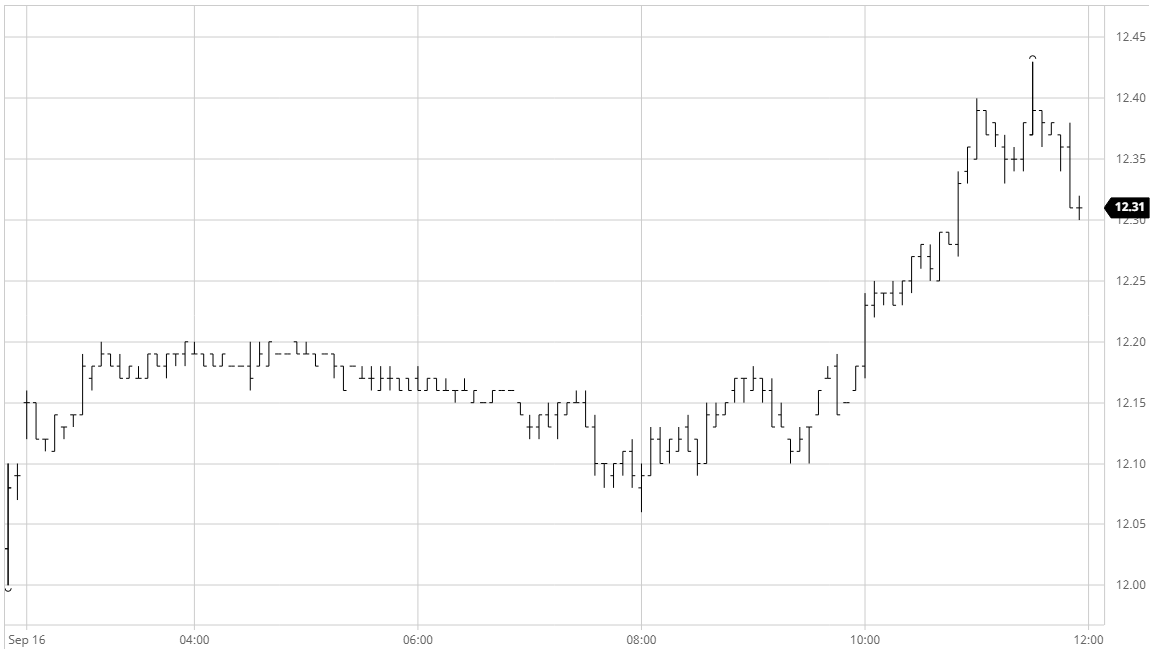

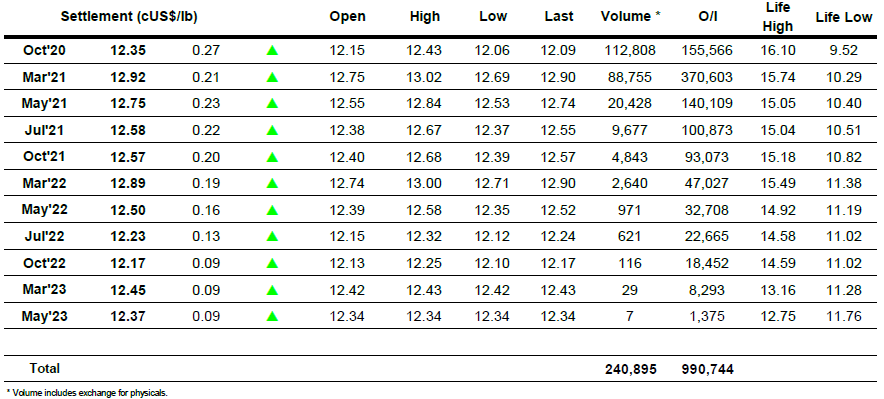

A very slow start to the session saw values trading little changed before finding some support which took Oct’20 up to 11.91 ahead of the US morning. This support appeared to be based upon tonight’s Oct’20 option expiry with a desire from some to try and pull the underlying up to the 12c strike level, however macro concerns initially limited the gains as we fell short. Renewed support arrived once US based traders entered the fray and the market moved to new session highs with a 12.01 print, though maybe of concern to those with a vested interest in defending the 12c options we then retreated back to the range once the buying eased. Despite the index roll window concluding yesterday there remained strong volume for the Oct’20/March’21 spread and all of yesterday’s losses were being reversed with the differential recovering back to -0.65 points. This served to assist the option related buyers and a fresh push upward later in the afternoon had Oct’20 reaching above 12c to a new session high mark of 12.05 with a further push for the close taking it higher still to 12.10. With settlement level established at 12.08 the recent technical negativity has been halted though whether it leads to a wider recovery is questionable with that dependent upon the specs as physical support seems unlikely to follow immediately higher and the fundamental outlook remains unchanged.

Oct – Sugar No.11

The strong conclusion to yesterday’s session encouraged in some early buying as Dec’20 began its tenure at the front of the board by pushing above $357.00 during the opening minutes. These early gains pushed values well in advance of the No.11 with WP values immediately a couple of dollars firmer than last night’s closing values though as the morning wore on so selling began to creep back in to push back downward, Dec’20 gradually sliding back to record a session low 352.30 while the Dec/Oct’20 WP retreated to $85 from an early high of $89. The continuing WP weakness suggests that there remains limited reason for values to recover fundamentally however with No.11 continuing to attract buying interest we were again pulled higher and made new session highs as the final hour loomed. The move continued to feel as though it was under some duress as we failed to find the same level of spec support as was being seen for No.11 though we remained positive to settle at 358.00 before giving back some ground in the final couple of minutes.

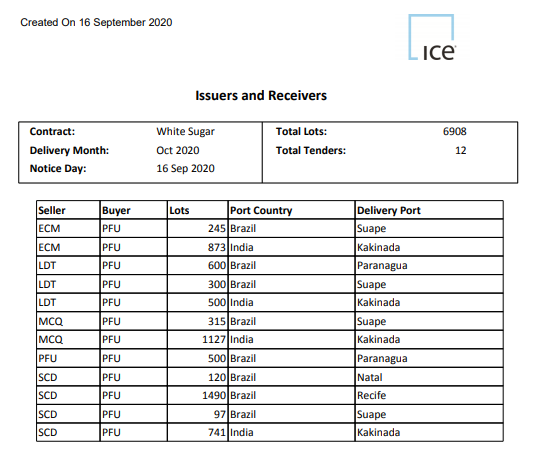

As was widely anticipated the Oct’20 expiry saw 6,908 lots (345,700mt) tendered with Man (ECM & MCQ), Dreyfus (LDT), Tereos (PFU) and Sucden Paris (SCD) delivering to Wilmar (PFU). Full details are shown in the exchange notice below:

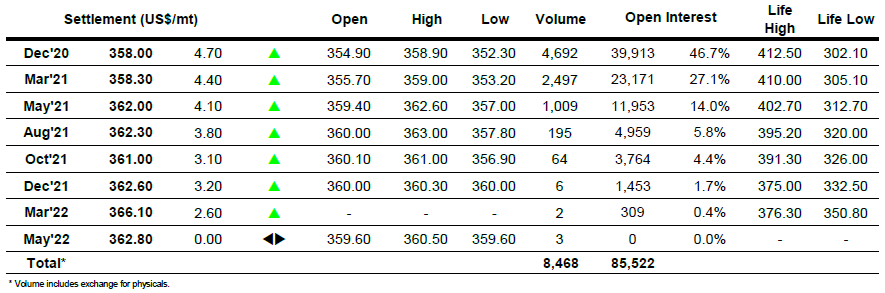

Dec – White Sugar No 5

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract