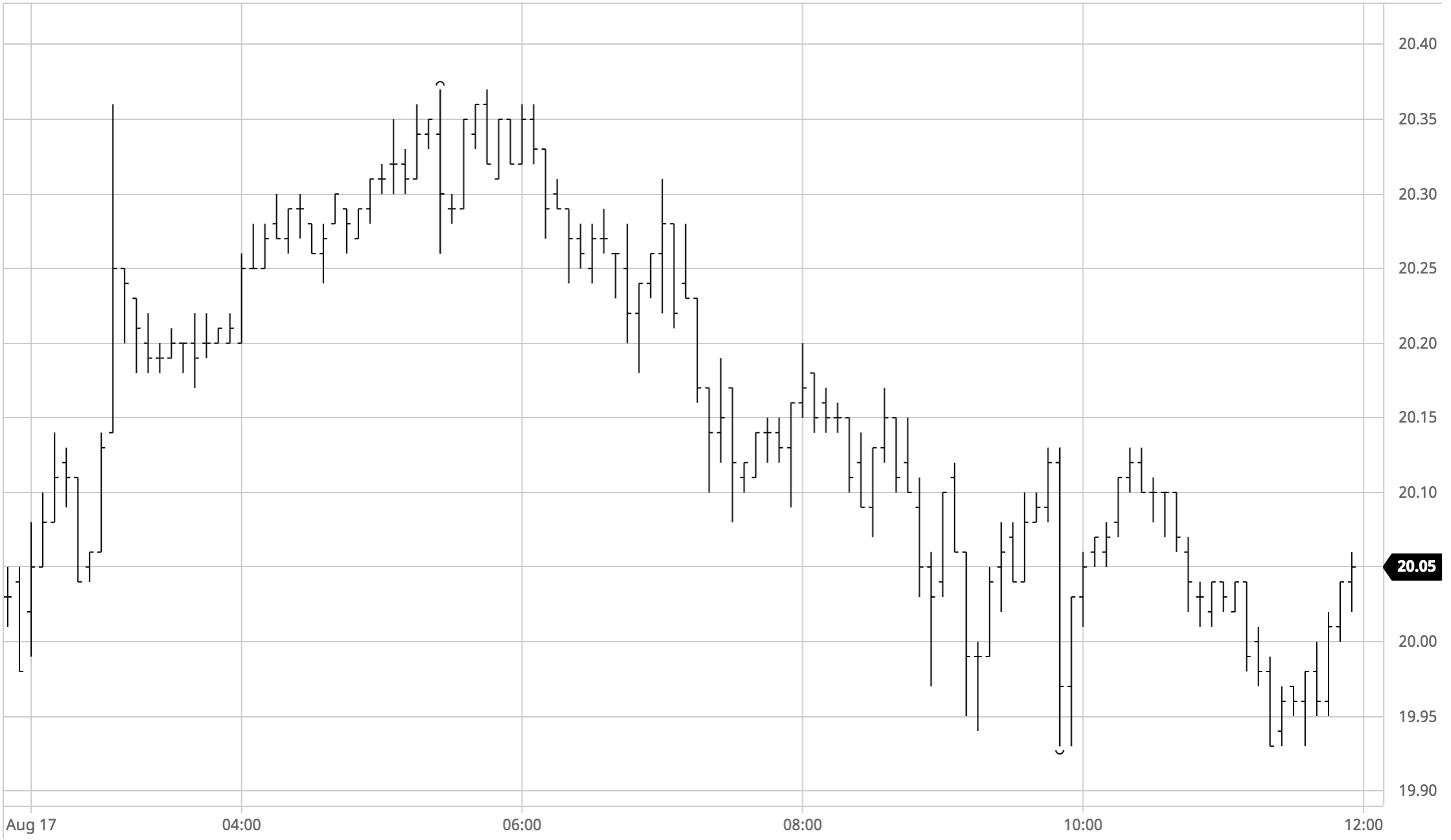

Sugar #11 Oct’21

The shackles were taken back off of the market this morning and able to move away from 20c the Oct’21 soon launched ahead once again to reach 20.36 on a few light buy stops before entering a period of consolidation in the 20.20’s. Sentiment continues to be extremely positive despite the increasingly overbought short term nature of the market and picking back up over late morning we made a marginal new contract high 20.37 to provide a very firm footing ahead of the US day. Rather than seeing yet another spike upward this period proved to be rather flat with process instead slipping back into the lower half of the day’s range, possibly a sign that the extension in prices over the past two weeks is running out of steam with specs and funds not nearly so visible. The macro was also rather flat and given the way in which we have extended significantly beyond the wider herd in recent times some cooling is inevitable, and this became more apparent as we worked through the afternoon with a couple of dips back beneath 20c though these found buying and were picked back up. The decline from morning highs did see some wide swings in spread value with the morning rally having been largely confined to the front of the board. Oct’21/May’22 had extended to 0.62points before heading into the red to be trading into 0.45 points later in the afternoon while there were also some interesting movements further down with Jul22/Oct’22 extending from 0.53 to 0.62 points over the morning and then making a low at 0.48 points later on, significant change for consecutive prompts in the centre of the board. Matching the lows during the final hour we found buying which ensured a late recovery to leave Oct’21 settling just a single point lower at 20.02, with March’22 unchanged at 20.63 and the middle months showing moderate gains. This further raises the question of the contrarian nature of spread contraction and outright strength and while that cannot continue indefinitely there is no sign that the specs will let the flat price fall too far without a fight.

Sugar #5 Oct’21

Five successive days of gains have seen the whites dragged back to life and from a mildly higher opening we were soon back on the offensive with Oct’21 pushing through $500 for the first time with a spike to $503.50 before cooling. The retreat was brief and we soon resumed the upside with a more steadily paced climb over the rest of the morning which extended the gains to $505.60 while at the same time bringing the Oct/Dec’21 to its highest levels in a while at -$13.90. This placed Oct’21 almost $50 above the levels at which it was trading just last Tuesday and so when the early afternoon saw prices ease back away into the range it can hardly have been unexpected with the higher levels attracting some selling on the basis of the heavily overbought technical picture. Still the retreat was incredibly orderly with no sign that the specs were looking to close out any of their longs, and with buying remaining for the front month so the headline white premium made another day of gains, putting into perspective the scale of the recent move by trading in the high $50’s from just $32 last week. The steady afternoon decline led Oct’21 to marginal session lows during the course of the final hour however the long stepped in with late buying and over the final 20 minutes the price rallied back through $500 to ensure a sixth day of gains with a settlement level at $501.40.

· Another positive session for the front month extended the recovery for Oct/Oct’21 to $60.00 while 2022 positions showed little change, March/March’22 at $65.60 and May/May’22 at $81.00.

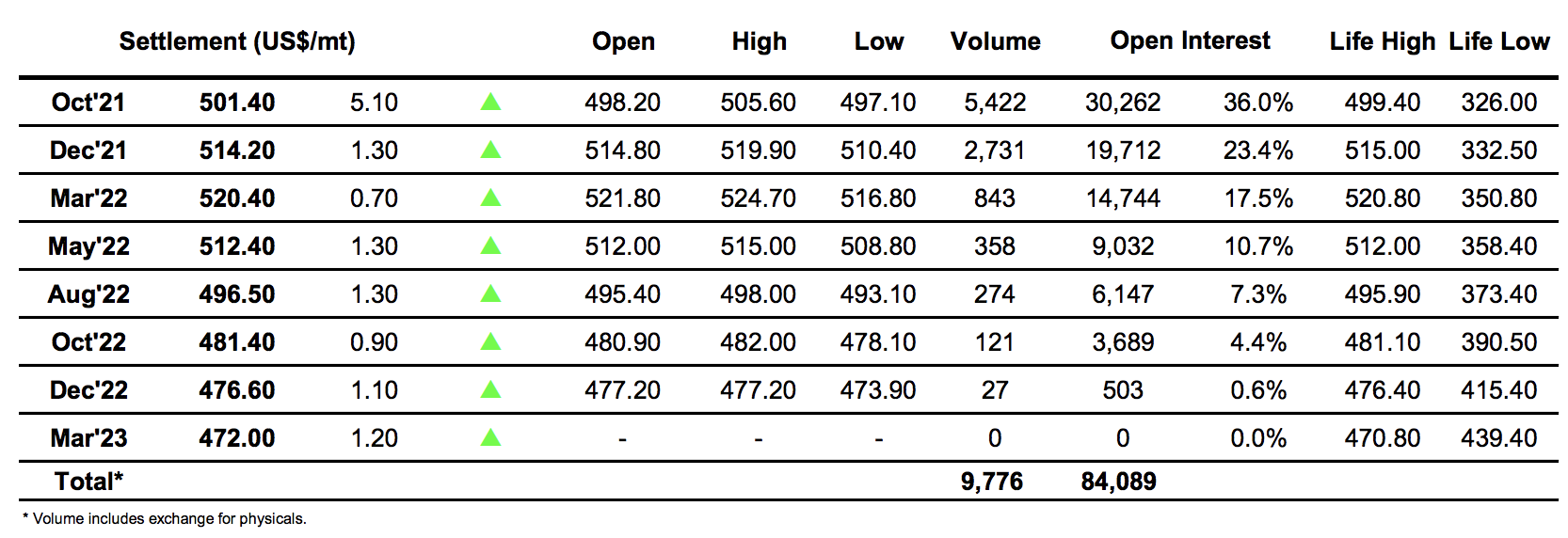

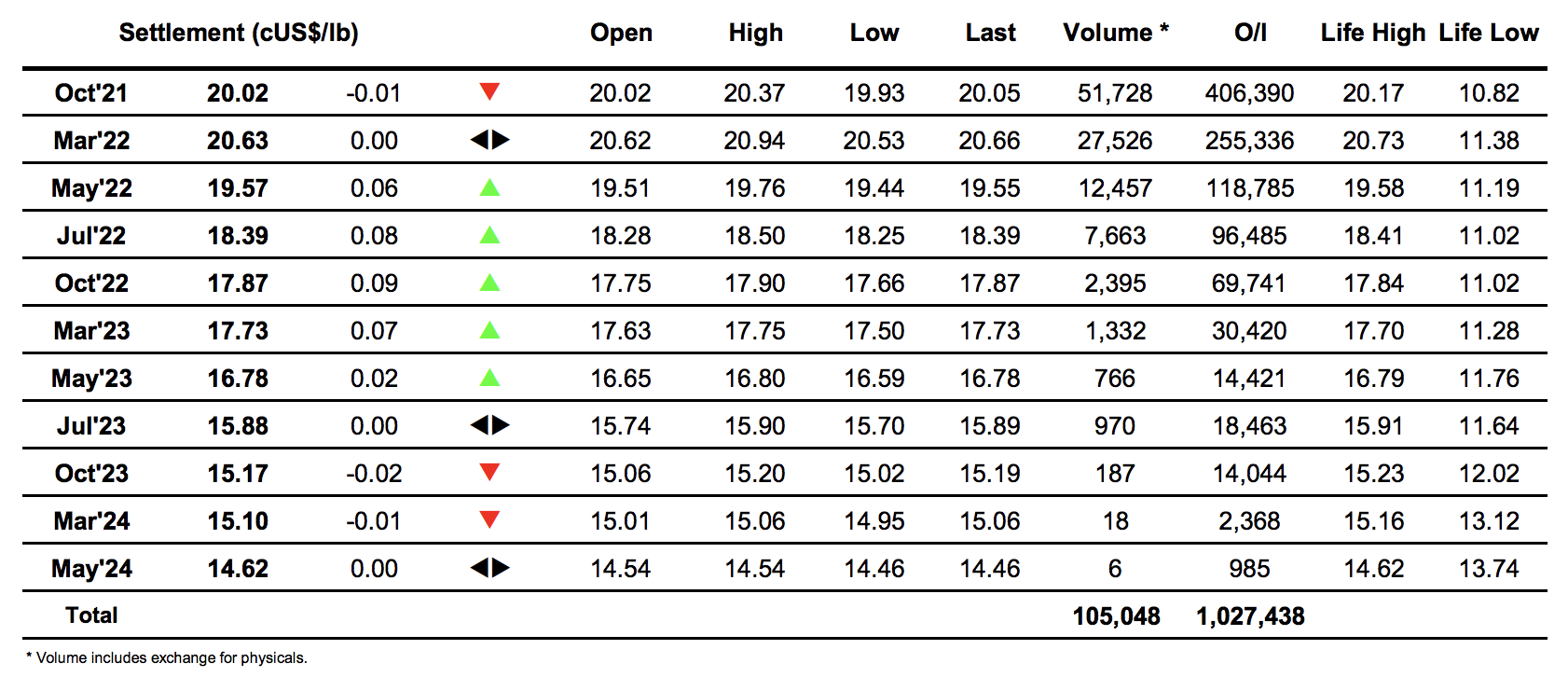

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract