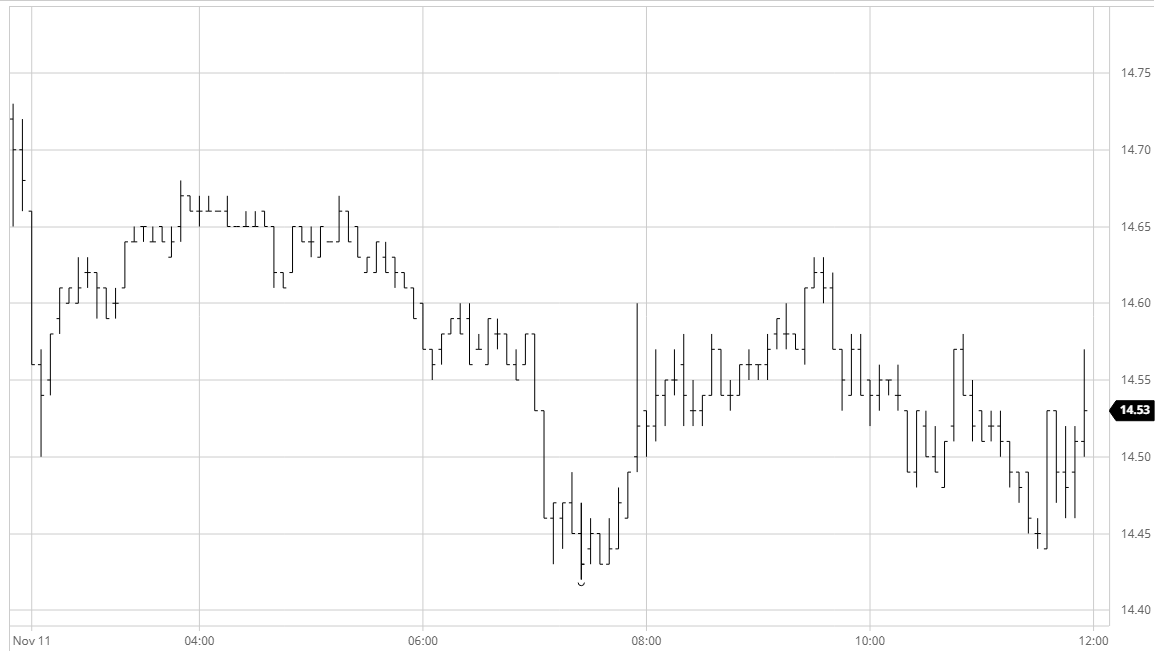

Mar 21 – Sugar No.11

Opening selling put March’21 immediately on the back foot, pushing quickly down to 14.50 before finding some buying which erased the losses over the course of the following hour. The market then edged sideways on very light volume though the lack of upward momentum started to tell and we eased back beneath 14.60 ahead of the US morning, though for a change the MarchMay’21 remained unaffected and was finding some buying to trade back to 0.70 points. A fresh pushed down to 14.50 triggered a short burst of spec selling as the recent vulnerability moved back towards the surface however with the macro performing solidly once again there was sufficient support around to pull prices back upward into the range. The latest UNICA figures covering the 2nd half October were published showing 26.79m t cane / 1.73 m t sugar / 43.63% mix and while just above market estimates for total sugar there was no immediate reaction and we continued comfortably within the range. The latter stages saw prices ease lower once more, this time aided by the March/May’21 narrowing back in to 0.64 points and in so doing we moved to the bottom of the commodity picture and maintained our recent contrarian macro credentials. The close saw now familiar defensive buying ensure that we settled a little above the lows though at 14.49 we were beneath yesterday’s range which adds to near term technical negatives.

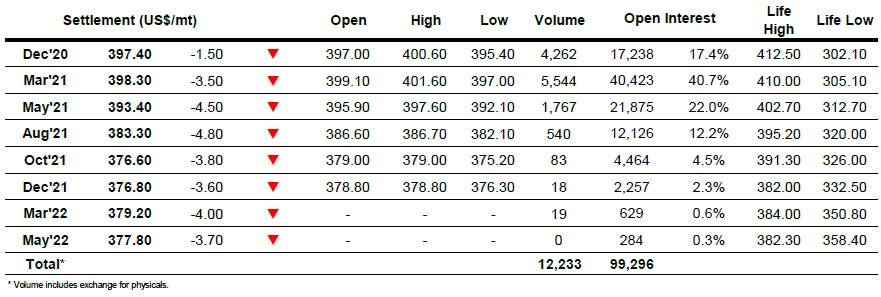

Dec 20 – Sugar No. 5

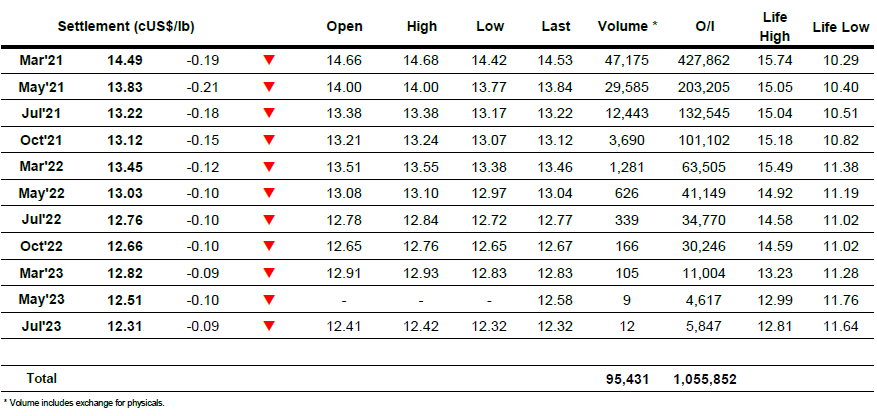

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract