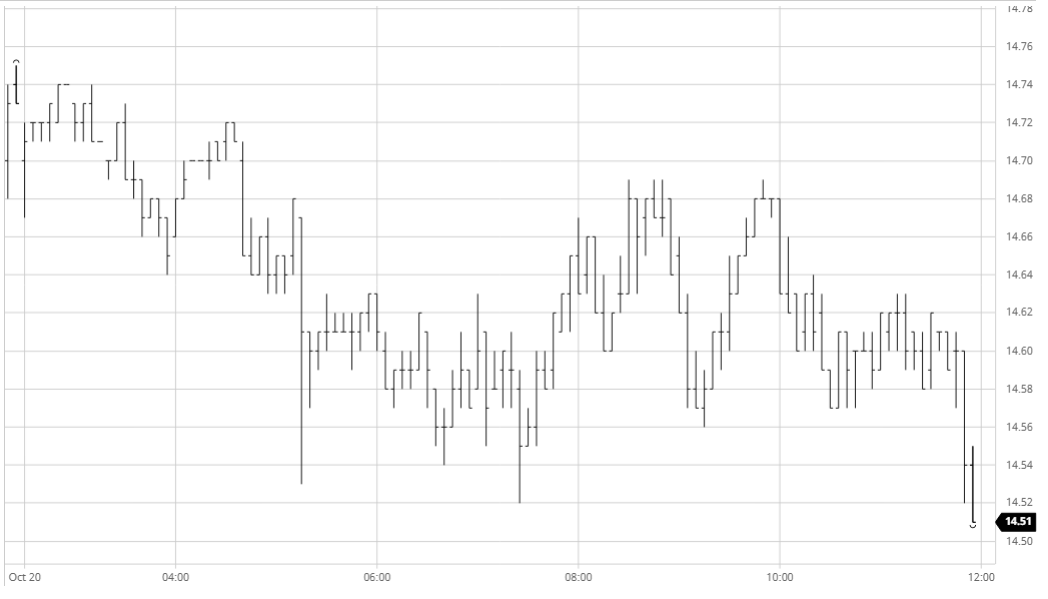

Mar 21 – Sugar No.11

Having rallied to another new set of recent highs yesterday we commenced near to unchanged levels though struggled to progress by very far with some strong selling sitting in place ahead of 14.75 as producers looked to take advantage. This led to something of a stalemate for a while but gradually the lack of progress impacted upon the day traders with prices sliding back by a small distance as some long liquidation took place. Moving into the afternoon we continued at the lower end of the day’s trading range finding moderate support in front of 14.50 to keep the pullback in check, while nearby spreads also levelled out having lost ground on the slide narrowing to 0.64 points for March/May’21 and 1.14 points for March/Jul’21. In quiet conditions the afternoon saw prices yo-yo within the range but falling short of the morning highs until the final stages when a few thousand lots of selling (long liquidation) sent March’21 back to trade a marginal new session low 14.51, settling just above this level at 14.54. While this was a weaker close it only represented an inside day on the charts and goes a small way to unwinding overbought indicators, though it will be a test of the specs desire and capacity to see how they react as without any real consumer activity the onus remains upon them to maintain the move higher.

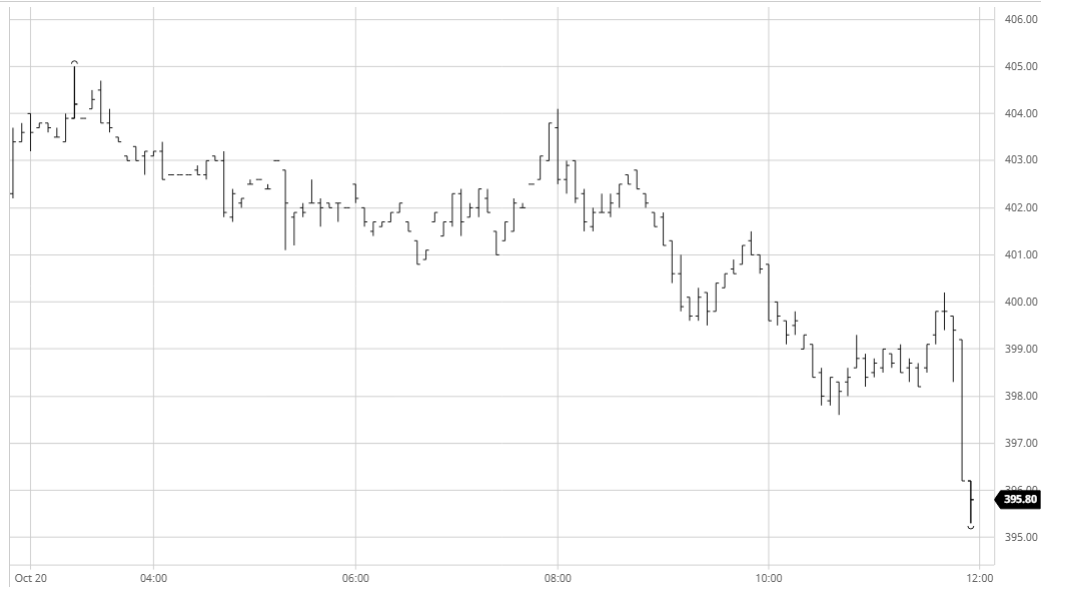

Dec 20 – White Sugar No 5

An initial push up to $405.00 for Dec’20 stalled in the face of white premium selling linking to heavier selling for the No.11 market, leading prices to slip back by a few dollars where a period of consolidation ensued. Volume was quiet outside of the Dec/March’21 spread which was finding some steady selling to push the value back towards parity, leaving outright values to drift along quietly with dec’20 holding near to $402.00. A brief rally during the early afternoon took us back to the upper end of the range however it was not sustained and we instead began to work lower with each attempt to pick the market back up failing to gain traction and further losses following as day traders got stung a little. Worryingly for the bulls the pullback also saw some quick vulnerability for white premium values and as the afternoon progressed we were back to $76 for March/March’21, $85 for May/May’21 and $87.50 for Aug/Jul’21. An attempt to pull prices back away from the close proved unsuccessful as some late selling sent Dec’20 tumbling to a session low $395.30 with the Dec/March21 narrowing back to -$0.90 discount, and while not critical to the technical picture it puts a dent in the momentum that had seen gains of more than $30 over the previous two weeks.

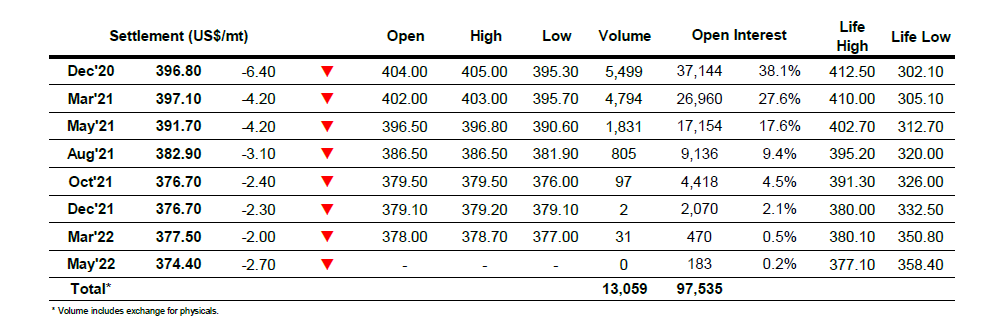

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract