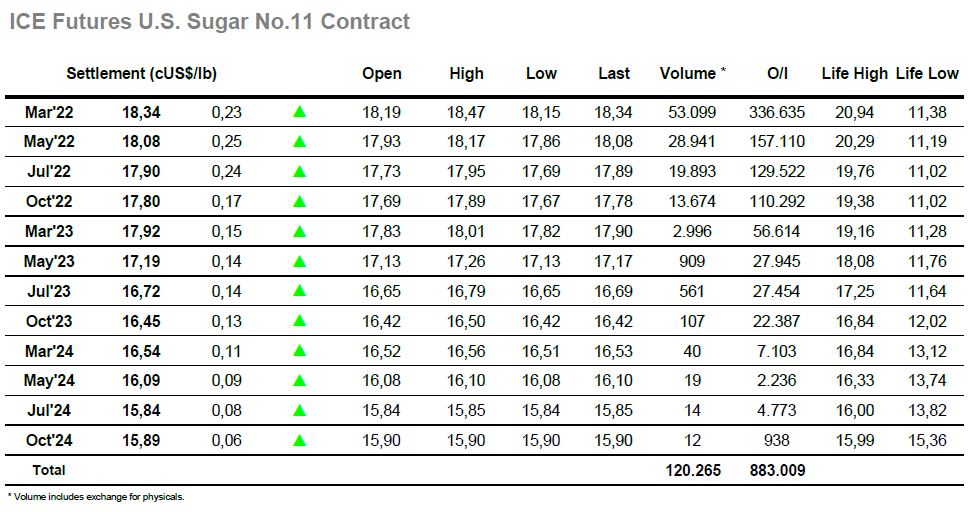

Sugar #11 Mar ’22

Yesterday’s recovery has brought some confidence back to the market and a positive start to today’s session saw March’22 up to 18.25 on the opening to immediately register a new high for the rally. There was some further probing higher during an otherwise calm morning which saw prices up into the low 18.30’s, but though sellers were few and far between we did not run away with buying also proving to be moderate. Things remained calm until early afternoon when a sharp push to new highs drew in some more aggressive buying that quickly swung the price up into the first resistance area at 18.46/18.52. Naturally, there was more significant selling in place at this area and having touched to 18.47 the price edged back a touch to sit either side of 18.40 om lower volumes again. The announcement of the UNICA numbers for 2H Dec’21 drew apathy from the crowd given that it merely represents the tail of the crop and the flat price maintained broadly sideways through into the final hours. Spreads were also fairly calm with March’22 not finding the same positivity that it did 24 hours ago, and despite a high mark of 0.31 points it was back trading an unchanged 0.28 points ahead of the close. Further selling followed for the spread to end the day lower at 0.26 points, and while the flat price remained steady in the 18.30’s (March’22 settlement at 18.34) there was no further interest in testing the overhead resistance. Breaking through this area either side of 18.50 will prove crucial in the coming days if we are not simply to stall and slide once again, the question now is whether the specs/funds have sufficient interest in taking the market further ahead given the recent sentiment shift in the physical picture.

Sugar #5 Mar’22

The recovery seen yesterday has reinvigorated the market with positive USD moves and macro activity leading buyers to chase higher from the start again today. Steadily the price climbed up through the lower/mid $490’s and while volumes were quite light and progress orderly there was so little resistance that the move felt as though it would maintain. It was not only the flat price which was improving with white premium values also continuing their resurgence as whites pushed further ahead of the No.11, a lack of selling here with refiner scale pricing having been concluded over recent weeks allowing March/March’22 to push up into the mid $90’s. Moving further ahead during the early afternoon we experienced a spike to $504.90 on some light buy stops / aggressive buying but quickly returned to the $500 area where the steady upward bias resumed once more. Trading toward the upper end of the range we were at levels not seen since 23rd December to represent a remarkable turnaround given the previous two weeks of struggle, and while we did not trade beyond the earlier high mark March’22 was only a small way short with a closing value at $503.30. Spreads and premiums also ended strongly, March/March’22 was touching $99 on the call, leaving the picture rather more constructive though if we are to continue upward the pace of the past two days will be tough to maintain.