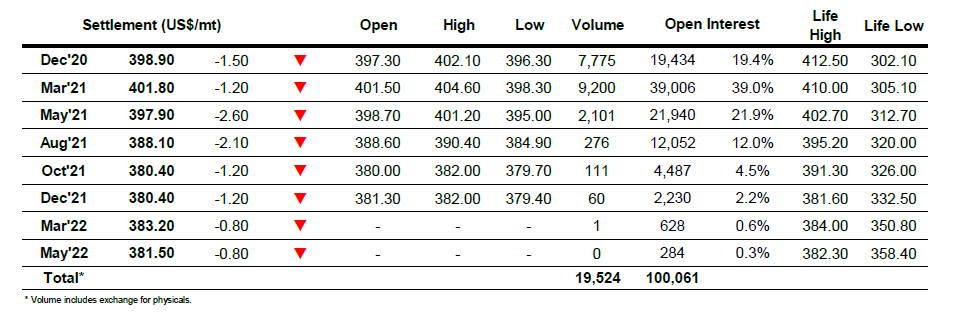

Mar 21 – Sugar No.11

The market failed to follow the broader macro higher yesterday however the rally back to end little changed provided a sufficient basis for some further consolidation this morning in a far calmer environment. Much of the morning activity centred around the March/May’21 spread where sellers were once more in the ascendancy to send the differential back into the low 70’s and maintain the recent pullback. Prices showed greater movement during the early afternoon with newswires picking up on stories that India are reviving plans for export subsidies, and though there was a degree of weakness with new session lows some defensive support arrived to pull values back towards unchanged once again. The recent trend of wider daily ranges was maintained as a second wave of selling sent March’21 down to 14.53 and the March/May’21 into 0.67 points placing No.11 at the bottom of the commodity pile as we continue to play out our own story and largely disregard the wider commodity world. A push back upwards during the final hour petered out quiet quickly before some late selling pushed March’21 back into the 14.60’s while March/May’21 traded a narrowest 0.61 points. While the session suggests that we are liable to see continuing action within the broader range for the near term the continuing weakness of the March’21 spreads sends a negative sentiment which will be of concern to longs.

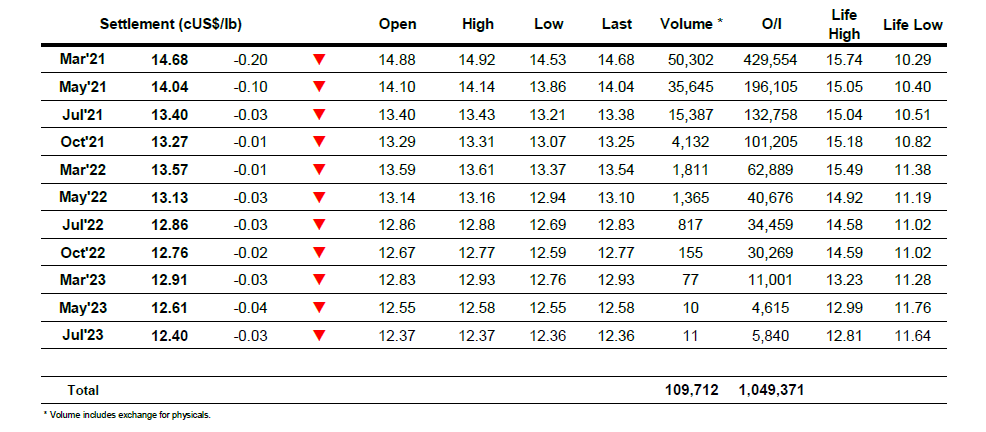

Dec 20 – Sugar No. 5

Early losses were reversed over the course of morning trading as buying for the Dec’20 and March’21 pulled the rest of the board away from initial lows. By the end of featureless few hours the March’21 contract had clawed its way up to $404.60 however the steady climb was brought to an abrupt halt with some better volume selling sending the price back to the $400 area in quick time. News that India are again considering export subsidies on the newswires was clearly unsettling some of the longs and despite a brief recovery from the lows the market saw a second plunge lower which sent values to fresh session lows with just a couple of hours remaining. The drop did not hinder nearby white premiums which were finding some decent support to widen the March/March’21 out beyond $77, while there was also support for the Dec’20/March’21 spread as it approaches expiry with a move up to -$1.50. The final couple of hours saw a recovery which saw a virtually identical topping out to the early afternoon recovery before closing selling emerged to leave values ending the day in mid-range.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract