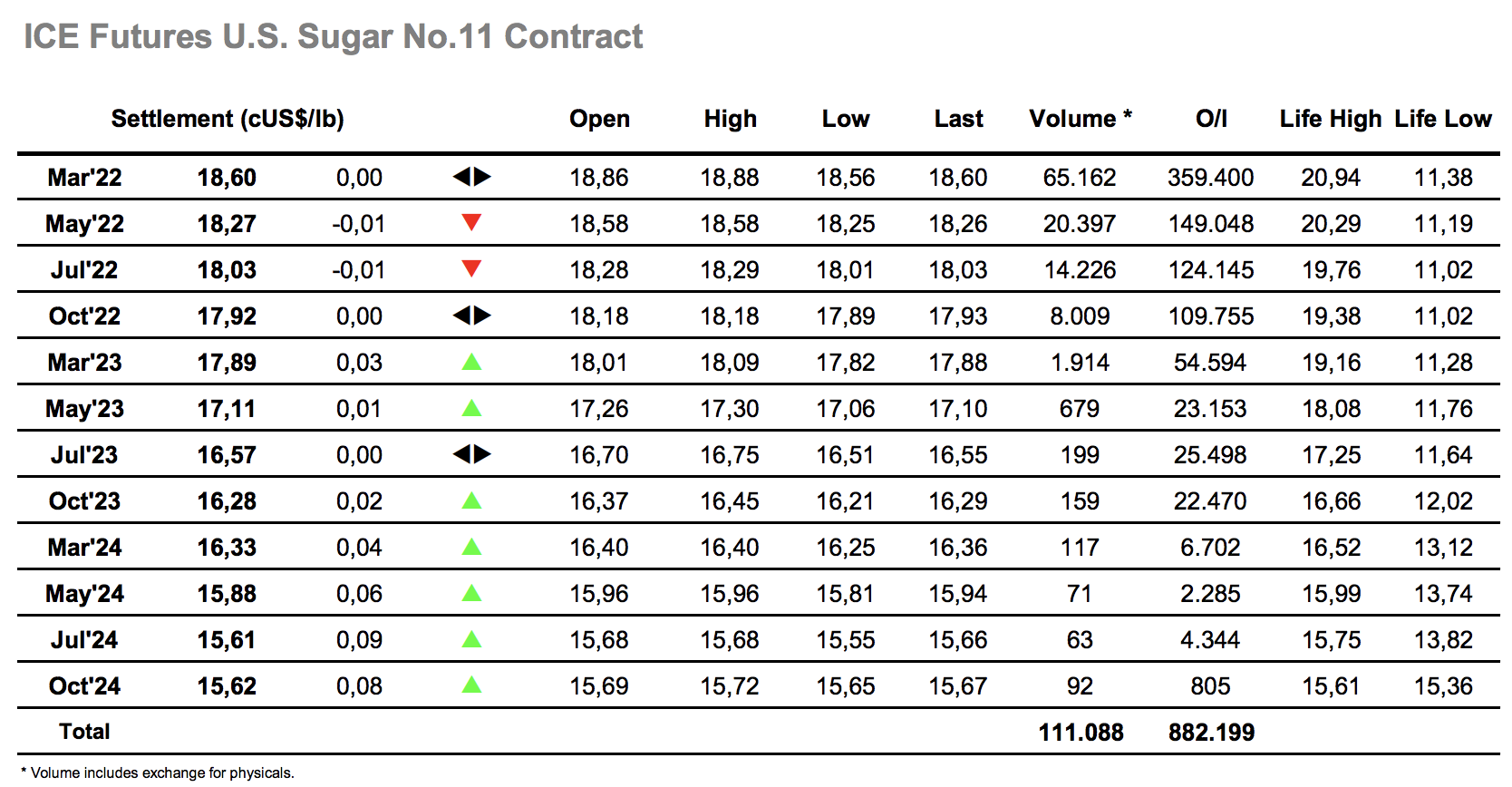

Sugar #11 Mar ’22

Following on from a tough few days the lower levels drew out more buying interest and with the macro also attempting to hold we saw an immediate push to 18.88 on the opening. Values pulled back a touch as the initial buying was concluded however there was further interest feeding in from consumers/end users keen to take advantage of the lowest levels seen since August and this led prices to push back towards the early high. Yesterday’s action did some harm to the technical picture and the reluctance of the market to continue beyond the 18.80’s raises questions over the ability to recover in the near term. The start of the day in the US brought some new spec liquidation to the fore with a sharp decline to 18.56 ensuing before stalling as stronger buying emerged in front of yesterday’s lows, though having held it was soon followed by short covering, returning prices into the range. A calm afternoon then ensured with values sitting comfortable within the range, enabling nearby spreads to regain some composure with March/May’22 back to 0.33 points having narrowed a touch to 0.30 points on the dip. We maintained comfortably within the range until the final stages when the continuation beneath 18.82 seemed to encourage sellers to re-emerge. March’22 slipped back towards the lows with settlement at 18.60, and while today represents an inside day on the charts the broader picture maintains its negative leaning.

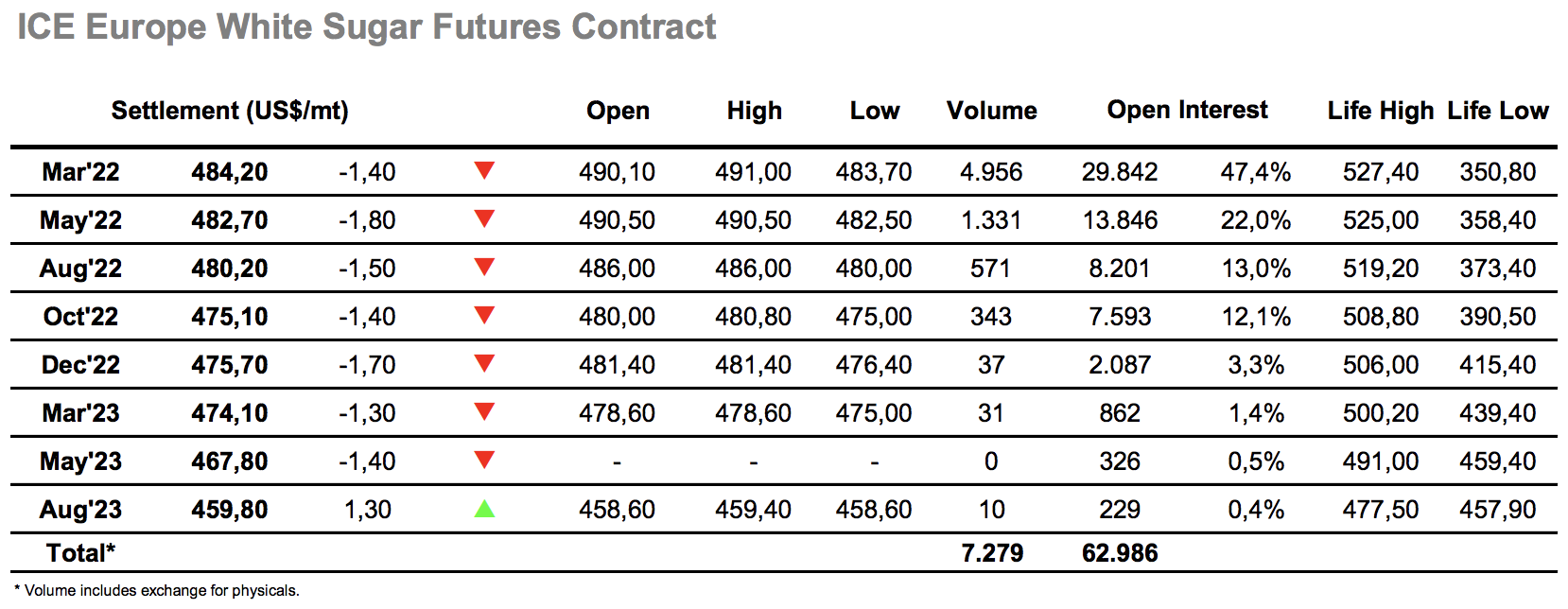

Sugar #5 Mar ’22

The significant recent losses due to global concerns over the impact of the latest covid variant have presented an opportunity for consumers to price at the lowest levels seen since August, and clearly some interest had generated overnight with an initial spike for March’22 to $491.00. Though prices then eased back by a few dollars there was limited selling and so the market remained well away from yesterdays lows, consolidating a broad $488/$490 band and allowing some calm to resume. There was no change to the picture until the afternoon when a little more selling (further spec liquidation?) joined the fray and sent the price back down to $485.00, though finding support in the vicinity of yesterdays lows the market once more gathered itself for further consolidation/attempted base building. The environment remained calm through until the final hour when with the prospect of an inside day looming large the market encountered some fresh selling. March’22 declined to a new low at $483.70 while the March/March’22 white premium headed towards $73 having been touching $76 earlier in the session. Settlement was only just above the lows at $484.20 with the weak close maintaining recent technical negativity which may encourage further selling for the near term.