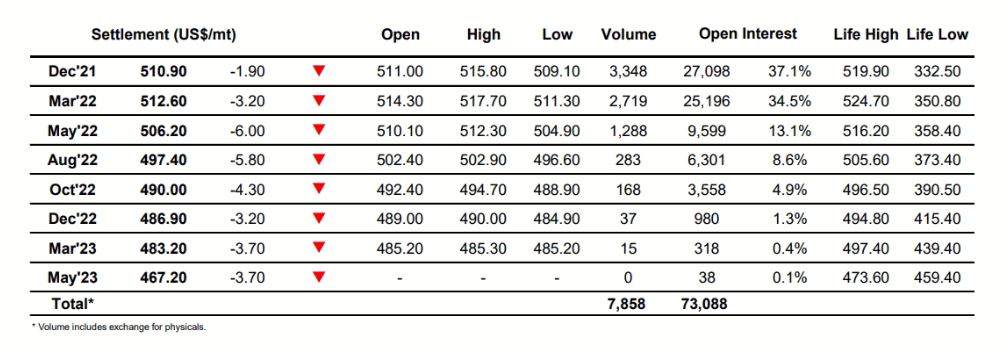

Sugar #11 Mar’22

A lower opening was initially picked up as interest appeared to try and maintain/continue the positive movement from last night, but having briefly printed to 20.35 the enthusiasm waned with the rest of the morning spent holding a narrow band in the 20.20’s. Despite the lack of overhead selling, a situation which has not changed despite the recent USD currency movements, there was no sign that the specs wanted to follow up yesterday’s move with more buying, and instead the dawning of the US day was met with selling as light liquidation eased the price back to sit just ahead of 20c. There may be no enthusiasm to push aggressively at present however the afternoon did show a willingness to maintain above 20c and not let yesterdays move simply be one of valuation dressing, holding values comfortably within the range but with no apparent likelihood breaking from the range and preventing an inside day. Slow progress was made until the close which saw more excitement than the rest of the day combined as pre-weekend long liquidation send March’22 crashing back to the session lows. Settlement at 20.06 takes away some of the shine from yesterdays efforts and there remains no sign that we will exit the current broad range anytime soon.

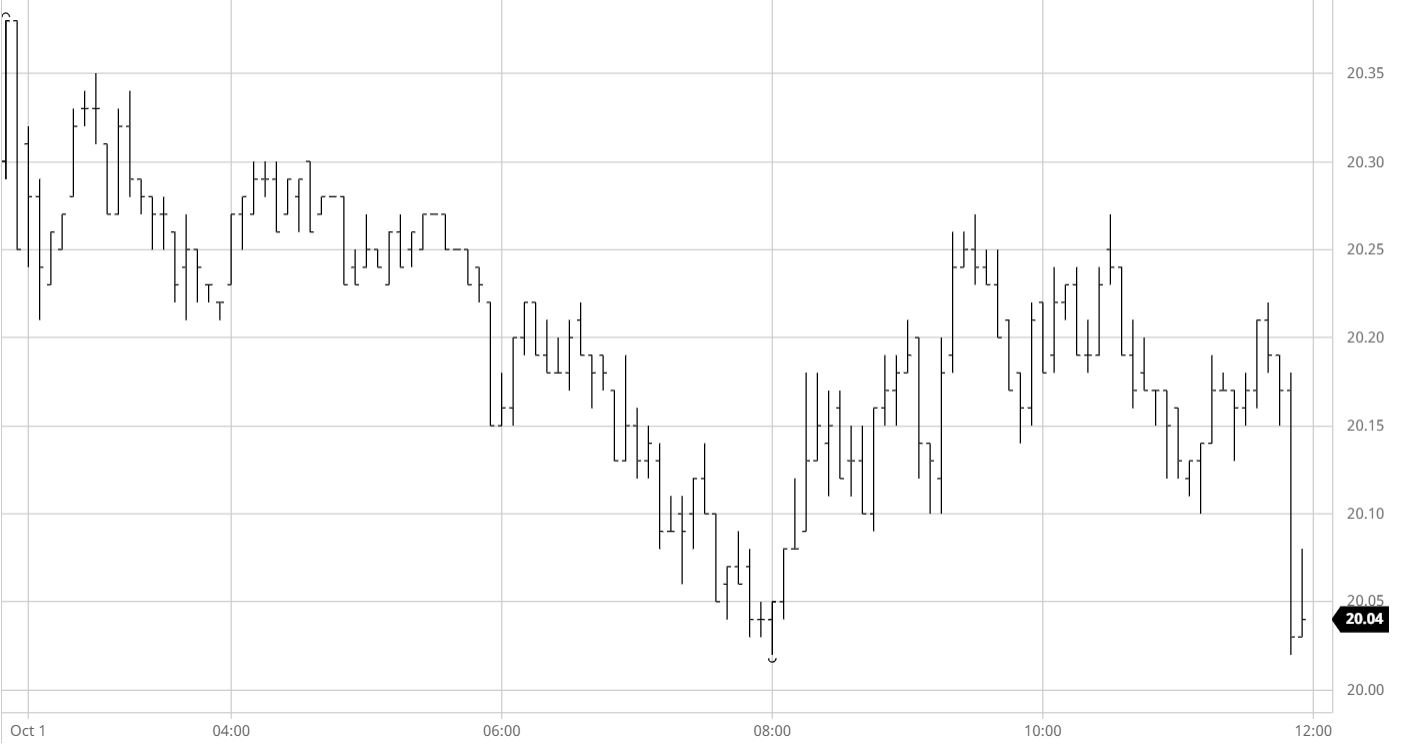

Sugar #5 Dec22

The market chopped either side of unchanged levels during the first hour before trying to build upon last night’s positive conclusion, however the rally stalled at $514.50 and we instead entered a slow decline. There was no enthusiasm to pick things back up as the next three hours saw March’22 trade a down to $509.10, seemingly suffering some kind of hangover with the month/quarter end now behind us. Some interest reappeared during the afternoon and this enabled nearby spreads and arbs to pick back up following a couple of days of losses, Dec’21/March’22 moving up to -$0.70 while the March/March’22 white premium nudged back towards $71. Though the afternoon saw prices to marginal new daily highs which were maintained through into the final hour there was precious little news still and it felt as though most participants were simply counting down the clock until the close. The call proved to be hugely eventful as Dec’21 plunged by more than $5 to settle at the lower end of the range $510.90, maintaining the rangebound status quo as we head into the weekend

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract