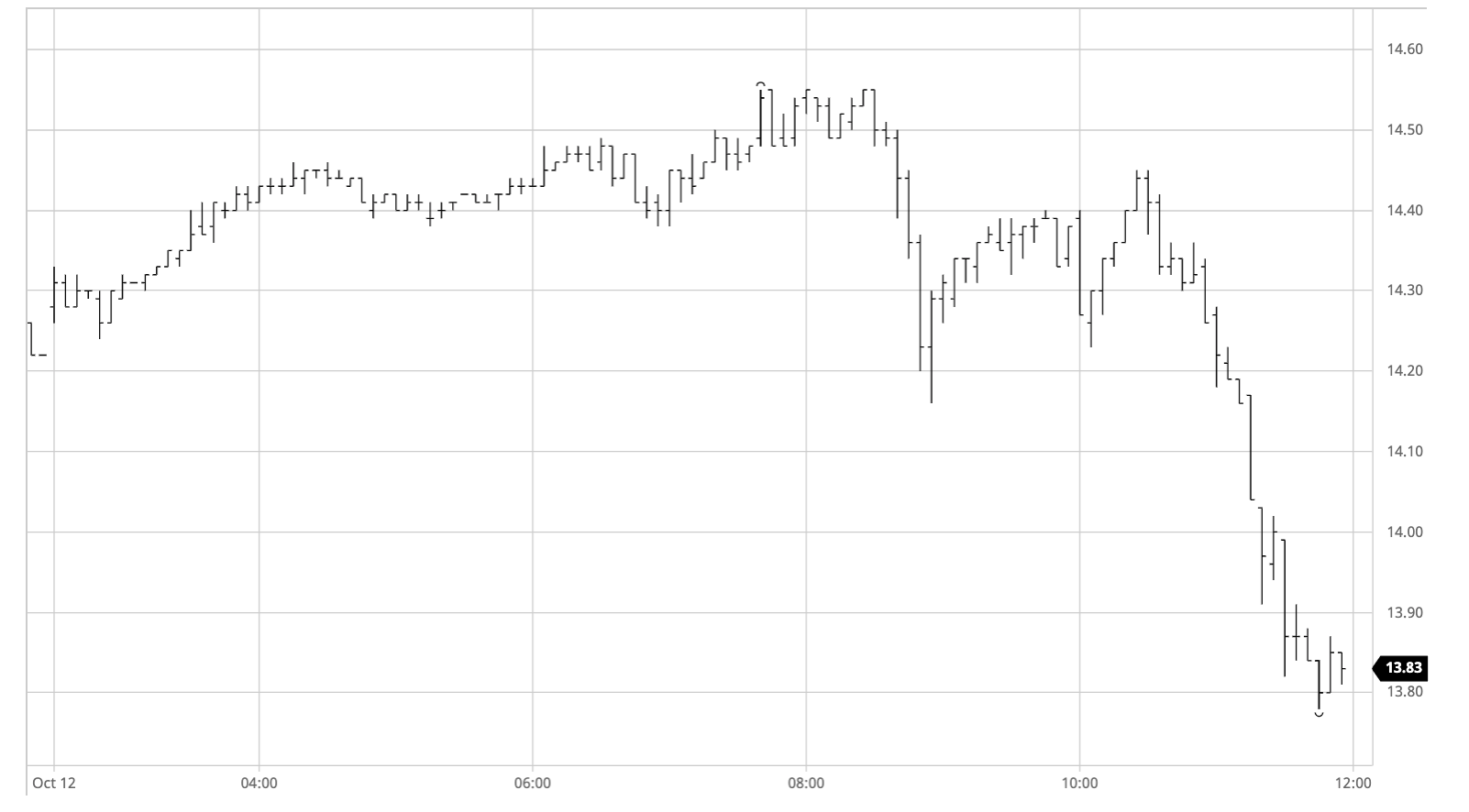

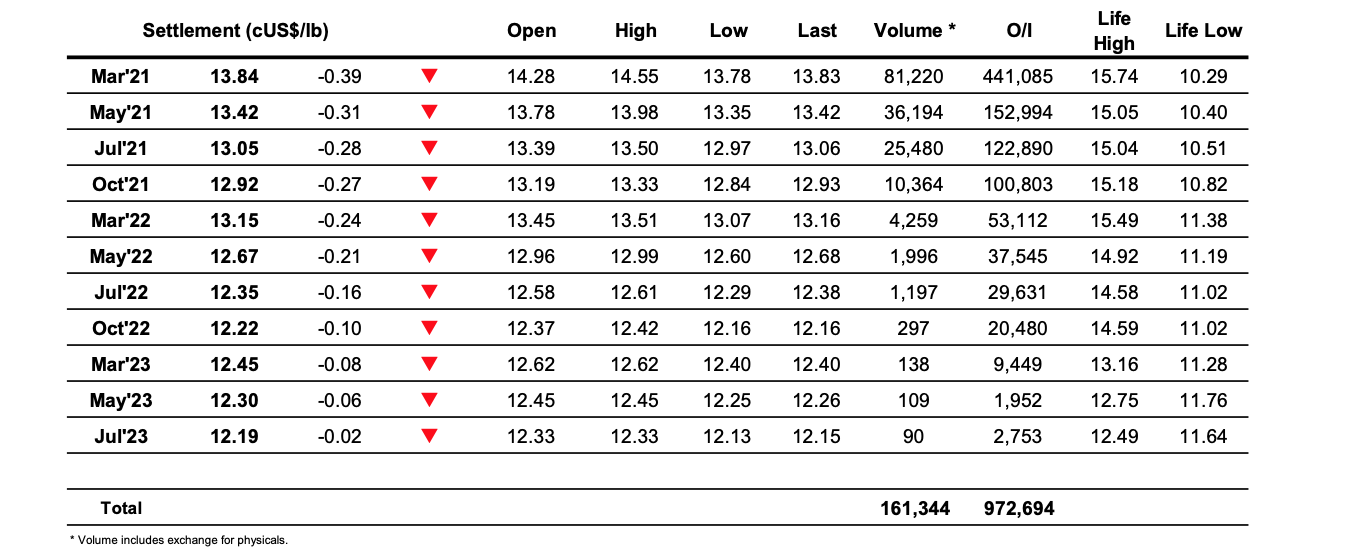

Mar 21 – Sugar No.11

The strong technical picture from both a daily and a weekly perspective provided a strong foundation from which specs continued to push higher this morning, taking March’21 into the 14.40’s on moderate volume with sellers few and far between. In addition to the technical factors today also represents a public holiday in Brazil and with the sell side guaranteed to be less populated while the USDBRL is closed there was additional motivation for the specs to keep pushing, with more aggressive buying during the early afternoon sending us through the moderate producer scales to a new high mark of 14.55. A period spent near to the highs has recently been a precursor to further upside movement however today we instead saw the opposite as March’21 experienced a sharp pullback to 14.16 with specs chopping out of earlier purchases before the market made an effort to stabilise once again. It seemed for a while that we may settle into the range however the final hour carried a sting in the tail for the longs as the market slid back to, and then through the earlier lows. Various sell stops were triggered as the front month swiftly printed back beneath 14c and though a brief attempt was made to stem the decline and pick it back up above this level the lack of any other meaningful support soon had prices retreating further. Spreads were also impacted significantly on the decline with the March/May’21 that had found little resistance as it widened to 0.59 points earlier in the day now on its knees, narrowing all the way back to 0.41 points to undo a large portion of the recent gains. The front month meanwhile printed to a session low 13.78, just a solitary point above the former 13.77 double top which was providing some technical support, but though this was sufficient to enable some late short covering which enabled a settlement level of 13.84 the sharp nature of the decline will be concerning to the fresh longs should a further technical breakdown take place with no sign of any noteworthy trade or consumer support in the immediate vicinity.

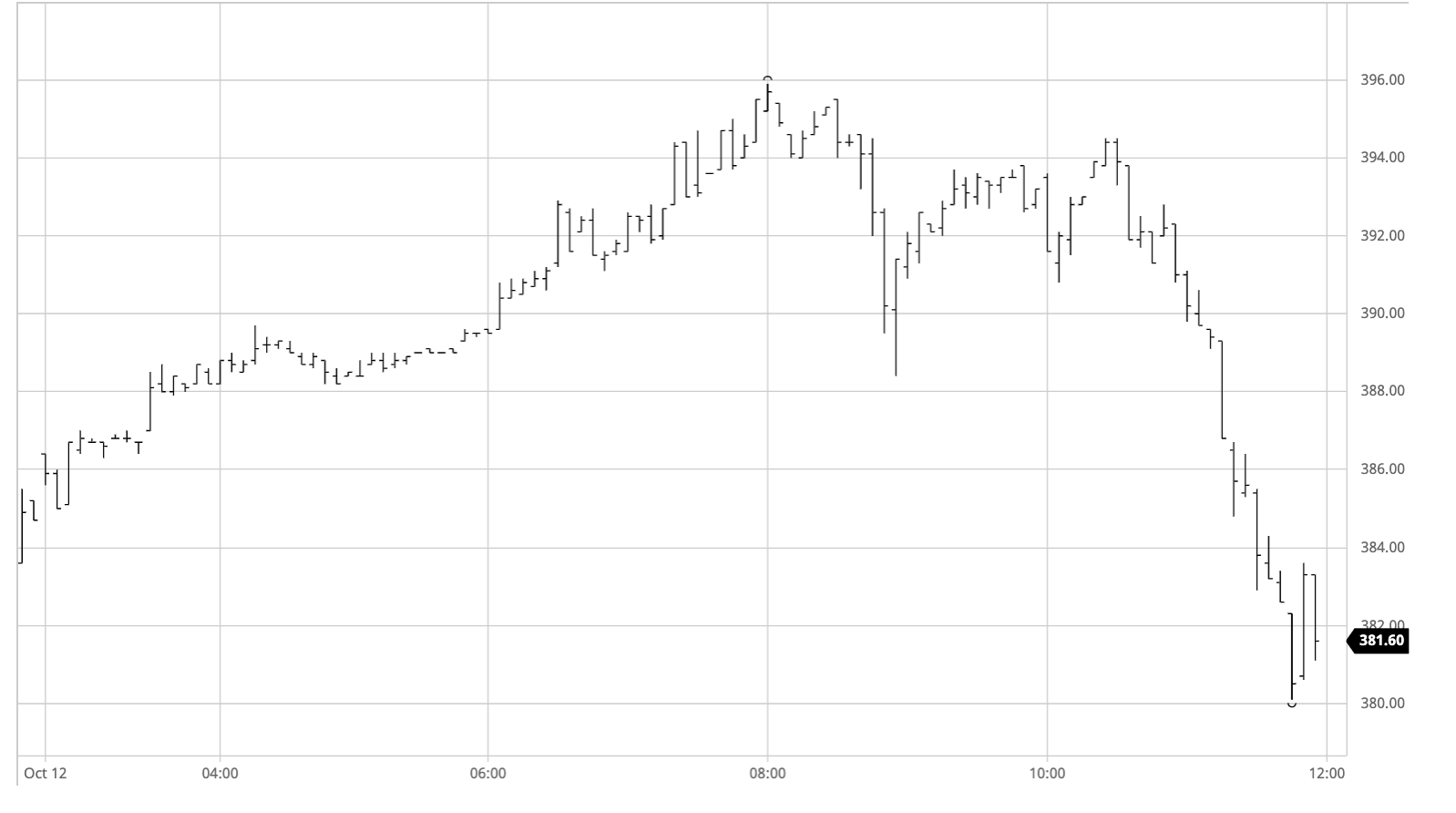

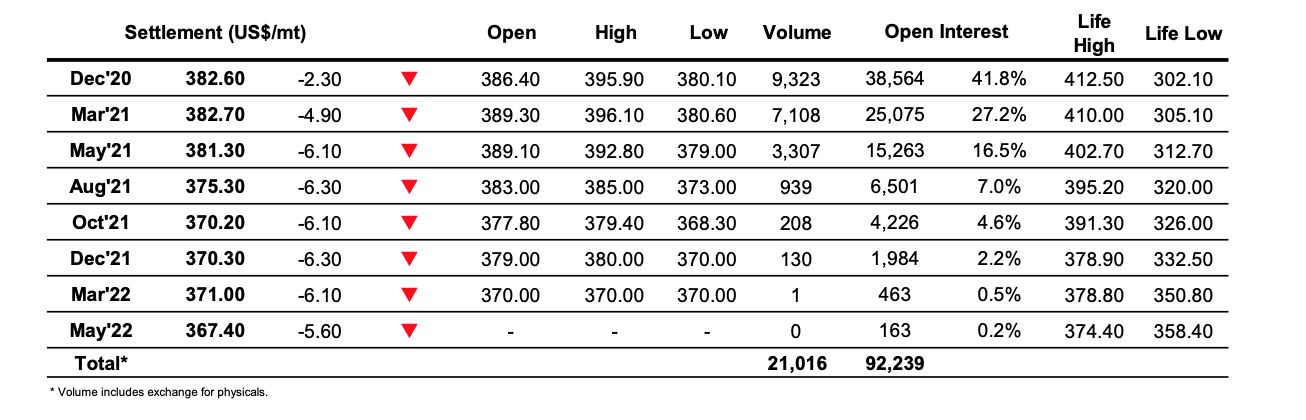

Dec 20 – White Sugar No 5

The week started with the market immediately on the front foot, building upon the recent strong technical picture to make further gains over the course of the morning which saw Dec’20 challenging the 390.00 area. Selling was proving limited on the move higher and with greater volumes of spec led buying appearing during the early afternoon the drive higher continued with the front month reaching $395.90 before stalling. These gains were proving more significant than our No.11 counterpart and led to significant increases for the nearby spreads and also reversed some recent losses for the white premiums with March/March’21 working back towards $78 in its strongest showing for some time. The reliance upon spec led buying was shown soon afterwards as a large chunk of the morning gains was quickly eroded before defensive buying reappeared, however later in the afternoon when the No.11 experienced a second wave of spec long liquidation there was little we could do in the thin trading environment but follow lower, losing more than $10 across the final hour of the session to trade $380.10 until some late short covering pulled it back a little with settlement at 382.60. Hite premiums gave back some of the earlier gains though were still firmer overall with March/March’21 near to $77 going out, while Dec’20 spreads didn’t get hit significantly so leaving the Dec/March’21 firmer on the day as it ended near to parity. This did not disguise what is technically a very disappointing performance and reversing the recent hard work in such quick time will not inspire confidence, making it imperative for the specs to stem the move promptly if we are not to see further erosion.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract

Dec 20 – White Sugar No 5