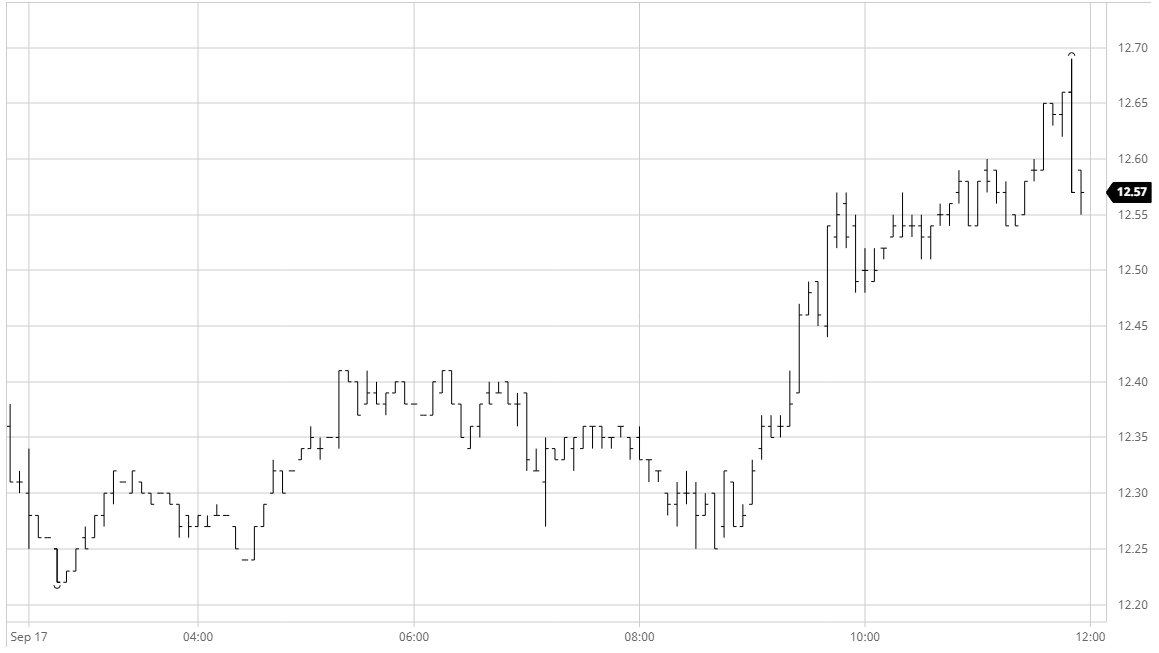

A relatively slow start to the day saw nearby values working a little lower, a lack of any significant fresh sales at the higher levels leading to reduced buying. A mid-morning rally appeared to be based on a push from day traders attempting to break yesterday’s highs and build technical strength however when this fell short and prices retreated back towards the lows it seemed a day of consolidation was the best that could be hoped for. How wrong this assessment proved to be as a renewed wave of buying midway through the afternoon gained some significant traction as March’20 pushed up through 13c. Buying poured in from specs and algo traders keen to pursue the technical strength from the long side buoyed by news that Saudi Arabia has expressed its determination to stop OPEC+ members exceeding their production quotas and its impact on crude values, and in turn there was also buying emerging from the trade as they rushed to cover shorts on the move. With March’21 now the virtual spot month as Oct’20 moves towards expiry there was also some significant movement for the Oct/March as the impact of the outright strength was felt through a weakening spread, giving back some of the recent sweeping gains and moving back to -0.65 points with the front month unable to keep pace. WE continued to climb at a slower pace during the final couple of hours as producer sellers appeared from the woodwork for the first time in a while, only slipping during the final stages as day traders squared out positions.

Oct – Sugar No.11

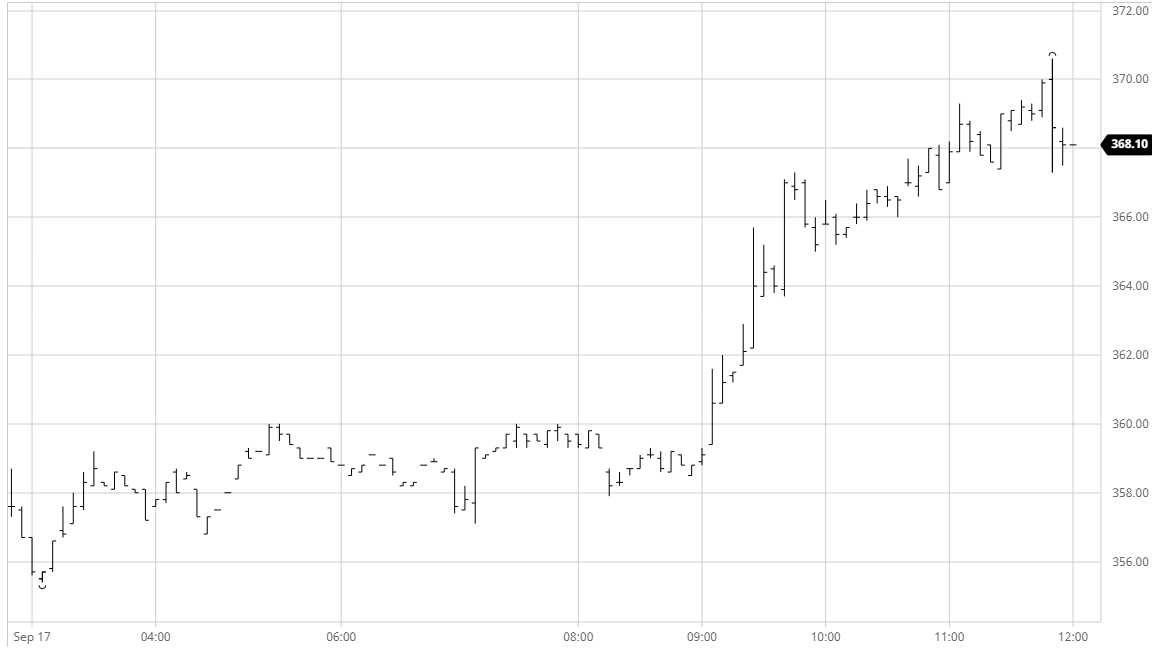

Early trading took place either side of last night’s closing levels as traders looked to consolidate the recent recovery. With No.11 values lagging the WP’s were a little firmer though for a long period there was no real impetus to continue the drive higher. A brief period of fluctuation around mid-session failed to lead to any significant movement and we resume the status quo until mid-afternoon when the specs entered the fray to push prices sharply higher once again. The move was triggered by stops in the No.11 as specs moved in reaction to news that Saudi Arabia has expressed its determination to stop OPEC+ members exceeding their production quotas and the resultant recovery in crude values. With sellers few and far between our surge higher continued to outstrip the gains for No.11, further widening WP’s to see Dec/Oct’20 out to $91 and March/March’21 to $77. The pace of the rally eased during the final couple of hours but still we rose to record a session high for Dec’20 at 370.60 before encountering some last book squaring which established settlement a couple of dollars lower. Still this provides a strong technical performance and places last month’s highs in the lower 380’s firmly in view, a remarkable turnaround from where we were just three days ago.

Dec – White Sugar No 5

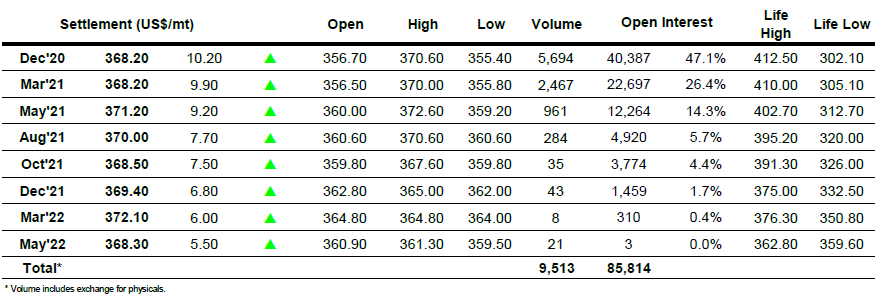

ICE Futures U.S. Sugar No.11 Contract

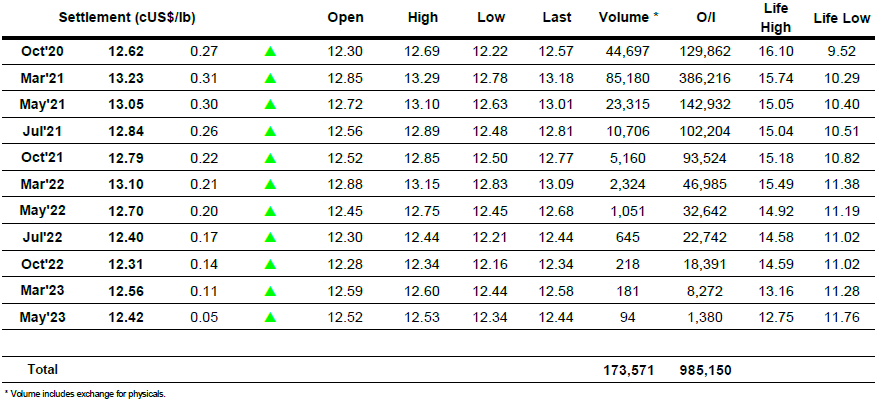

ICE Europe White Sugar Futures Contract