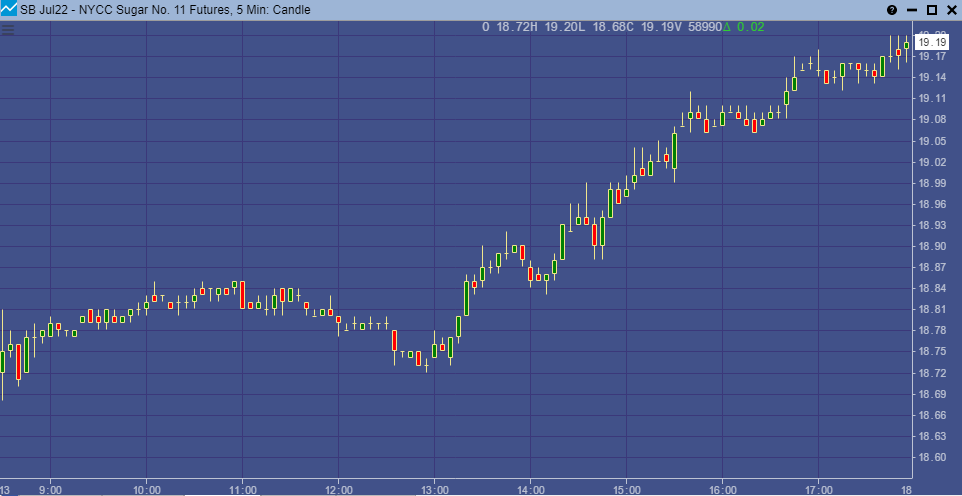

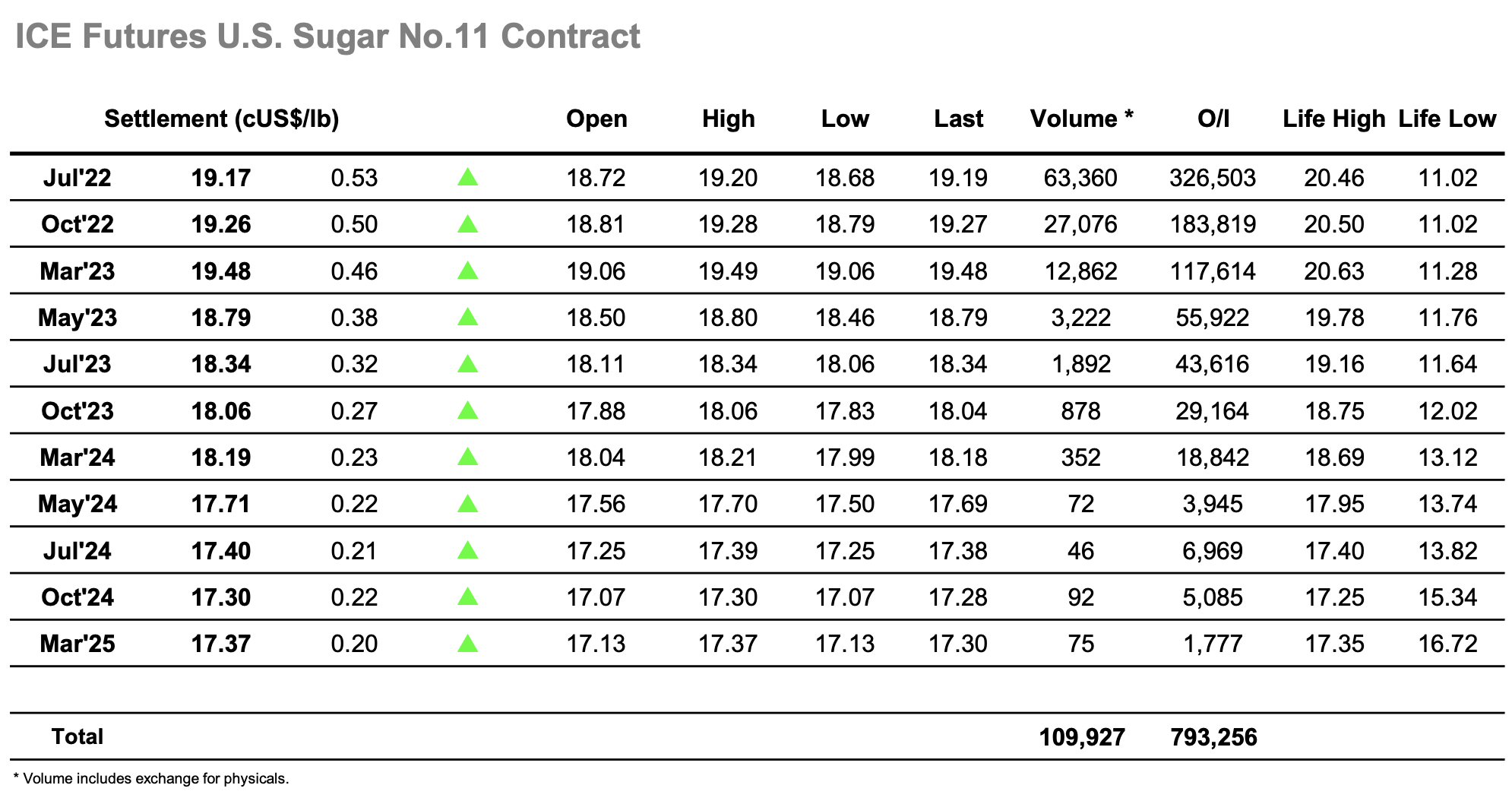

Yesterday’s recovery represented the most positive thing to be seen in the market for a while, and with the macro shaping up positively again this morning there was buying around to build upon these efforts. The morning efforts were spent consolidating the early push with Jul’22 holding either side of 18.80, and though there was a small easing ahead of the US-day getting underway it was on limited selling with small net gains maintained. Talk around the market centred on estimates from one trade house of a $29mmt Brazilian crop this year, placing them $3-$4mmt below the consensus of others, and while such estimates should be viewed cautiously at such an early stage in the crop it seemed to provide specs with reason to continue the higher push. The macro was becoming more mixed (energy stronger / grains weaker) but given the recent detached nature of sugar from the wider sector, the No.11 continued steadily higher to make a series of new session highs through the afternoon. Traders were clearly content to hold onto longs as Jul’22 printed new highs at 19.20 on the close and settlement made only a few points below at 19.17. Today’s action will be welcomed by longs that remain and clears any oversold technical indicators, yet it does not take the market outside of the past 3-weeks range and so there remains work to do if this is not simply to be a short-term correction – the coming days will provide the answer.