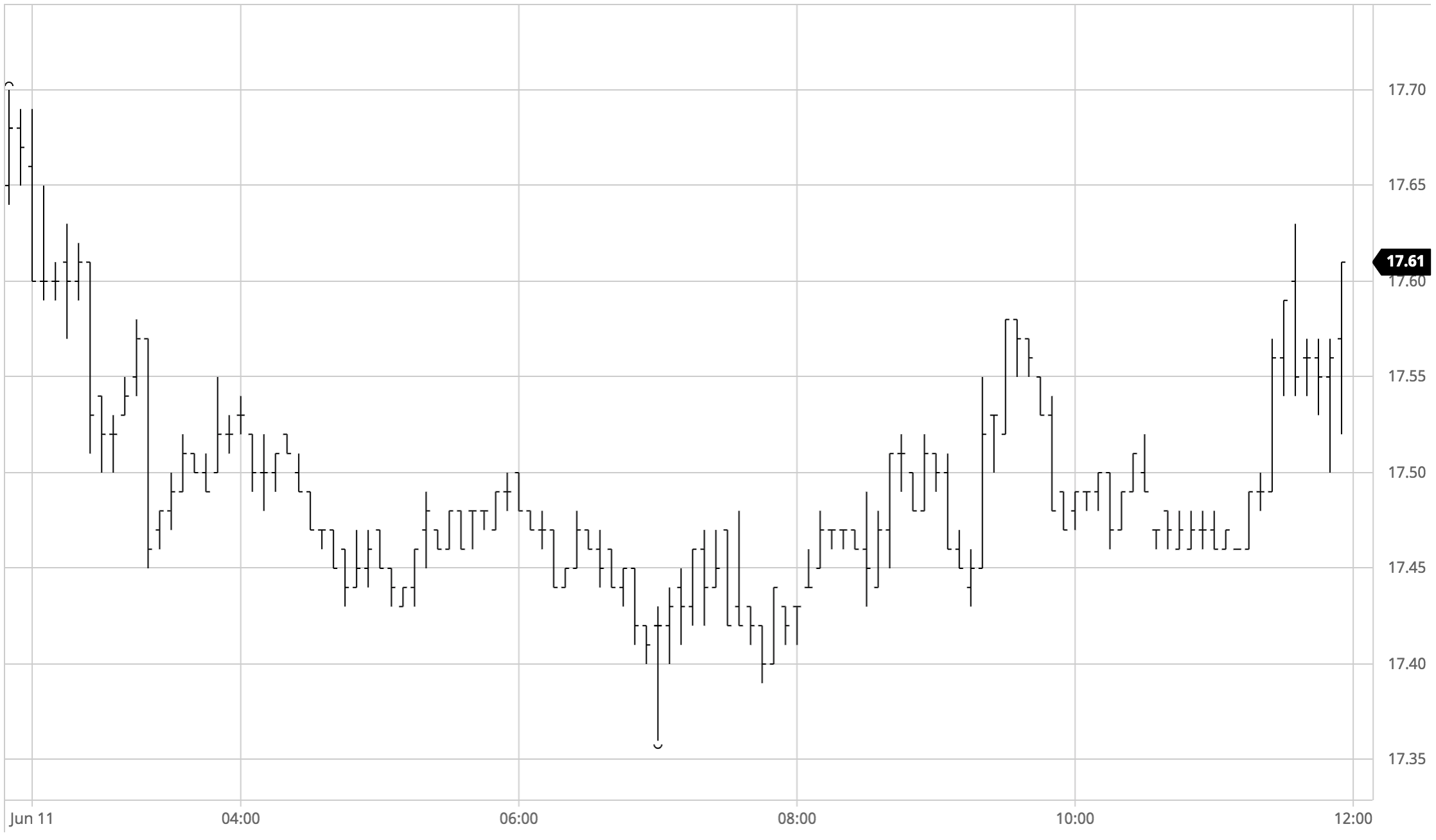

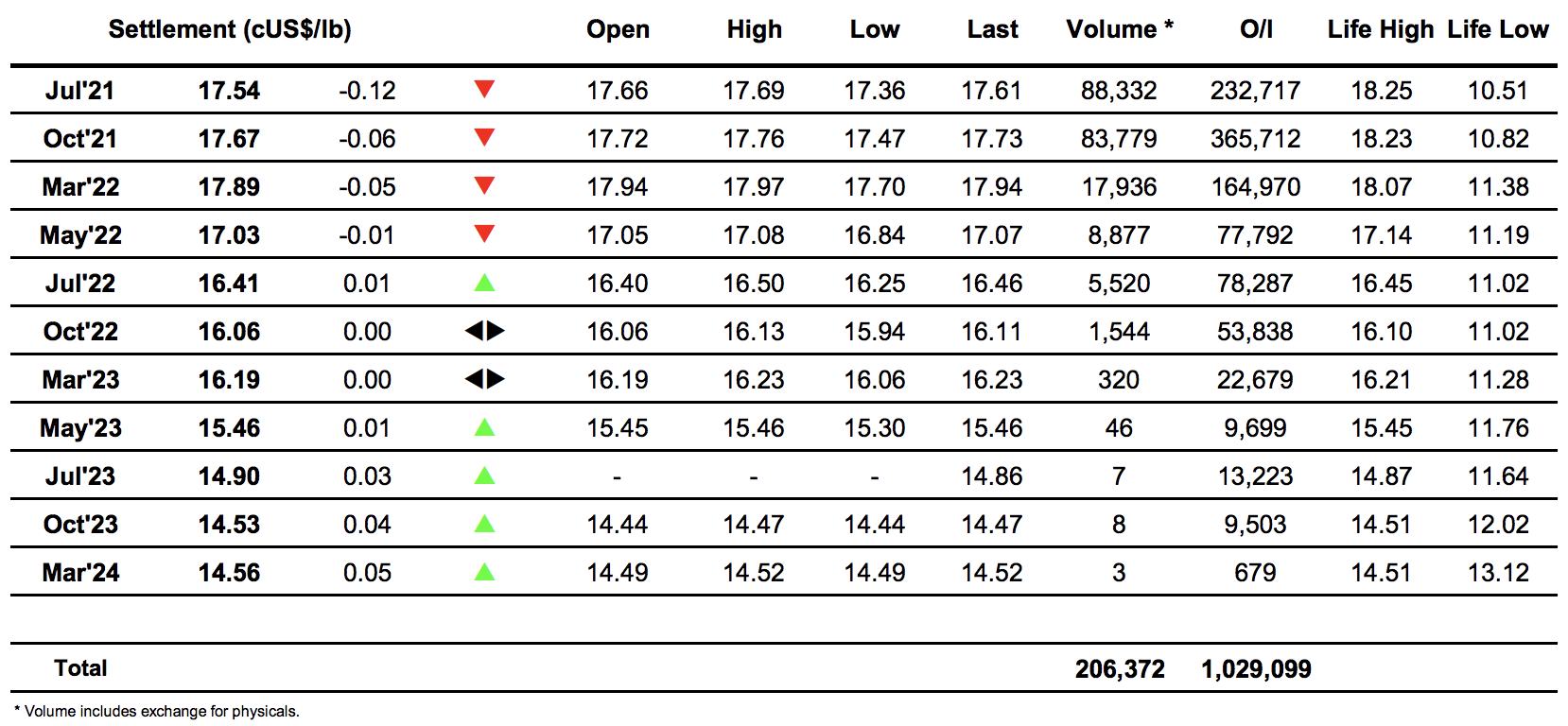

Sugar #11 Jul’21

Recent failure to break beyond 17.93 and a weaker whites market have led to some selling as shorter term traders flit back out of long positions with this activity sending Jul’21 back beneath 17.50 during early trading. Overall the No.11 has been proving far more resolute than the whites in reflection of the differing trade flows for the products in the near term and the greater confidence in No.11 continues to lead to support from trade/consumer buyers ahead of the recent 17.29 low which was in evidence once more. A question was raised by some spec selling midway through the session which saw Jul’21 briefly print to 17.36 however in the main the 17.40 area was providing a solid base for the more limited outright activity with the final day of the index roll window ensuring the Jul/Oct’21 spread continued to dominate activities. Moving through the afternoon there was a small push north of 17.50 however for the most part traders seemed content to allow the price action to continue quietly sideways, while the spread eased back slightly to -0.13 points as the volume continued to pour in from both sides. The final hour saw spec longs push back to the 17.60 area as they looked to paint a positive picture heading into the weekend, only partially achieved with Jul’21 settlement at 17.54. With the bulk pf the roll now complete next week brings the Jul’21 option expiry, maybe that will bring a little more interest to break the current 17.30/17.90 impasse.

Sugar #5 Aug’21

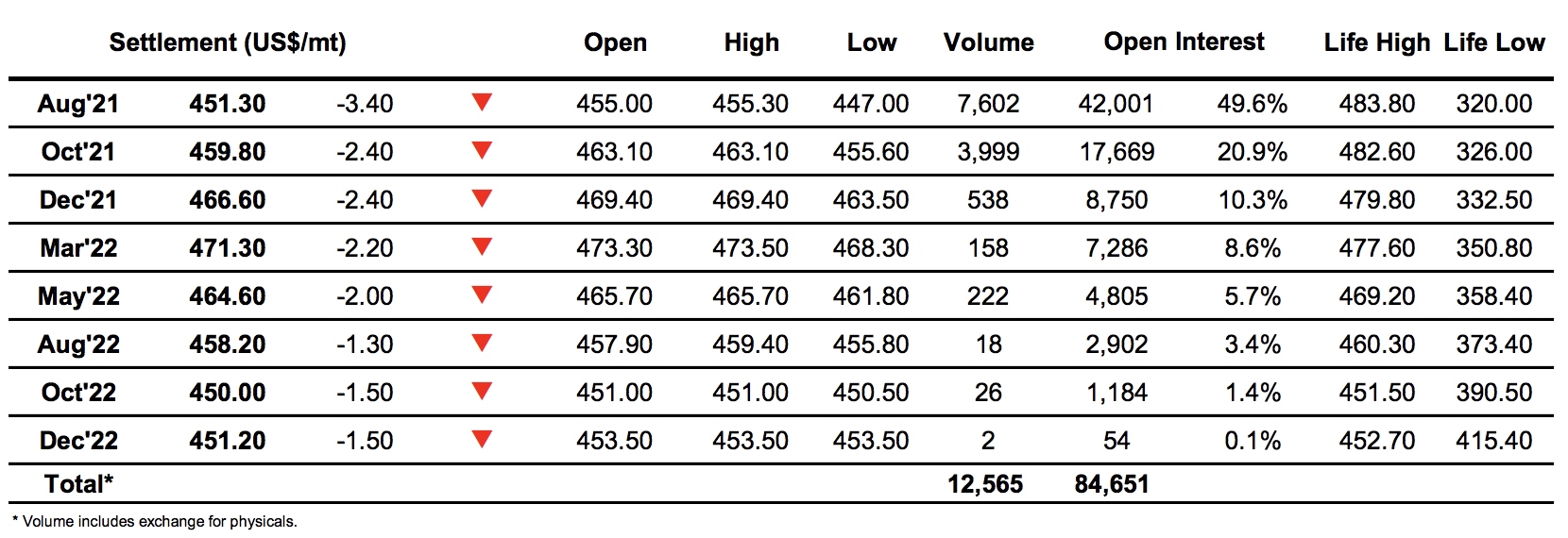

The sharp decline in nearby values yesterday has undermined confidence in the market and we continued to decline at pace during the first hour of today’s session as Aug’21 shed $5 to $449.70 before some buying started to emerge. The buying was primarily limited to scales however and over the course of the rest of the morning we saw further new lows recorded, reaching to $447.00 by the time that Americas based traders were coming online. One area that was not being so negatively affected today was the white premium values with the sharp decline yesterday bringing in some buying beneath $65 for the Aug/Jul’21 which allowed the differential to try and dig in, though in the spreads we were seeing further weakness with Aug/Oct’21 reaching a new low at -$9.30 as the market fell. Moving into the afternoon the market started to find a little more support which enabled the front month to pull back to the $450 area where it centred itself for the most part, aided by the No.11 which continues to hold resolutely in the same range that it has populated for the past two weeks. The price cemented further above $450 during the final hour and following some closing choppiness we head into the weekend with Aug’21 settling at $451.30

· White premium values were far less volatile today as buying emerged at the cheaper levels, though we still closed a touch lower for the day with Aug/Jul’21 settling at $64.60, Oct/Oct’21 at $70.30 and March/March’22 at $77.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract