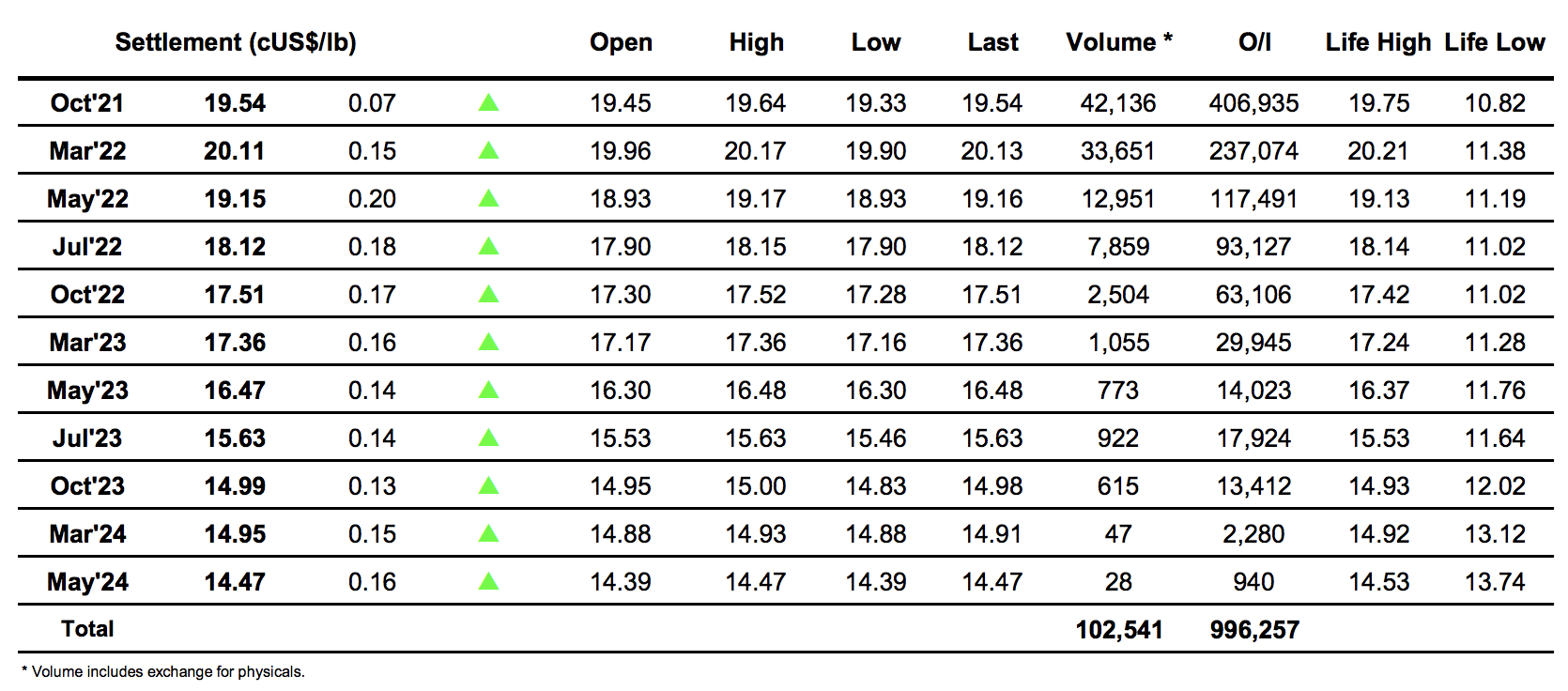

Sugar #11 Oct’21

An unchanged opening soon attracted more buying and this took Oct’21 upward to 19.64 before pausing. In a continuation of yesterday’s action this rally came in spite of a fall in the value of Oct’21/March’22 with the differential falling to -0.55 points as we touched the highs, presenting a paradox for which there is currently no answer. Prices continued to nurdle along at the upper end of the range into the early afternoon however the start of the US morning brought with it some further spec profit taking which sent values backwards through the morning range and down to a session low at 19.33. rebounding from this low we were soon back in the 19.50’s although with the spreads continuing to struggle it was tough to maintain the recovery and instead prices settled into a new consolidation pattern in the 19.40’s. Despite a calm macro we dug our heels in and pushed back upward during the latter part of the day to take Oct’21 back into the 19.50’s ahead of the closing call, levels which were maintained to ensure a marginally positive front month settlement level at 19.54 while the rest of the board was firmer still and posted solid double digit gains. Overall it was another solid technical performance from the flat price which despite the ongoing concerns flagged by the spread presents a platform for the specs to try and end the week with a flourish tomorrow should they have the capability.

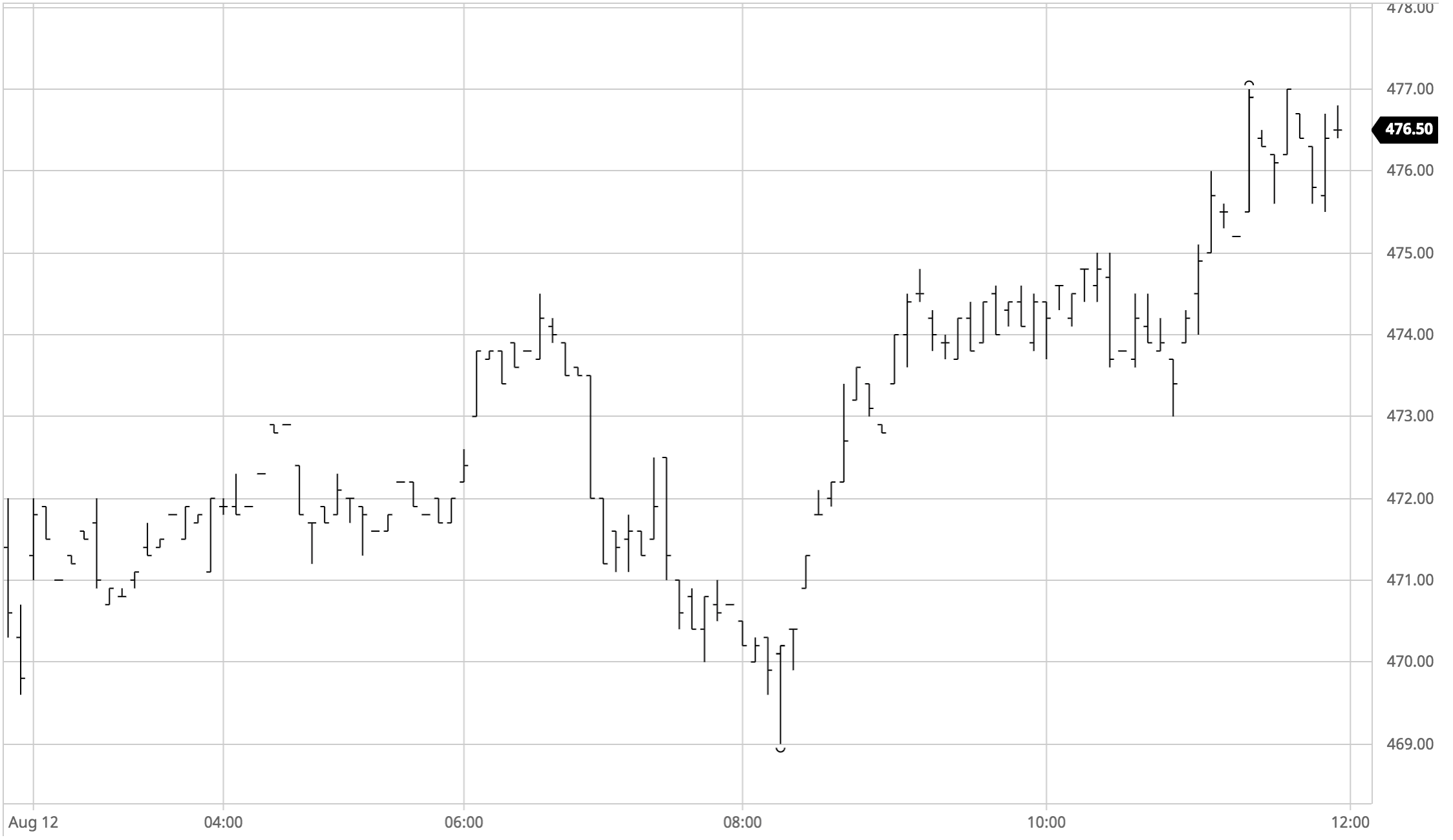

Sugar #5 Oct’21

The market environment continues to be positive and initial buying took Oct’21 up by a dollar to $472.30 with the rest of the board firmer still as Oct’21 spread values took an initial knock. Continuing consolidation throughout the morning provided the basis to pop up a touch further to $474.50 as NY based traders entered the fray however this rally was not sustained and prices soon set back lower to trade beneath early morning levels with Oct’21 back in the red at $469.00. Sentiment continues to be positive however and the dip was quickly gathered up through a sharp but low volume rally that pulled us quickly back toward the earlier highs, leaving prices once more at recent highs midway through the afternoon. This provided a platform form which to continue upward and having struggled for so long recently it was suddenly the whites which were the driving force for sugar as a final hour push onward to $477.00 brought the prompt white premium back out beyond $45, some $13 above Tuesdays exaggerated lows. Settlement at $476.10 leaves us continuing to view initial resistance at $478.80 with the life of contract high mark of $482.60 firmly in the sights of the longs.

· As mentioned the white premium values were resurgent today to leave some positive settlement values showing Oct/Oct’21 at $45.30, March/March’22 at $58.90 and May/May’22 at $75.90.

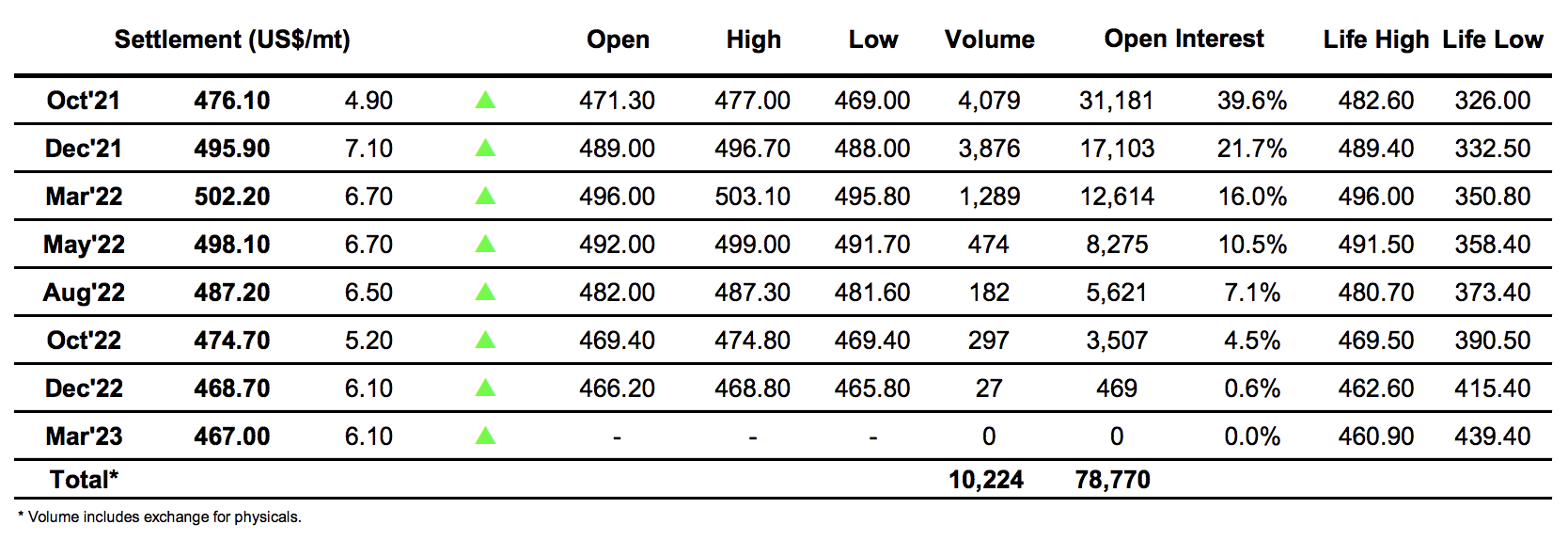

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract