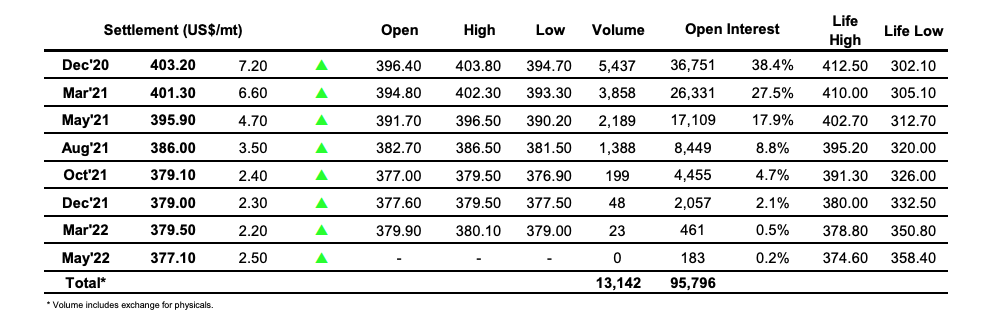

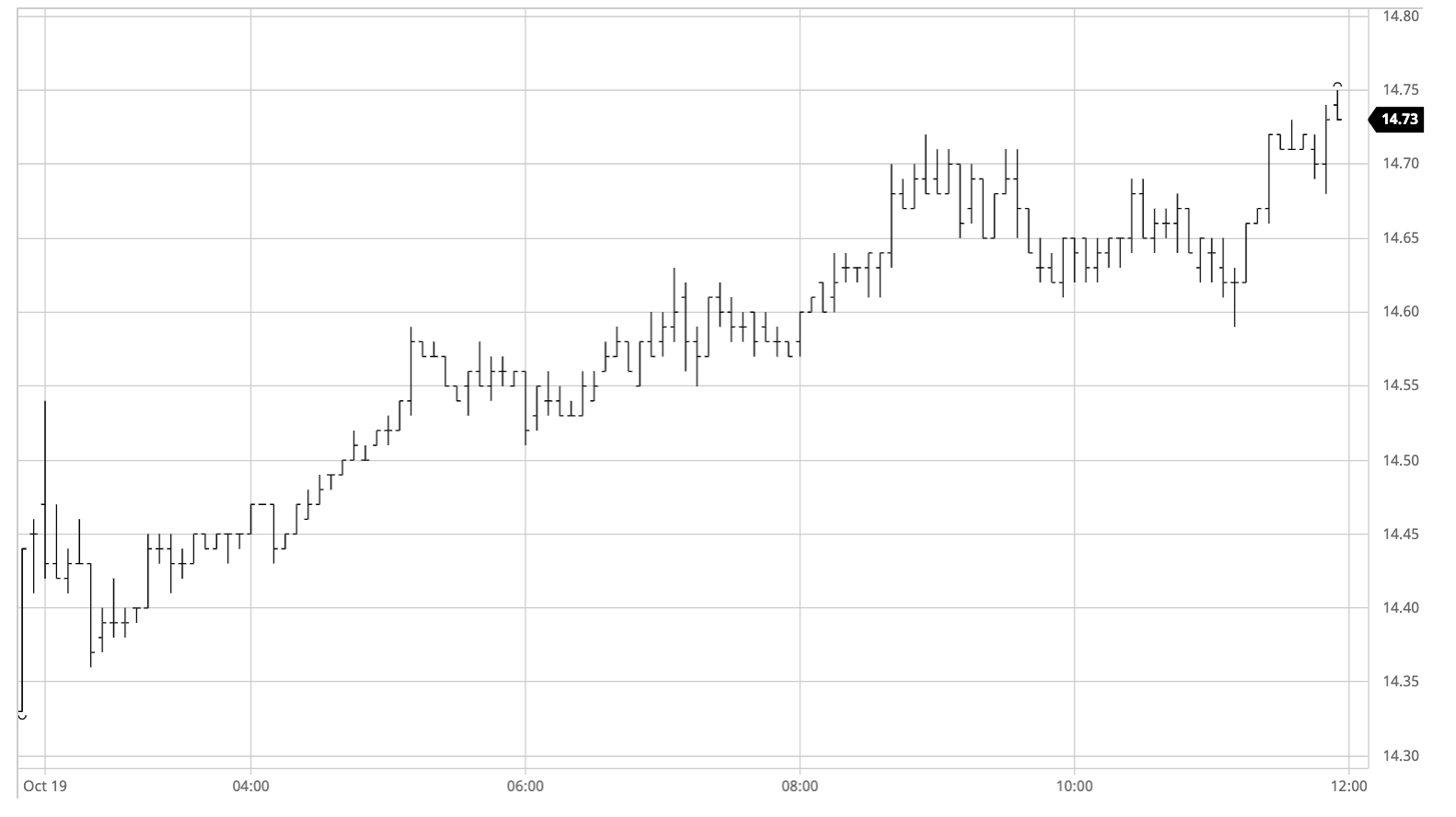

Mar 21 – Sugar No.11

The new week began with an immediate spike to 14.54 basis March’21, and though values quickly came back to overnight levels it was not long before the upward trend resumed with prices climbing slowly but steadily upwards. By late morning we had broken through last week’s 14.55 high mark and though the higher levels were bringing in a degree of producer scale selling it was fairly limited meaning that even the moderate rate of spec buying on show was sufficient to maintain the move. Spreads were also wider once again with the buying centred on nearby prompts, bringing March/May’21 to 0.71 points and March/Jul’21 to 1.28 points widest, levels that will surely be having Indian producers dreaming of some positive news on export policy and an opportunity to price. Having reached 14.72 the market began to stall against the scale selling, though still the volume remained only moderate from the sell side with a lack of Brazilian interest despite the USDBRL remaining in the vicinity of 5.60. Talk around the market remains positive with some now suggesting that the rains in Brazil which before their arrival were construed as bearish given the benefit to next year’s crop can now be deemed positive in hindering the remainder of this year’s harvest, which makes one wonder to what extent people are now trying to find a story to justify the continuing move. The now familiar closing burst of speculative window dressing to maintain technical gloss sent March’21 to 14.75, almost 100 points above last Monday’s low and bringing the 15c closer into view.

Fridays COT report showed the funds long of 244,002 lots and the index position at 262,165 lots, with action over the four sessions since anticipated to have further increased this holding. With Open Interest just shy of 1,000,000 lots this combines to leave the wider “speculative” world at over half of the total OI, and while they can undeniably continue adding to their longs one feels they will need the commercial sector to be growing similarly to provide the space otherwise their continued buying could prove unsustainable.

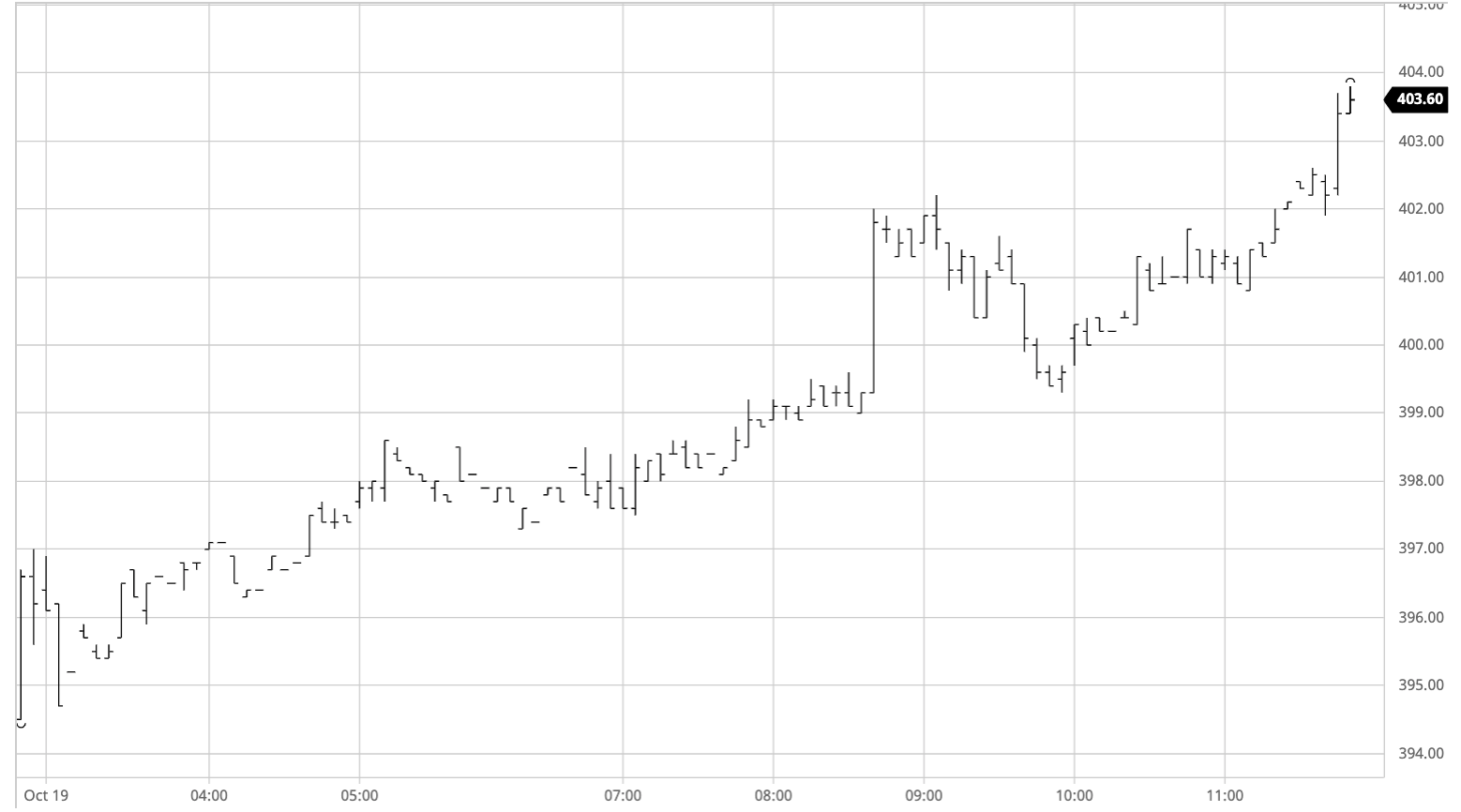

Dec 20 – White Sugar No 5

Early losses proved to be extremely short-lived and the market soon re-established itself upon last week’s upward path, making new recent highs with the $400 mark acting as a target overhead. In keeping with recent action we were again only seeing low volumes change hands with the sell side remaining rather thin and lacking in producer pricing. Nearby spreads further strengthened with Dec/March reaching a widest $2.20 having final broken above the resistance around parity late last week, while the white premiums were steadily maintaining their own recent recovery without really threatening to push further ahead. Pushing through $400 during the afternoon encouraged a burst of volume with a few buy stops triggered and this led Dec’20 on to a high mark of $402.20 before stalling and then consolidating a little way below. This remained the case until the closing stages when specs returned to provide some additional buying and pushed Dec’20 further north to $403.80, maintaining the technical move with another positive close and extending the rally further still.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract