Sugar #11 Oct’21

A technically weak conclusion to the last week and news that the COT had only reduced by around 7,000 lots to show the net spec position at 231,604 lots long provided the reasoning for some additional weakness this morning with Oct’21 dropping down to a new monthly low at 18.57 during the first hour. Though outright activity was light sufficient buying did then emerge to bring values upward once more and while the recovery was modest it began to allay some concerns of further correction and we held the 18.80 area as the Americas day got underway. The continuing dominance of the index roll on proceedings and an Oct’21/March’22 value stable either side of -0.70 points left very little to report with the flat price content to edge sideways in the absence of any fresh news. The only significant movement came during the final couple of hours and seemed to be in reaction to the pre-expiry activity in the whites where their Oct’21 contract was surging. This pulled some fresh buying interest in for the sector and enabled our Oct’21 contract to touch through 19c in the final 15 minutes with settlement only just beneath at 18.98. Overall this does nothing to reassert technical positivity to proceedings however with specs clearly not looking to lighten the load by much at the present time it may go some way to enabling a bottom to form albeit ahead of likely range bound continuation for the near term.

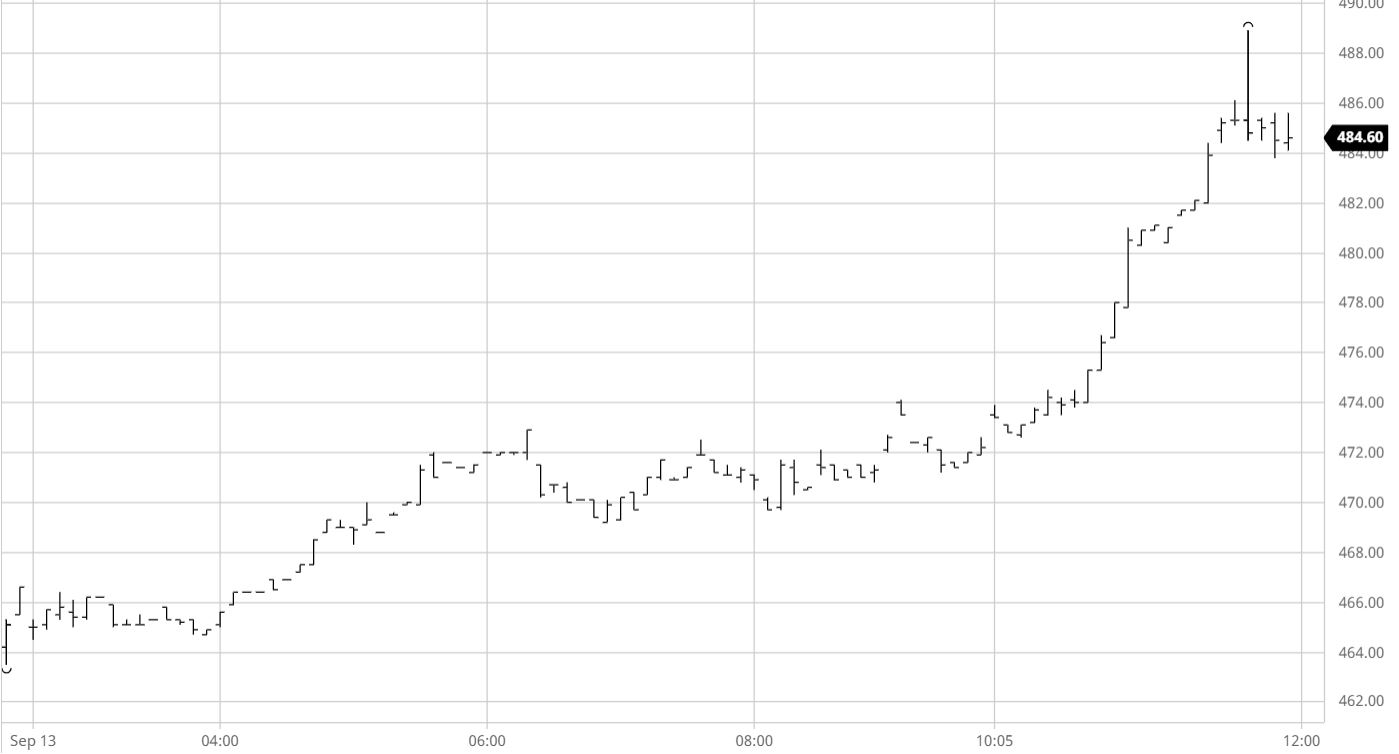

Sugar #5 Oct’21

Having performed poorly at the back end of last week we saw Dec’21 initially continue on the backfoot with initial sideways trading leading us beneath Friday’s low to $485.20 before stabilising to sit in the upper $480’s once more by the end of the morning. With just three sessions remaining (including this) until the Oct’21 goes off of the board however it was more so the Oct/Dec’21 spread which remained in focus with decent sized rolling still taking place as it pulled back upwards to the -$20 area by late morning, no doubt further reducing the already small 7,491 lot Oct’21 open interest. Uneventful trading left the Dec’21 price continuing sideways as we moved through into the afternoon while the main event being provided by the spread provided more interest with the rally further extended to the -$16 area with just a couple of hours remaining. Hat followed during the final hour came as something of a surprise with the market igniting on the back of the spread, causing Oct’21 to spike and pulling the rest of the board along on the back of the spot movement. Over a period of just 45 minutes the Oct/Dec’21 shot up to -$7 with very little selling to be found though some did return for the call to leave it settling at -$10.30. The Dec’21 meanwhile ended at $495.00, largely reversing the move of Friday and stemming the technical weakness for the moment.

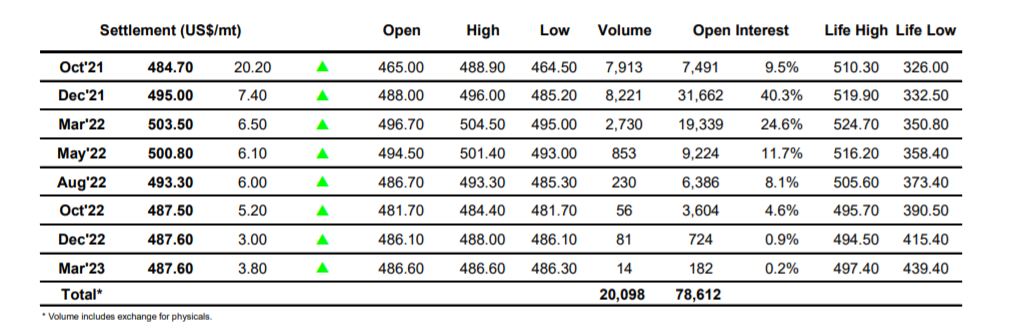

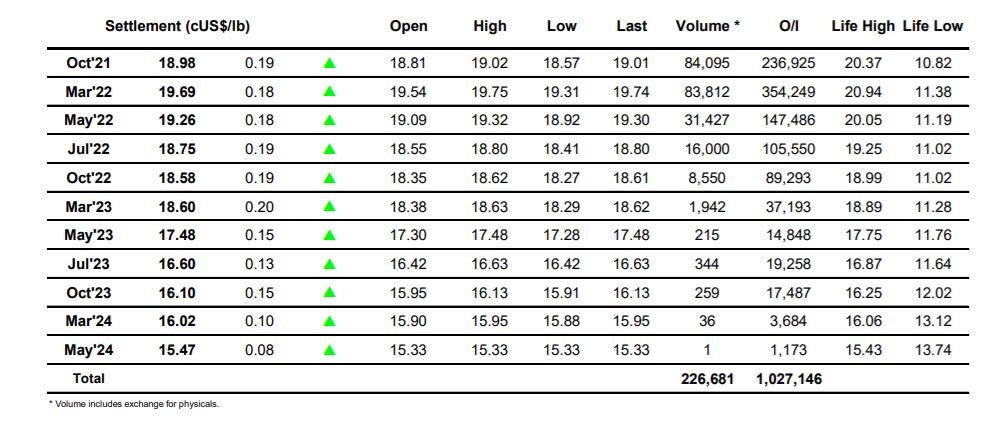

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract