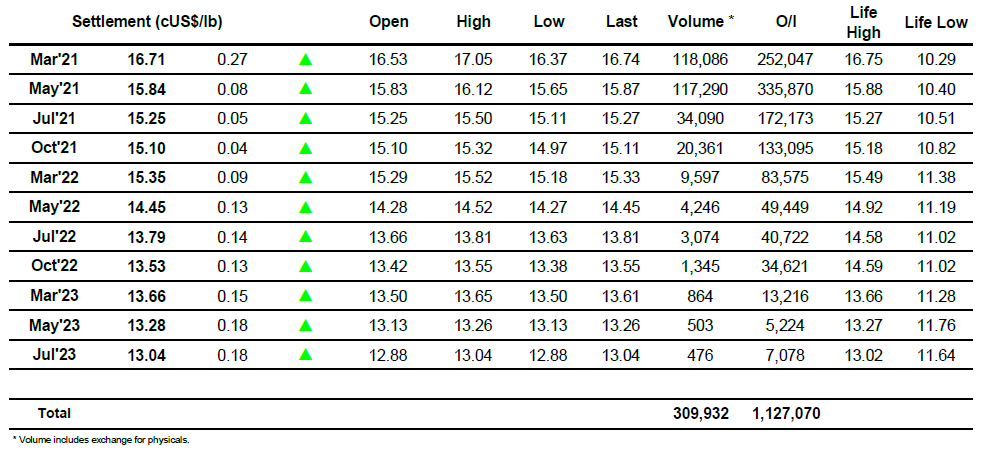

ICE Europe White Sugar Futures Contract