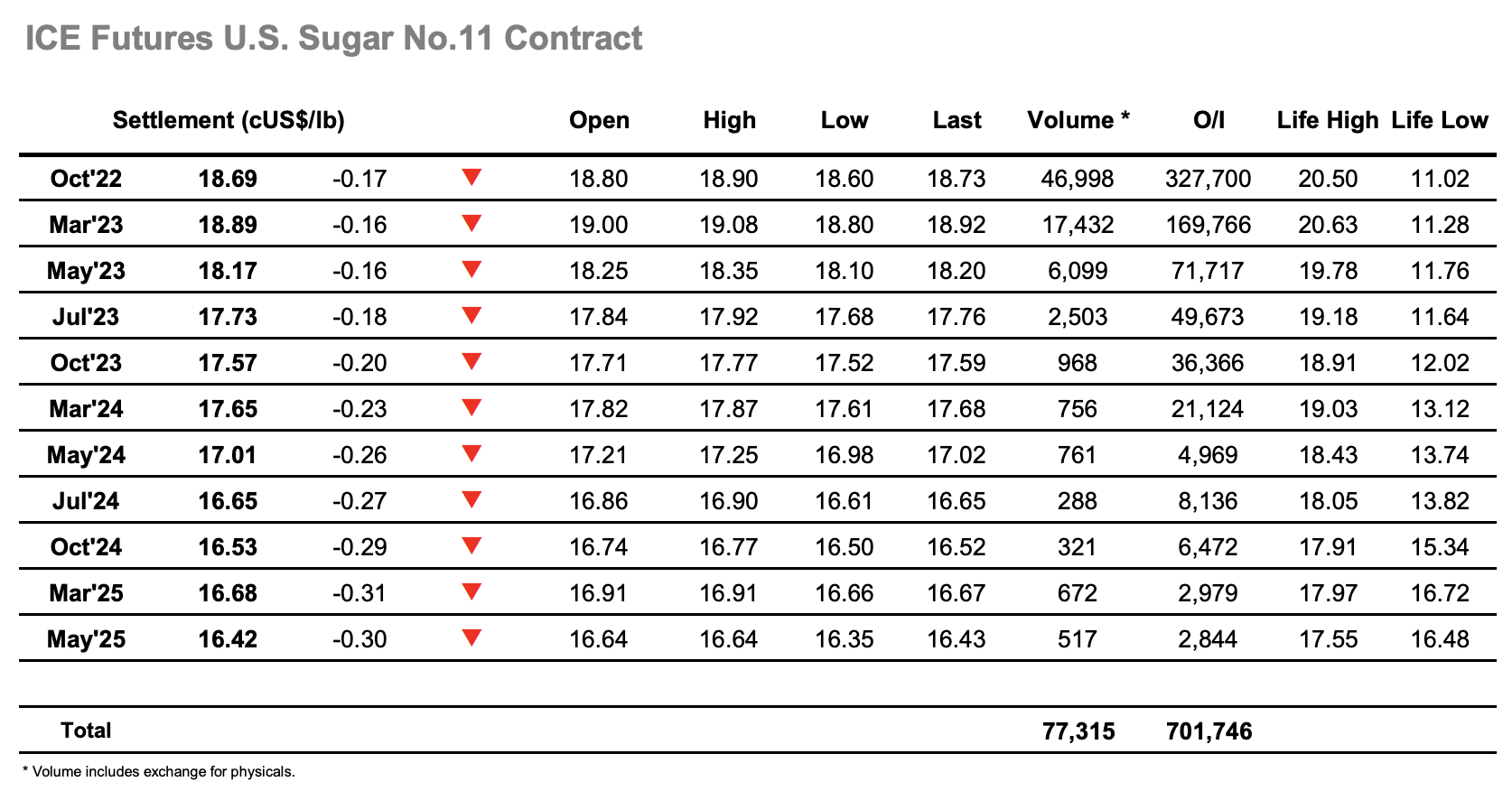

The market chopped around a little during the opening hour however things then settled down to leave prices consolidating near to 18.80 throughout the remainder of a slow morning. Recently the macro has been an increasingly dominant influence, and with a sea of red again showing on the screen some spec selling emerged to pressure the market down and increase our relatively modest losses heading into the afternoon. Still the market did not collapse with the downside extension of reaching 18.60 for Oct’22, the market evidently content to drift along quietly. Mid-afternoon brought news of the latest UNICA numbers which showed cane production of 41.876mmt / Sugar production at 2.487mmt / Mix at 45.46% / ATR 137.08 kg/t. As anticipated, these were lower on the year-on-year basis while also being a small way beneath most market estimates, though no obvious positivity was derived from the situation with the market continuing quietly in the 18.60’s. A small, short covering rally did follow to pull back to mid-range however we slipped again late in the day to end a quiet session at 18.69.