Sugar #11 Oct’21

The upward drive in sugar seems to be having a break, even with the impressive 5+% rally in the energy markets today. The NY#11 contract opened 0.21 above Friday’s settlement, but this soon eased as it didn’t take much to drive the very thin volume back to the high 19.50s. Afterwards, the market remained stable for the rest of the day, mostly confined to the 19.50 -19.65 range, with the lower bound appearing to be a significant point of resistance in the near term, and the absence of selling pressure in the back months allowed for a significant normalization move on the spreads. The white premium also trimmed recent gains with the front premium closing below 47 USD/mt, which seems to agree with the lack of overall demand for the sweetener. All in all, some interesting things to watch this week in the commodities land are: 1) The Jackson Hole FED meeting, which may decide on the tapering pace and provoke swings, especially on the energy and raw metals markets. 2) China facing stern headwinds in its economic recovery and pressure on the Properties sector, which could hurt Steel, Aluminum and Coal prices. 3) The drought has made Sugar and Coffee surge as Brazil (the top exporter of both products) was severely affected, and the approach of the rainy season in Brazil and the possibility of a La Niña event could in one hand provide much needed relief on the prices, but also added volatility to the market as the weather patterns become more unpredictable.

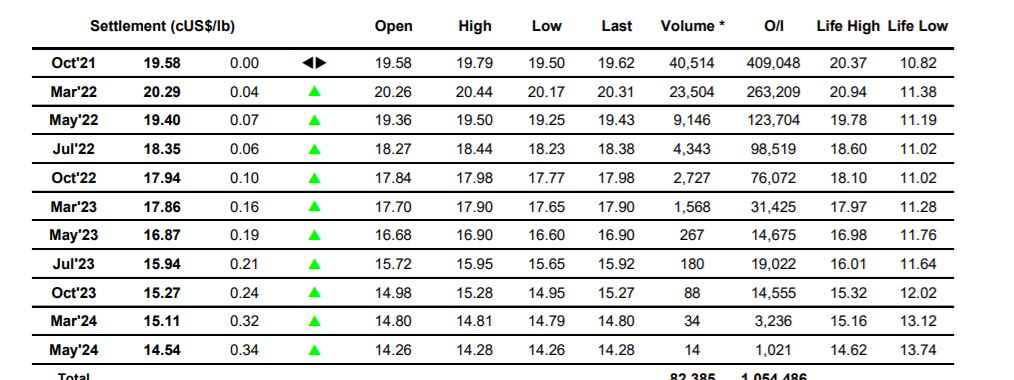

ICE Futures U.S. Sugar No.11 Contract

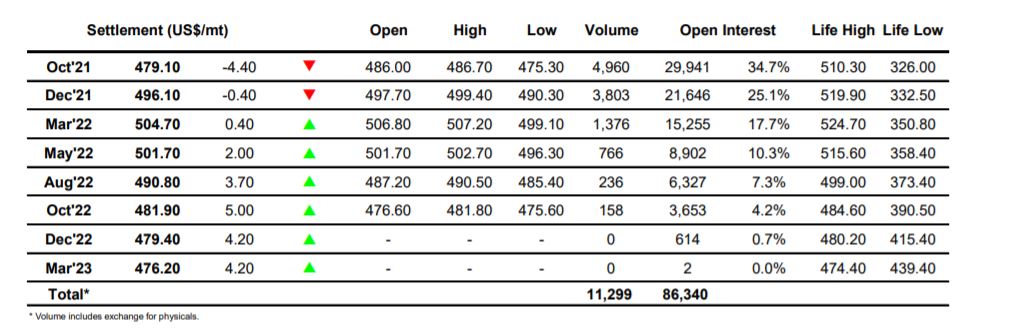

ICE Europe Whites Sugar Futures Contract