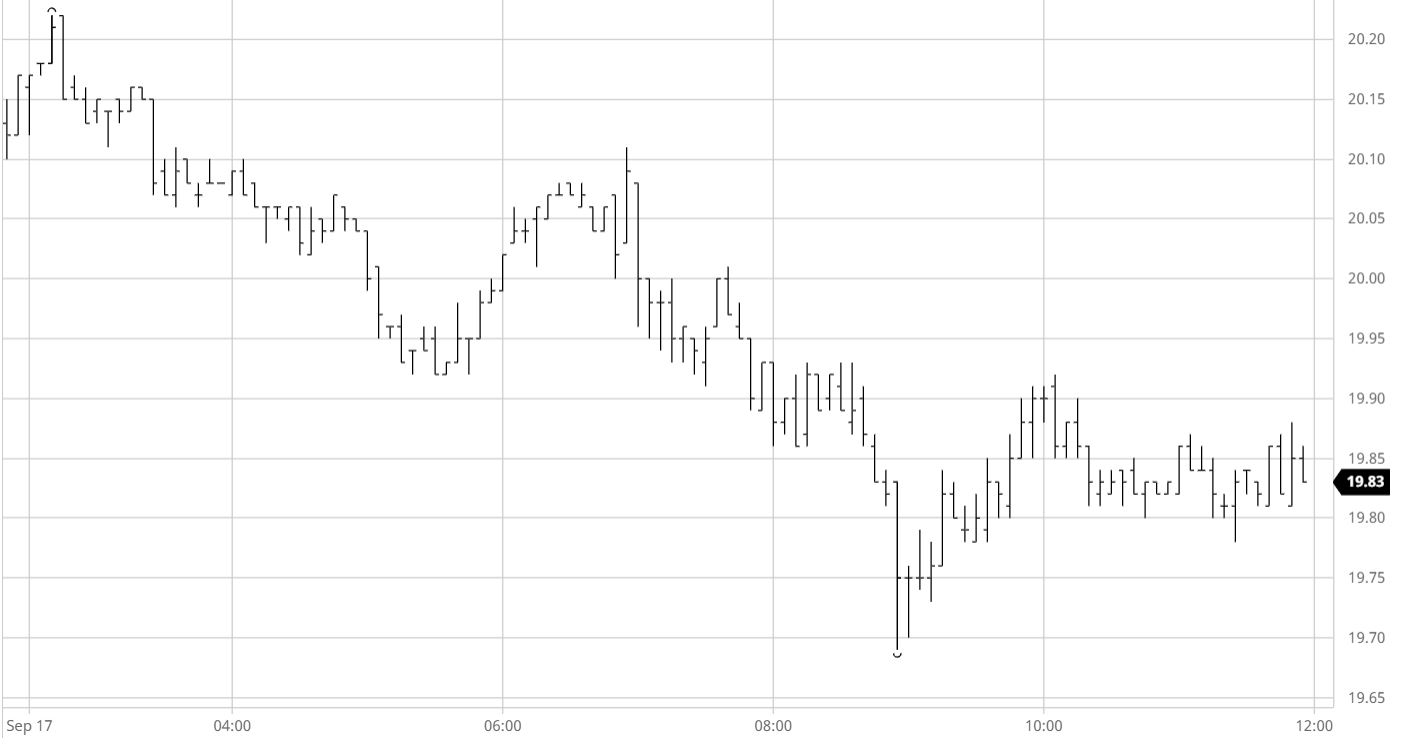

Sugar #11 Mar’22

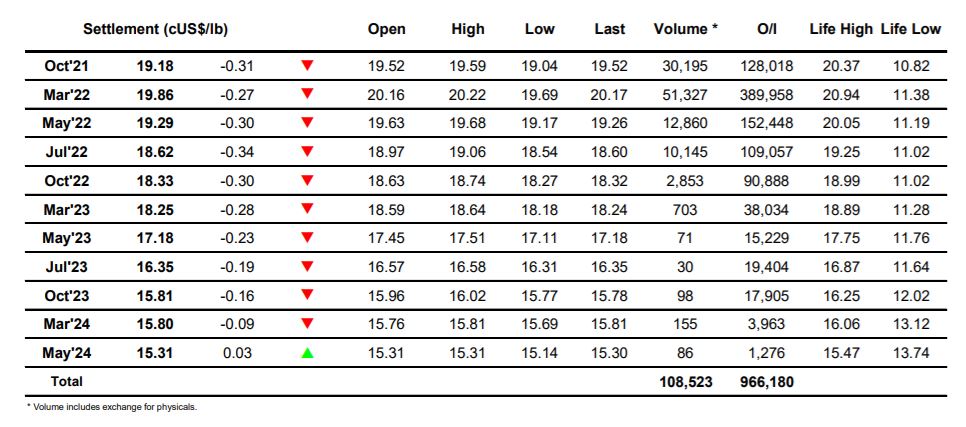

There was some initial buying on show which took March’22 up a little to 20.22 however we soon eased back toward overnight levels where prices began to drift. The tone has changed significantly in the last 24 hours with the spec buying and consumer panic having eased, and with the long side proving rather more thin we slipped back beneath 20c late in the morning. The dip found some defensive support however that proved rather short-lived with the US morning failing to garner any fresh buying, and so it was that we slipped again only this time with a little more conviction to trigger a few sell stops which sent the price to 19.69. The remainder of the afternoon was somewhat featureless as prices simply edged along at the lower end of the day’s range, content to head quietly into the weekend where we can discover the extent of ant spec selling on last week’s decline (though not how much was bought again on Wednesdays sharp recovery) Spreads were quieter than they have been for a while, not overly surprising with the Oct’21 OI now fare smaller, and the Oct’21/March’22 held back near to -0.70 later in the afternoon. Closing values were at the lower end of the range with March’22 at 19.86, providing a calmer conclusion to a choppy week.

Sugar #5 Dec’21

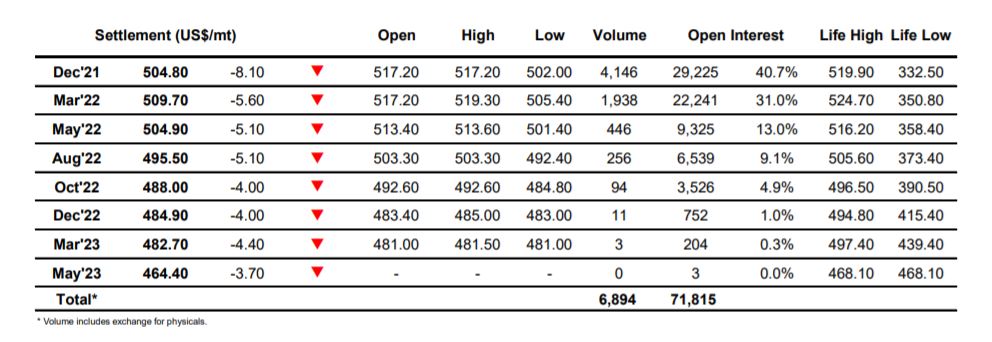

A spike upward to $517.20 on the opening gave way to selling within seconds and it was not long before the market was trading negatively, a sign that yesterday afternoon’s pullback would continue. For a while the decline was only very gradual and seemed to be due to a lack of buying rather than any noteworthy selling although by later morning a little more volume did appear to send Dec’21 down to $506. Some short covering followed however there was no desire anywhere to resume the higher path and it seems that the double top will dominate for a while removing technical buying interest. The change in sentiment for the flat price also resonated through the spreads with Dec’21/March’22 slipping back to – $4.90 this afternoon having yesterday appeared likely to move to a small premium, while March/May’22 dropped back to the $4 area. A featureless afternoon saw prices edge sideways at the lower end of the day’s range and with Dec’21 ending a wild week which has seen it range from $485 20 to $519.60 towards the centre at $504.80 we may well see a continuation of this calmer activity into next week as the market continues to struggle to find sustainable direction

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract