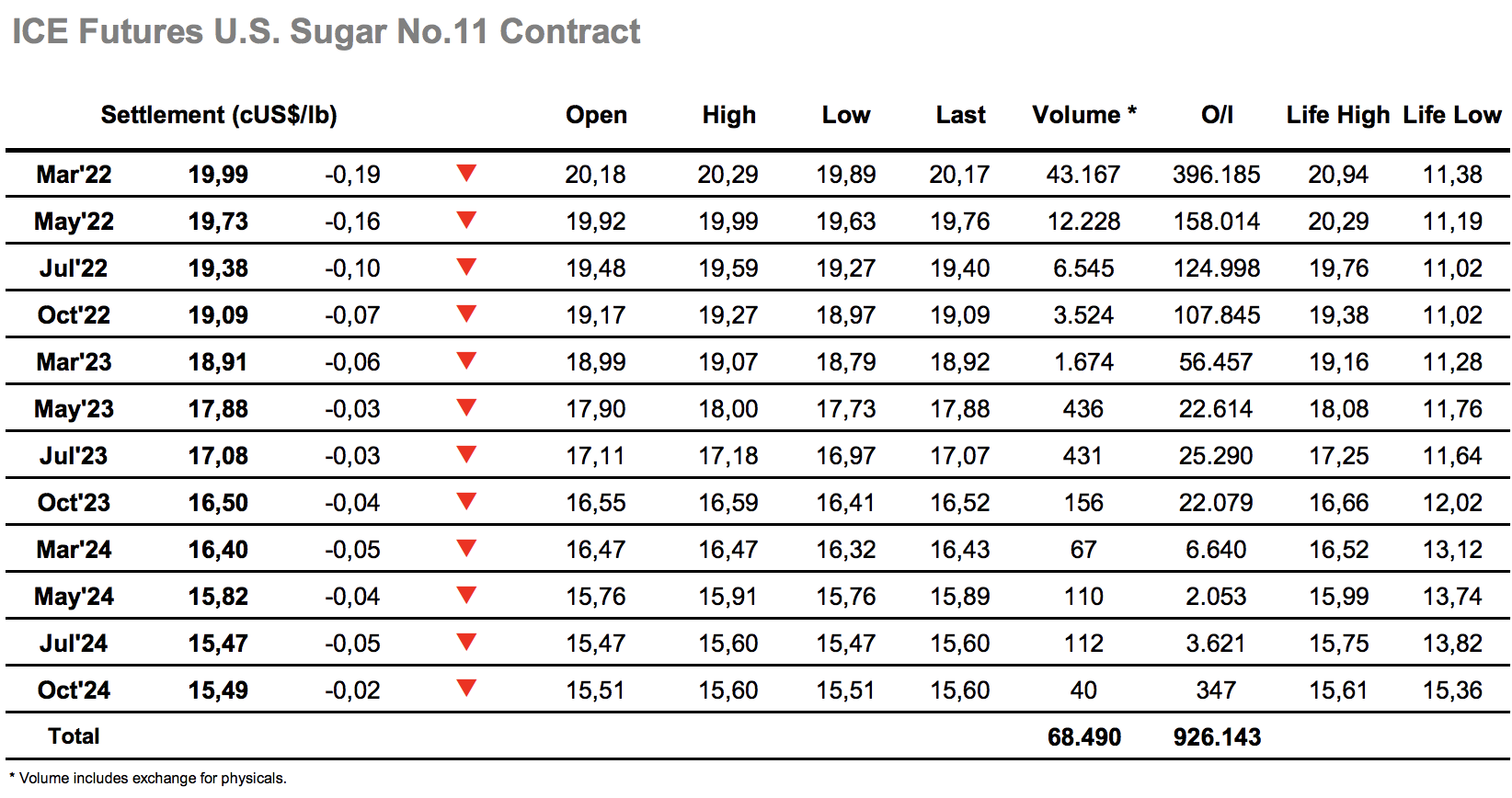

Sugar #11 Mar ’22

The sharp drop from recent highs yesterday afternoon stalled the spec momentum, however the close was by no means critical as it most likely just brings us back into an expanded range. Early activity today saw some light buying take March’22 upward to 20.29 however the interest soon dried up once hedge lifting had been concluded and prices slipped back into deficit. With support proving rather limited we triggered off a few more sell stops as specs exited longs (most likely entered into yesterday) to leave prices back in the 19.90’s once more. Volume today was back to very low levels, particularly the spreads where March/May’22 had barely seen 1,200 lots midway through the afternoon, and despite the efforts of some specs/small traders to renew the upside we settled into consolidation close to overnight levels with most seemingly waiting for the week to end. It seemed that day traders went hunting for more sell stops with a push down to 19.89 however it uncovered little and the market headed in towards the close holding the 19.90’s. Settlement was established at 19.99 to inflict the smallest possible psychological blow to bulls before a crazy posy close saw a surge to 20.17 on just 1400 lots as traders cleaned up positions ahead of the weekend.

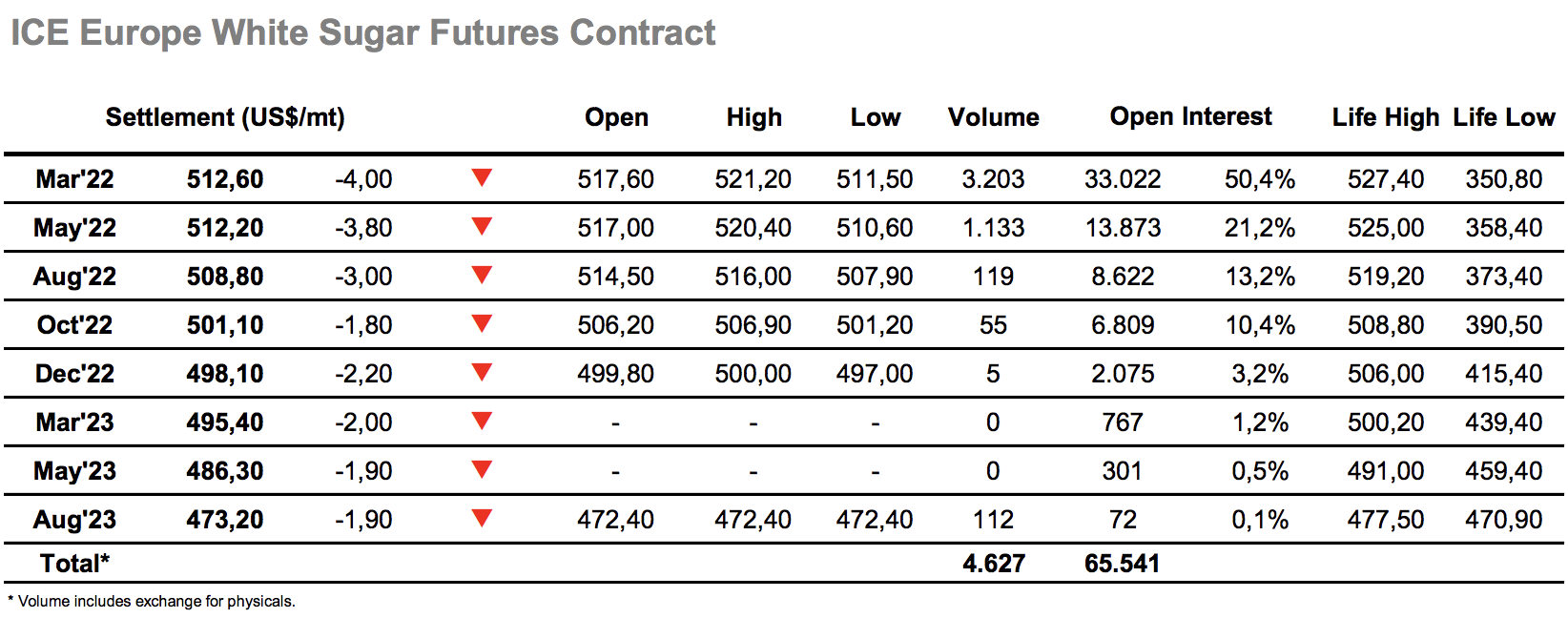

Sugar #5 Mar ’22

Having fallen back from contract highs yesterday afternoon the market picked up some early buying against hedge lifting to pull back upward by a few dollars. The recovery lacked substance though did have a positive impact upon the nearby premium values with March/March’22 pushing back out towards $75 before slipping back towards $72 once the buying had been concluded. Moving down through yesterdays lows encouraged some light selling though there were no stops being uncovered and a rather tedious dip to $512.30 ensued. The early afternoon saw values pick back up on the back of spec buying in the No.11, but that interest soon dissipated once more, leaving prices to slip back down to the bottom of the range over the following hours. A new low was registered at $511.50 as we moved through into the final hour and though we saw some late position squaring on the post close it was an otherwise quiet end to the week with March’22 settling at $512.60.