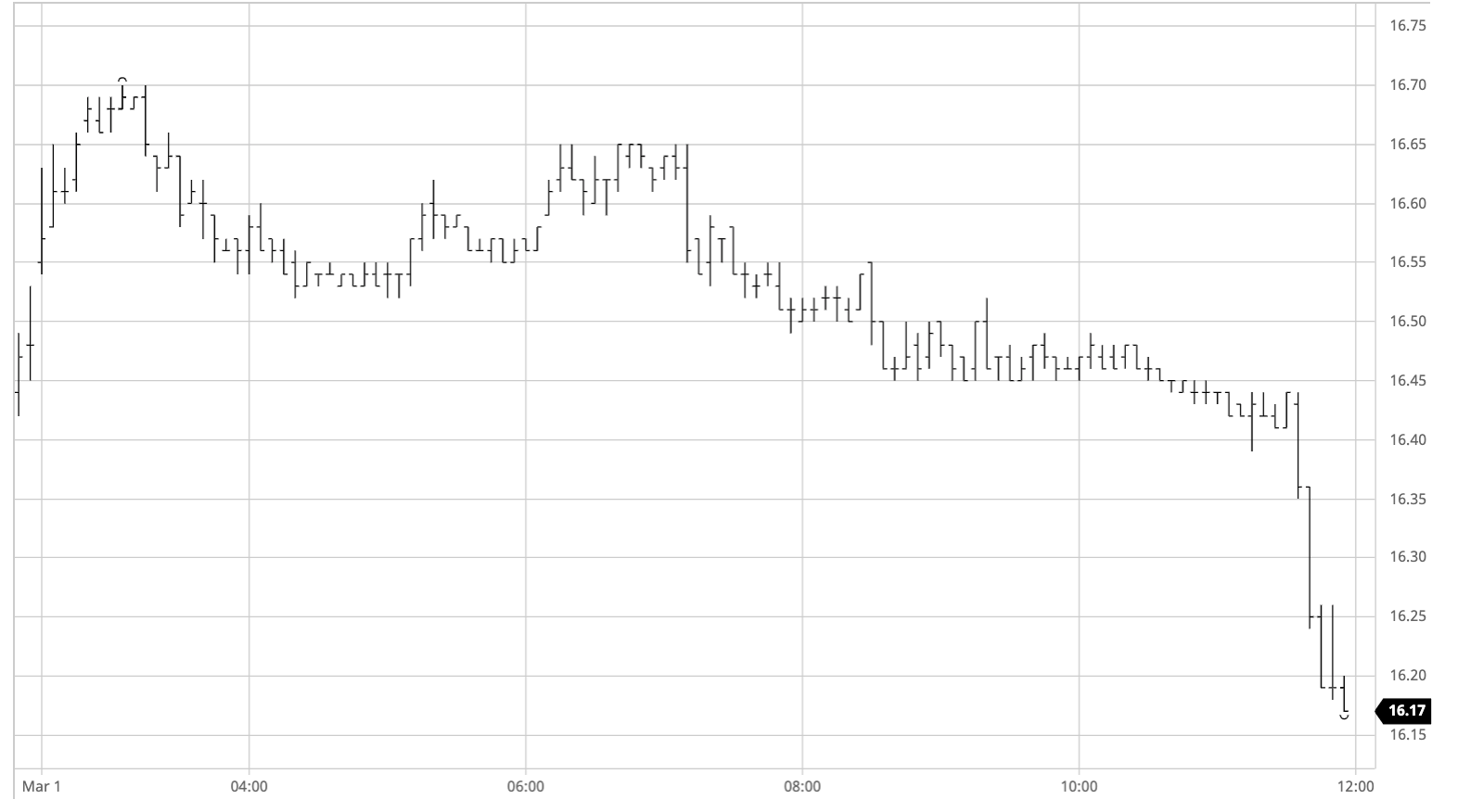

Sugar #11 May’21

Whether it was against hedge lifting of weekend physical sales or maybe it was just a desire to try and begin the week on a more positive note following the struggles of Friday but either way there was certainly some optimism around during the early part of the morning with May’21 pushing to 16.70. As the buying faded however so did the market though prices held in positive territory as we looked to consolidate and build a foundation from which prices can look to challenge the highs once more. During the morning strength there was a reasonable widening of the May’21 spreads however like the flat price it was unable to sustain and as we moved along with the range so May/July’21 fell back from its high mark at 0.67 points to be closer to overnight levels. A nudge upward during the early afternoon fell shy of the morning highs and the market soon fell back into a slow slide the sense of post expiry apathy combining with a rather mixed and directionless macro picture. Despite being at session lows we held in front of Friday’s 16.41 low mark for a long period until the desire to test it became too much leading to an aggressive push downward during the final 30 minutes. Breaking convincingly through 16.40 triggered off some long liquidation which sent the price to a session low 16.17 during the closing stages, while also smashing the May/Jul’21 spread value down to a narrowest 0.49 points, a factor which will not sit comfortably with the bulls. Settlement level was just above the lows at 16.21 which will do little to allay fears that we are not to continue trying to test lower for the near term.

As anticipated the March’21 contract saw 17,582 lots (893,210t) tendered against the expiry with a large variety of origins seen in the tape. Details are as below:

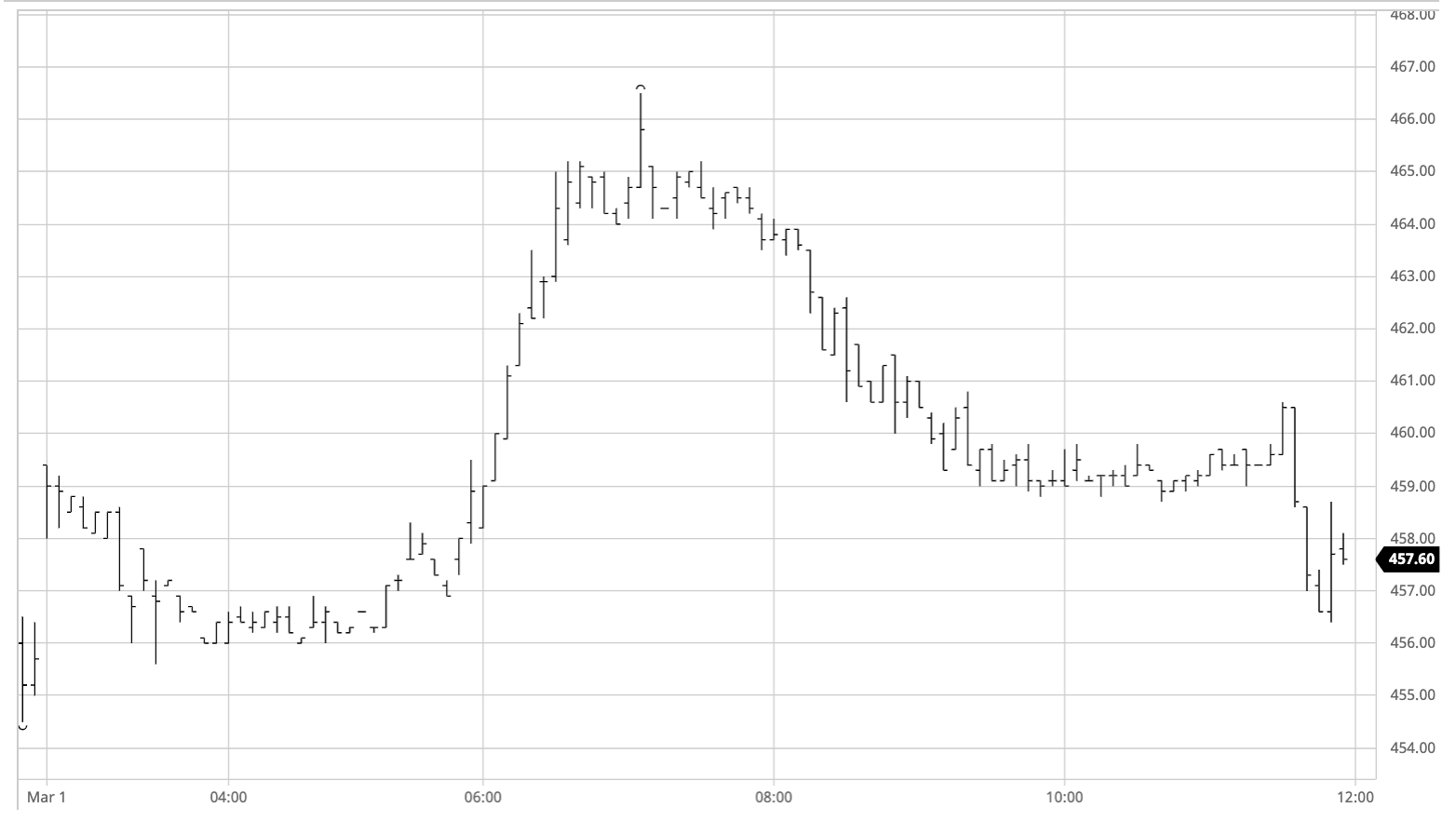

Sugar #5 May’21

The market jumped up to $459.00 on the opening but in mixed early activity struggled to sustain the move and soon fell back to consolidate the $456 area for a couple of hours. This lack of support for the whites led the white premium values to decline once more with May/May’21 trading towards $90 during the early part of the morning, and only beginning to pick up again as No.11 values eased back to mirror our own sense of apathy. What followed came as a bolt from the blue therefore as the premium values became the story of the day when from nowhere a burst of whites buying for May’21 hauled the rest of the board with it to drive through what little overhead selling the was in place and reach $465 in quick time. This brought the premiums up significantly to reach highs as follows: May/May’21 $100, Aug/Jul’21 $97.25, Oct/Oct’21 $90, Mar/Mar’22 $79. Moving through the afternoon we eased back from the highs however our direction was being dictated by the decline of the No.11 as shown by premium values continuing to hold near to the earlier highs. For a long period we seemed set to edge along comfortably toward the centre of the range for the rest of the day but an aggressive push down for the No.11 during the final 30 minutes took us along for the ride and sent values back towards morning lows. That we didn’t fall further was due to the continuing firm white premium values with May/May’21 reaching a new daily high at $101 during the final moments while the May’21 contract settled steadily at $458.10

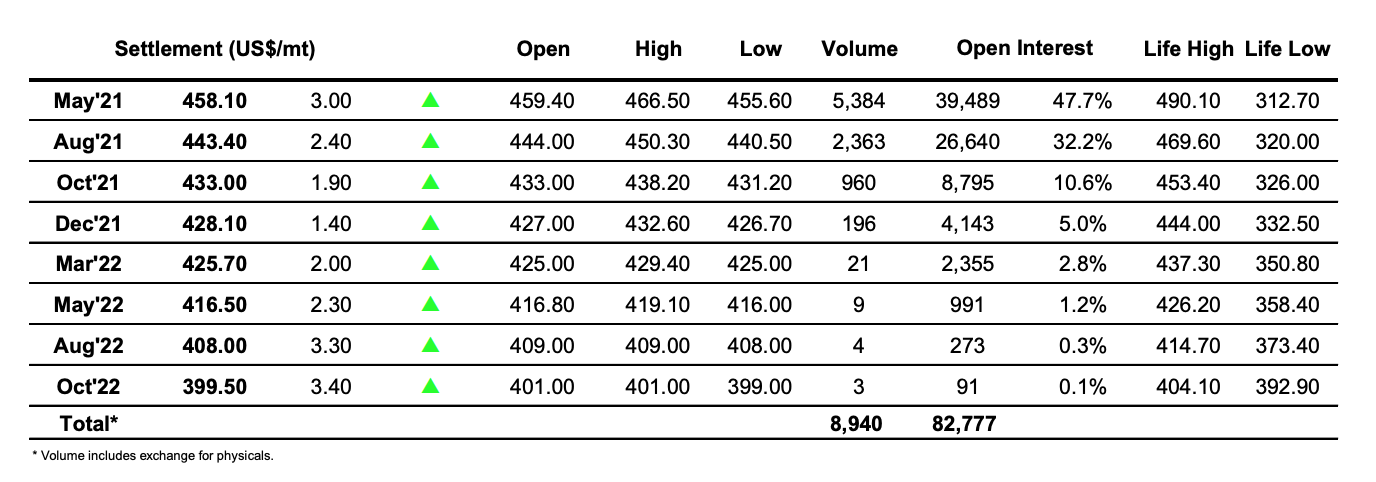

ICE Futures U.S. Sugar No.11 Contract

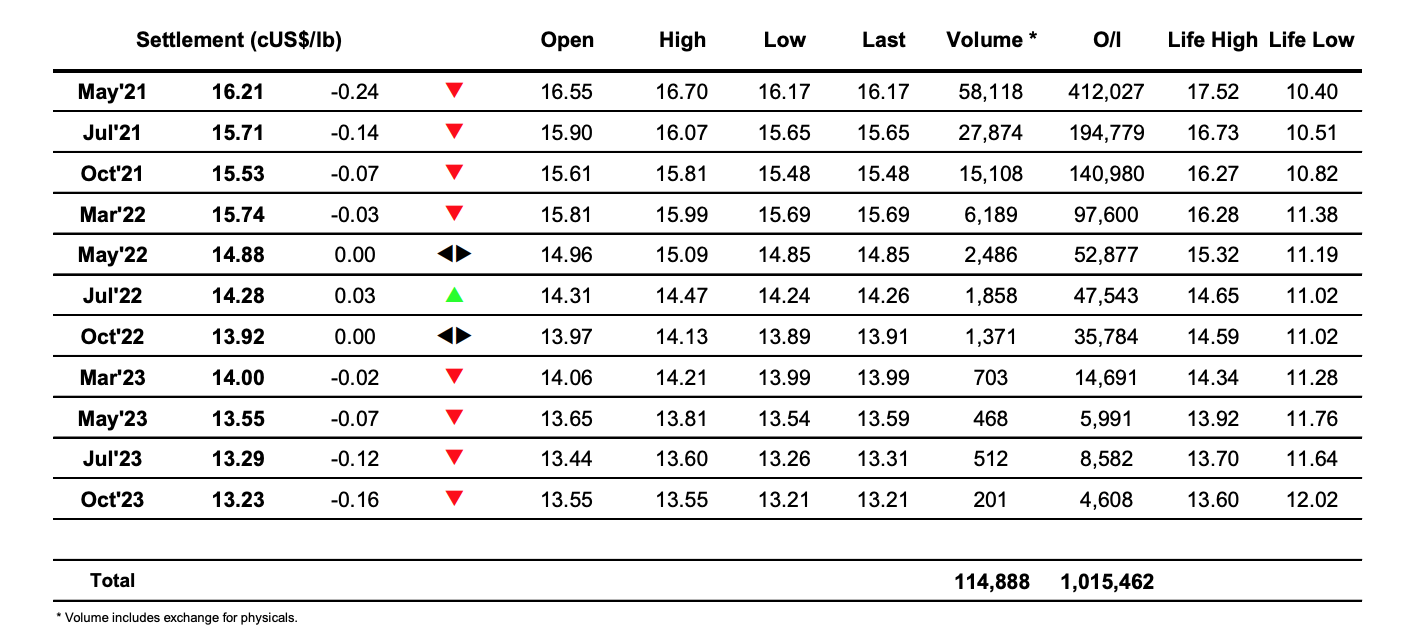

ICE Europe Whites Sugar Futures Contract