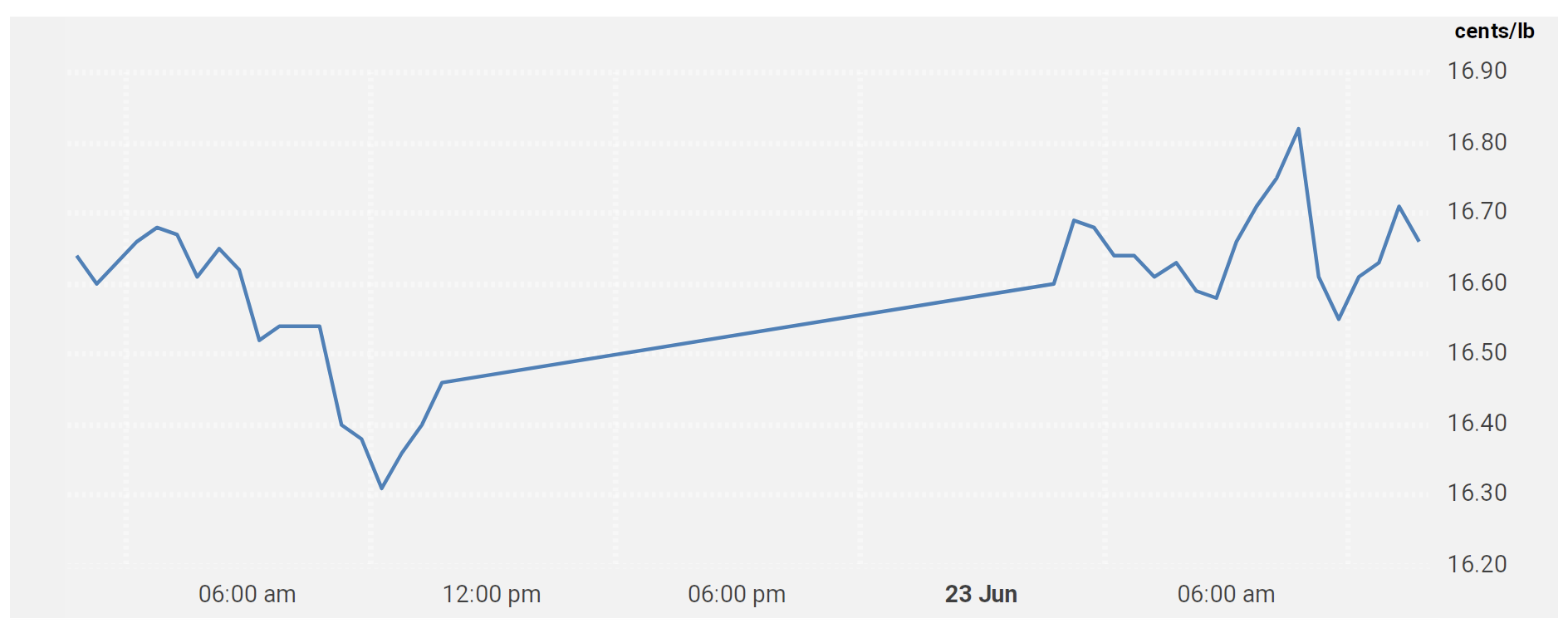

Sugar #11 Oct’21

The swings in the market over the past couple of days have created something of a vacuum between 16.50 and 17c and this lack of liquidity allowed Oct’21 to rally back up to 17.02 over the course of the first hour on only moderate activity. While the buying then eased back to minimal levels such was the lack of liquidity that we merely drifted along consolidating the 16.90’s for the rest of the morning, hoping that the arrival of our friends in the Americas would generate some much needed volume and movement. For a while the specs duly obliged in pushing Oct’21 upwards beyond the morning highs and the price experienced a brief spike upward to 17.14 before the buying halted and a more rapid fall based upon long liquidation sent the price all the way back down to 16.81. Still this was not calamitous and with the specs continuing to dominate proceedings a gradual return to mid-range followed. There was a little movement for the spreads as the market swung around with Jul/Oct’21 continuing its recent struggled with a widening of the discount to -0.33 points during the afternoon while Oct’21/Mar’22 punched up to -0.24 points intra-day as the specs pushed up the flat price but eased back to -0.28 points later on. Having pushed back to 17.06 during the final hour we found some late position squaring which left Oct’21 settling at 17.01, a positive conclusion though well within the weeks range and by no means suggesting that a break from it is yet likely.

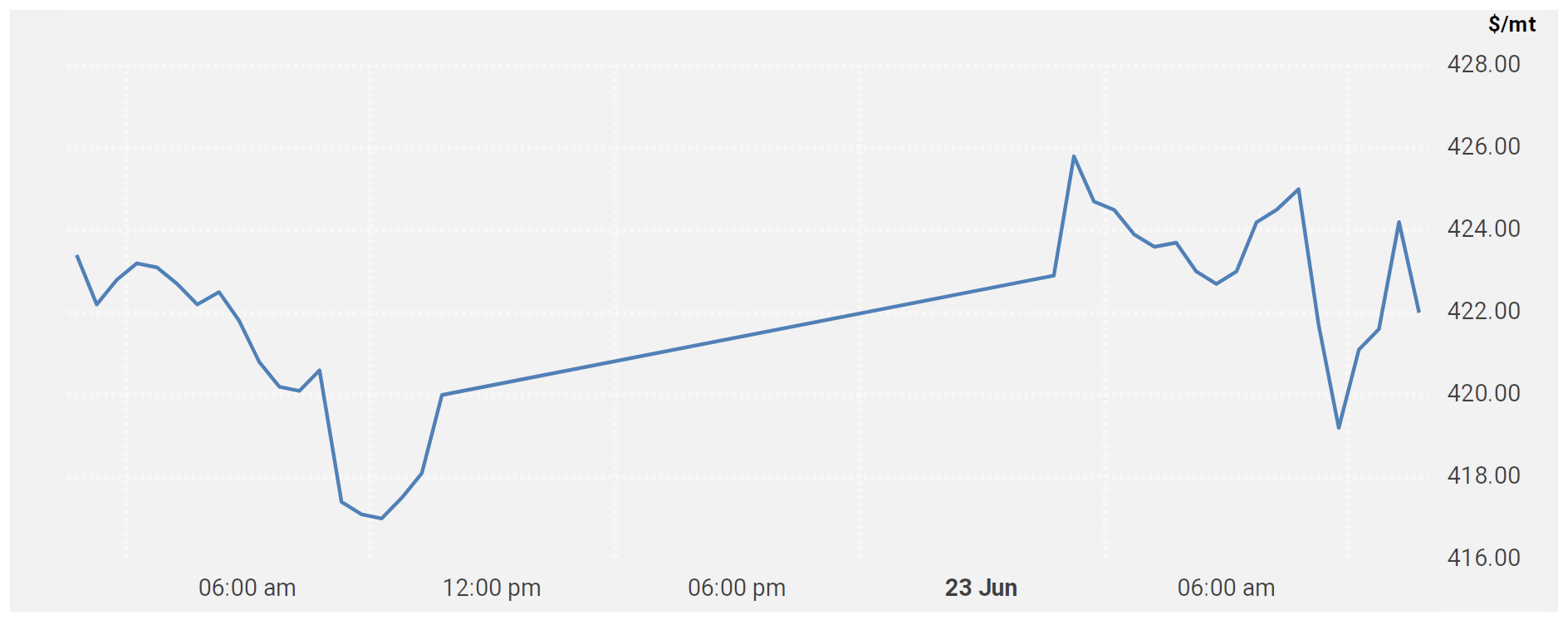

Sugar #5 Aug’21

There was buying for the opening which led the intra-day charts to gap higher with Aug’21 trading to $425.80 during the first hour to place it a mere 0.20c shy of yesterday’s highs. Such action suggests that the market is trying to establish a base ahead of the $415.60 / $416.30 double bottom and morning activity saw the gains consolidated with prices continuing comfortably in the $420’s, though there was again weakness for the Aug/Oct’21 spread which weakened towards -$17. The start of the US day brought spec buying back to the No.11 and clutching to its coat-tails we pushed back upwards to a marginal new daily high mark of $426.30 before the buying dried up. This served to emphasise the ongoing issue for the market in its current attempts to reverse the decline with long liquidation following quickly afterwards to fill the overnight gap and take the price beneath $419 before easing away and allowing calm to resume. The yo-yo nature of the market was maintained with a push back to the $425 area ahead of the close though settlement was made at $423.60 with late position squaring sending prices back away during the final 10 minutes, suggesting further rangebound choppiness is the most likely way forward for the near term.

· A mixed day for the white premium saw the spot under pressure in keeping with the spread but the rest of the board making marginal gains, leaving Aug/Jul’21 at $55.60, Oct/Oct’21 at $67.00 and March/March’22 at $75.00.

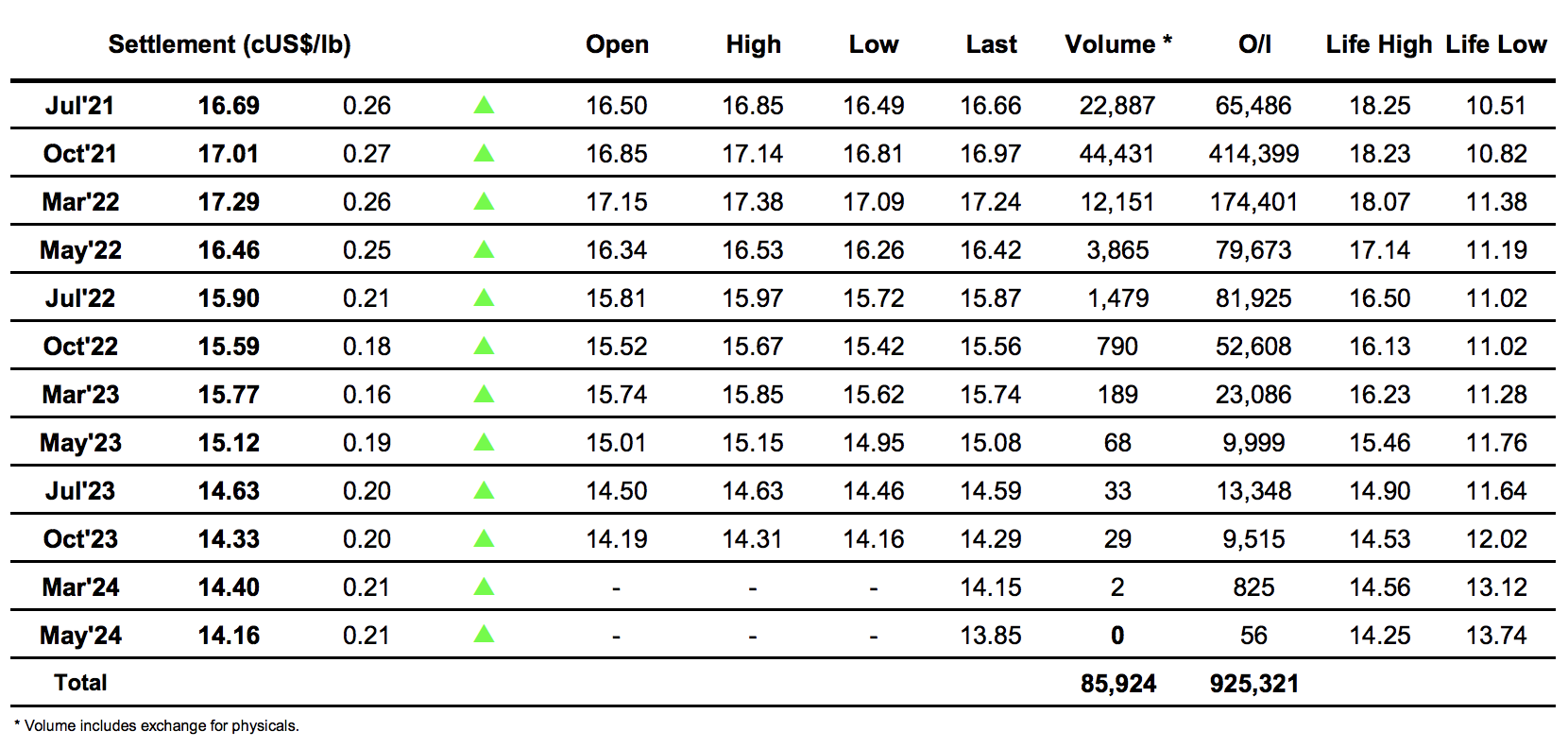

ICE Futures U.S. Sugar No.11 Contract

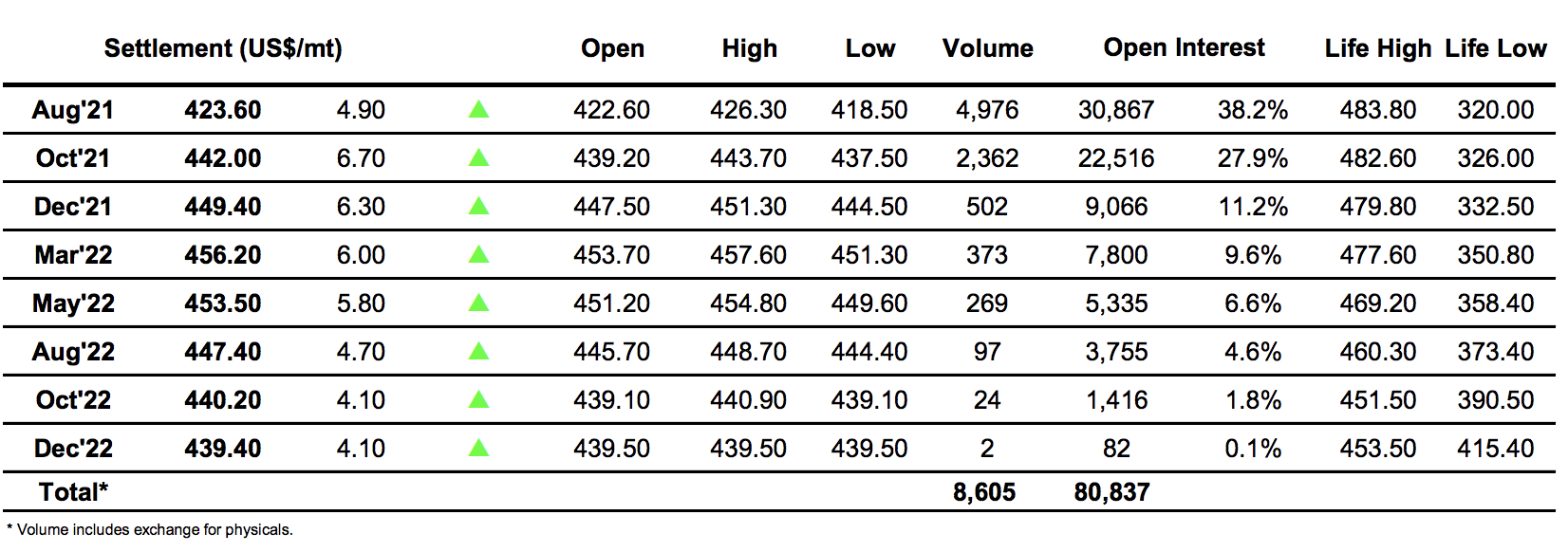

ICE Europe Whites Sugar Futures Contract