Sugar #11 Oct’21

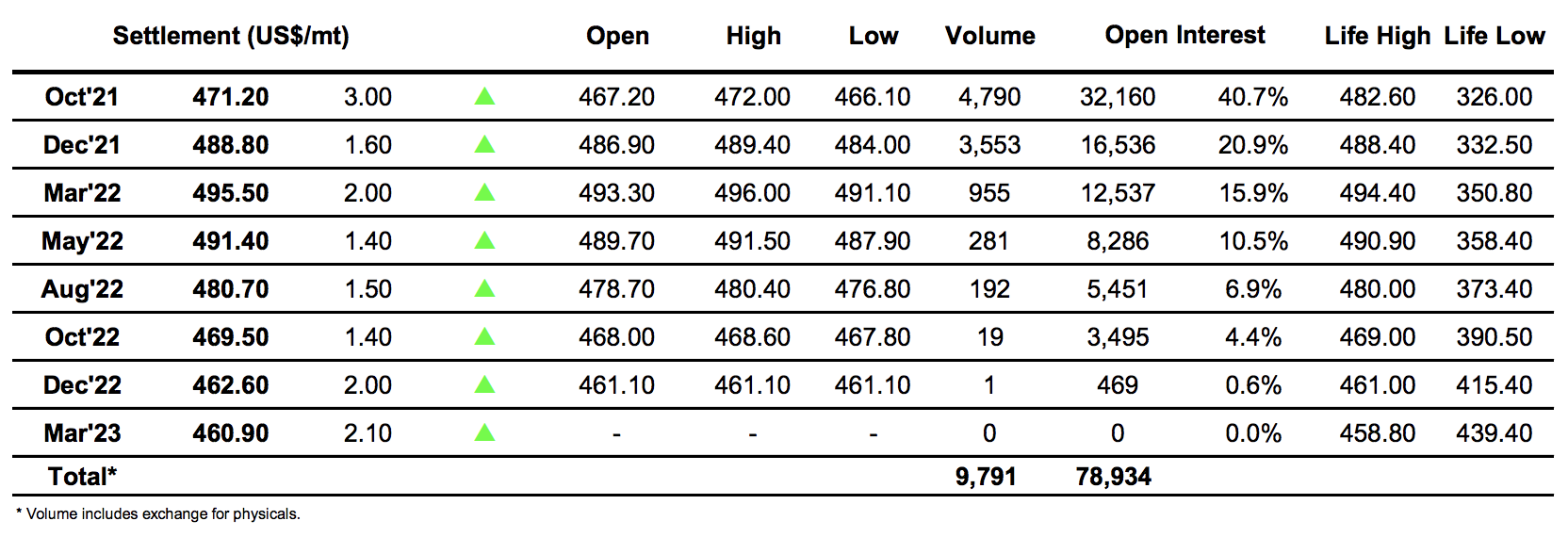

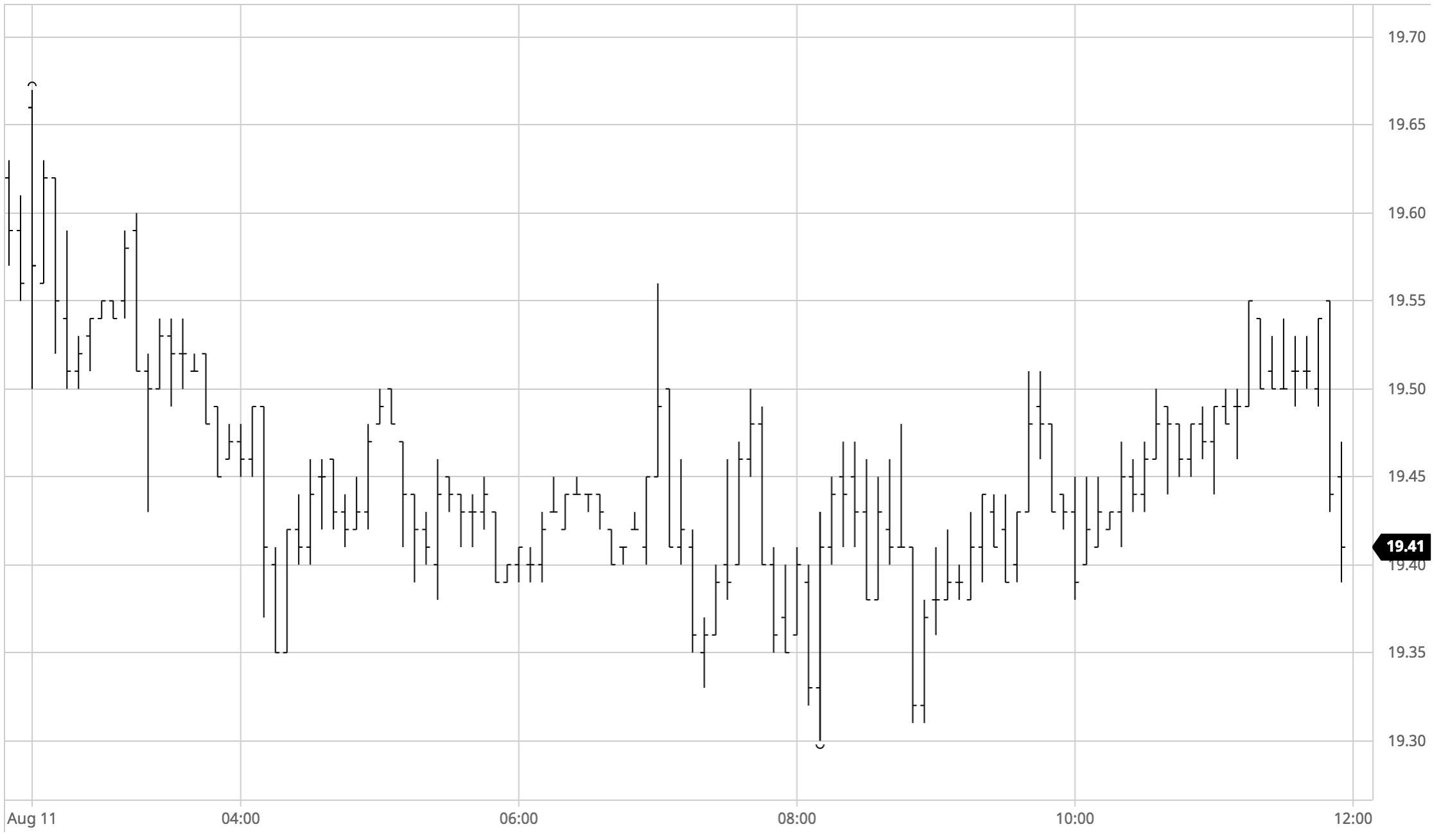

Following on from such a strong performance yesterday we saw initial volatility with Oct’21 swinging between 19.67 and 19.50 in the opening minutes. Activity settled quite quickly and a calm morning ensued with Oct’21 easing back a little further to 19.35 though this was in part due to selling of the front month spreads, leaving the 2022 positions to show only more modest losses. Moving into the early afternoon there was no immediate action from specs to re-ignite the upside which left the flat price continuing broadly sideways, though any hints of a further dip were quickly gathered up with defensive support as they look to protect current holdings. The spread movement presents something of a conundrum for those trying to ascertain where we go from here with afternoon movement seeing Oct21/March’22 back down at -0.50 not a great indicator of near term strength despite the ongoing supportive buying. During the course of the final two hours a little more buying emerged to take Oct’21 back into the 19.50’s while at the same time sending March’22 to a high of 20.03 in what seemed to be an effort to maintain technical strength on minimal volume/effort. Approaching the close we were near to session highs for all positions bar Oct’21 however settlements were pushed back a few points by some late selling as day traders headed for the exit, leaving Oct’21 valued lower at 19.47 while March’22 closed marginally up at 19.96.

Sugar #5 Oct’21

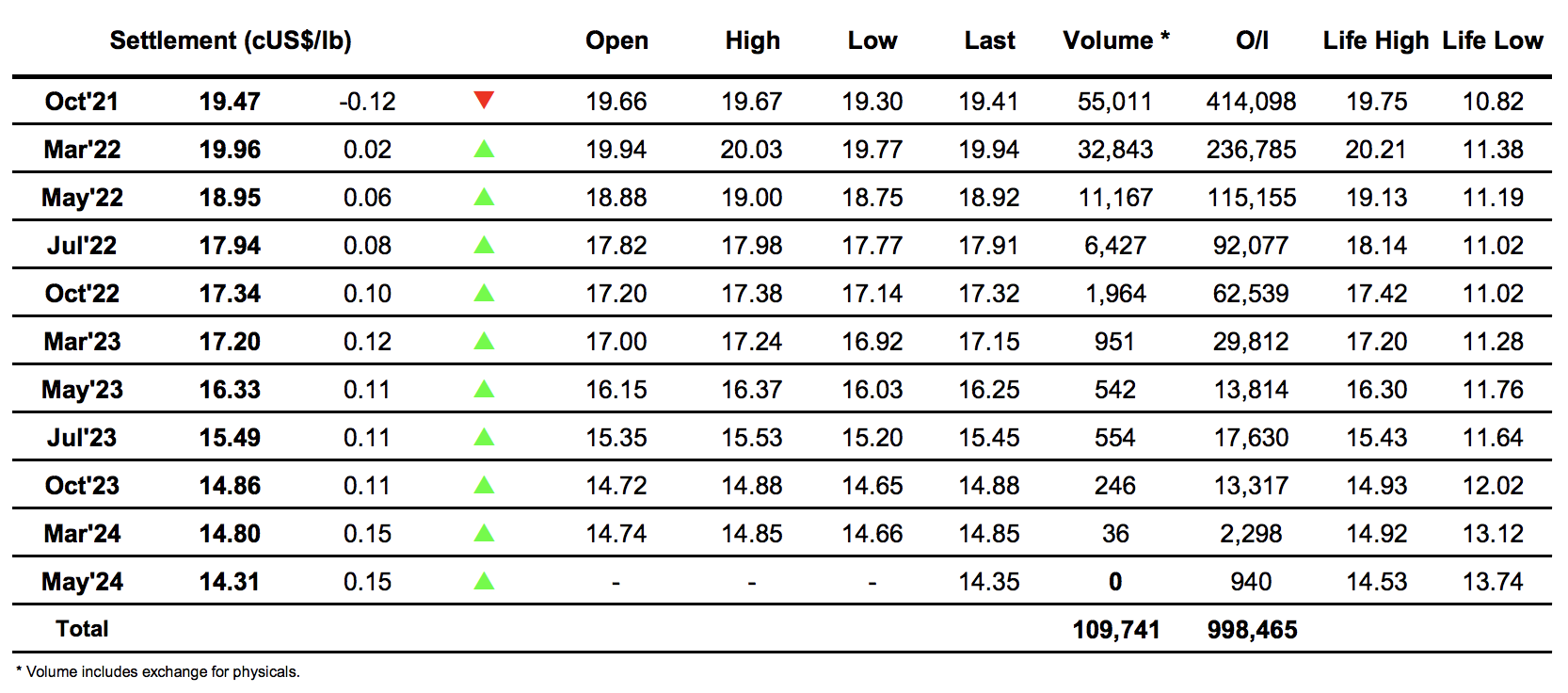

Regardless of the way in which the whites have been pulled upward in recent days they now find themselves in the best technical shape seen for a while and from an unchanged start we soon saw Oct’21 moving positively up to $471.00. Volume was moderate with a good deal of the early activity coming via the Oct/Dec’21 spread, while there was also some light buying interest for the Oct’21 white premium which pushed the differential back to $40, the historically cheap levels finally drawing some interest out. Moving into the afternoon we saw the range widen to both ends with much of the movement down to day traders, while the Oct/Dec’21 spread regained yesterdays losses despite the calm nature of the flat price, maybe riding on the coattails of the premium as the differential moved back to -$17.00. The later part of the day saw some steady buying bring the price back up and we matched the earlier high at $472.00 on the close with settlement established at $471.20. This keeps the technical gloss in tact for another day with $478.80 remaining the first target.

· The recovery in the front month white premium was maintained throughout to leave Oct/Oct’21 settling at $42.00. March/March’22 was also firmer at $55.50 while May/May’22 was little changed at $73.60.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract