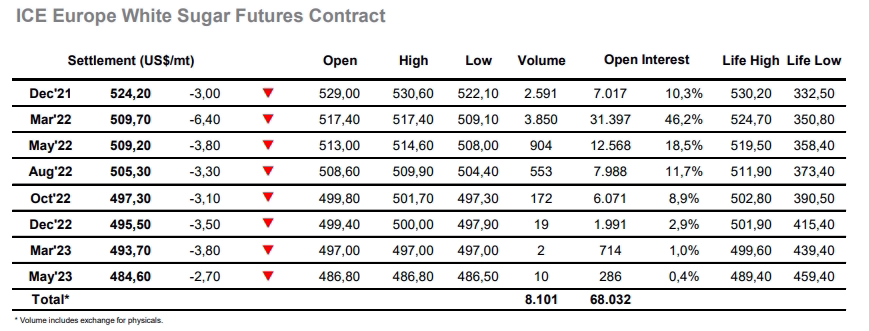

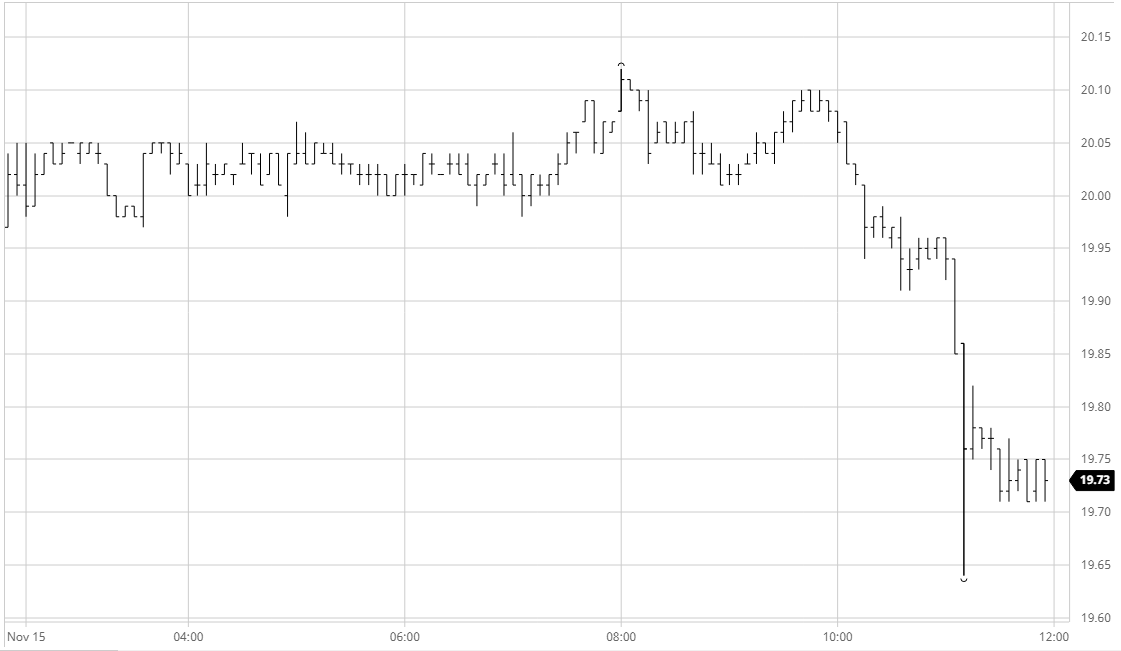

Sugar #11 Mar ’22

Despite the move back to the 20c area recent sessions have proved to be largely dull and uneventful, however today saw this taken to a new extreme as morning activity was confined to an incredibly small range either side of unchanged. With no COT report until tonight due to the federal holiday last Thursday we cannot gauge the spec position though expectations are that the smaller specs will have brought a small increase to the net long during the reporting period. They may well have added further to this since last Tuesday however there were no signs that they wanted to continue today as the move into the afternoon brought no change to the picture with the flat price relentlessly flatlining. With the macro rather mixed and being led by coffee (softs encouragement) while crude sagged we were somewhat caught in the middle however the final couple of hours saw some shine start to fade as we drifted down towards 19.90 and new session lows. Nobody expected what followed however as an extension into the 19.80’s triggered off a host of sell stops that spiked March’22 down to 19.64 on volume of around 6,000 lots, and while the lows were seen only briefly the recovery was unconvincing and stalled in the 19.70’s. The closing stages played out in this same area to leave March’22 settling at 19.74, a disappointing conclusion which likely condemns us to yet more rangebound trading.

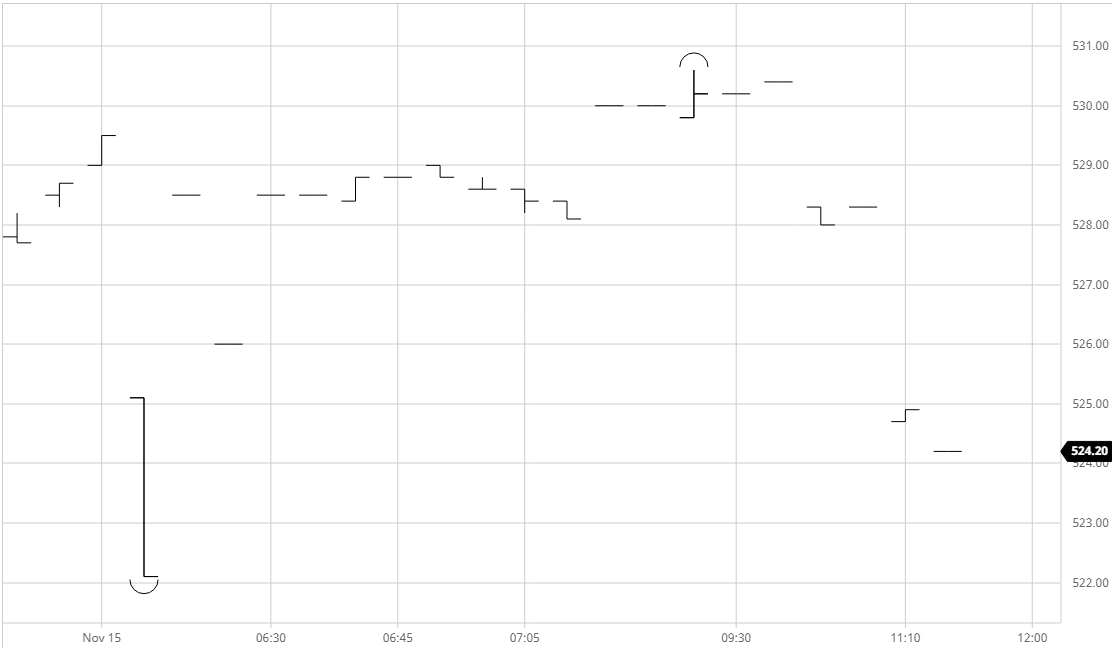

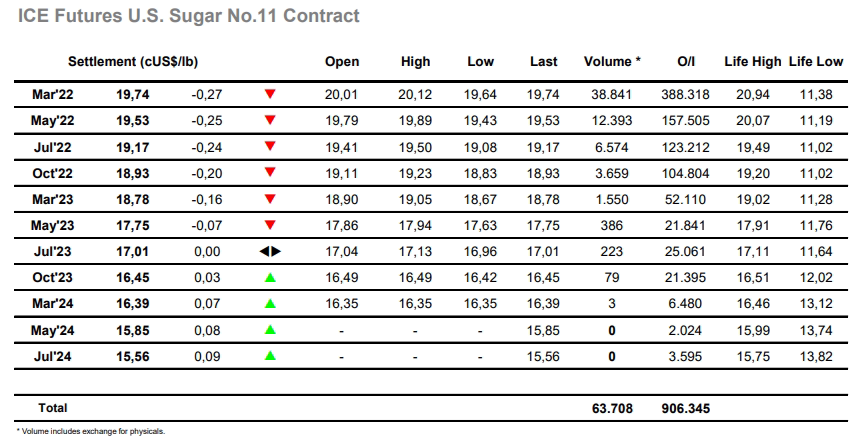

Sugar #5 Mar ’22

Initial buying quickly dissipated and the market soon slipped to spend the first couple of hours holding between $514 and $515. Flat price interest continue to be incredibly thin and so it was that all eyes were directed to the final expiry of the year as the Dec’21 contract reached its conclusion. The Dec’21/March’22 was not finding a great deal of liquidity during the early part of the day and printed in to a low at $8.50 before resuming the strength of last week with occasional buying taking the differential back out to $13. Open Interest dropped by more than 3,000 lots of Friday to start today with 7,017 lots Dec’21 remaining and as we moved through into the afternoon we saw more of the tonnage being AA’d out with around 2,000 lots posted to boost the thin volume being seen on the screen. The rest of the board continued quietly sideways and despite a couple of small nudges upward the March’22 contract was on course for an inside day until an unexpected burst of selling triggered sell stops to send March’22 tumbling back down to $509.20. There was not much of a bounce from this low and it was revisited on the close as March’22 settled at $509.70, undoing some of the recent positive work and pushing us back down into the broad range once more.

The Dec’21 expiry is expected to see 5,678 lots (283,900mt) tendered of Indian origin sugars. Full details will be advised tomorrow.