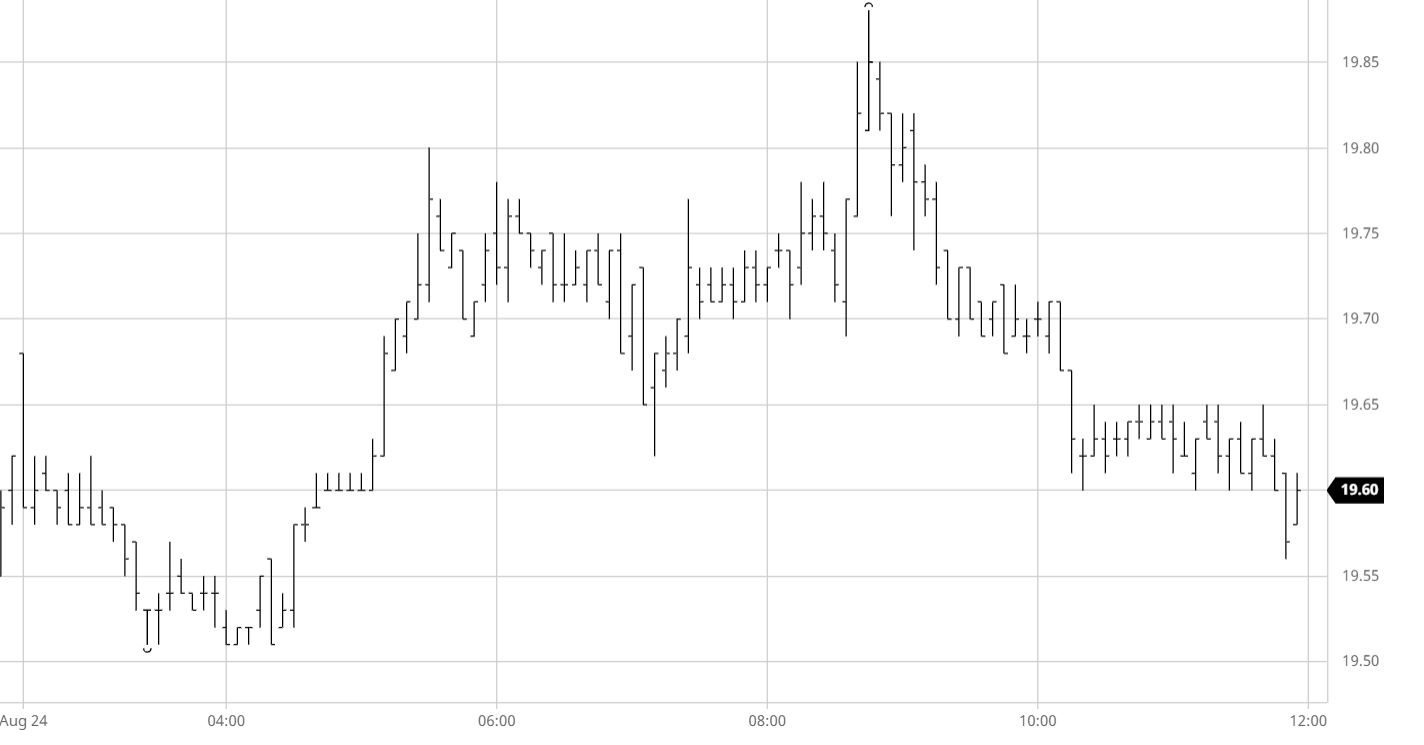

Sugar #11 Oct’21

In a day dominated by commodities’ rallies, and macro risk appetite, Sugar didn’t seem to do so well. The day started quiet, with the first position trades taking place at around 7am BRT, ahead of the UNICA numbers. Afterward, stability and low volume dominated until right before the release at 11am. The numbers, however, didn’t really confirm the worst expectations and, with a projected crop of 530MMT of cane in CS Brasil, the shorts started coming, perhaps sensing an overbought intraday market, and the NY dropped steadily from the highs throughout the next hour until reaching unchanged at settlement in the first prompt.The sharp 2.5% rise in the BRL today contributed to lower prices on the back of the board, and without the producer selling pressure the spreads once again ended slightly weaker. Without many new fundamental drivers to watch, we keep an eye on the Chinese success in fighting the virus (which by the way sent metals and energy markets soaring today), a more clement weather in Brazil in the short term, and the Jackson Hole symposium which has the ability to drive the big bucks.

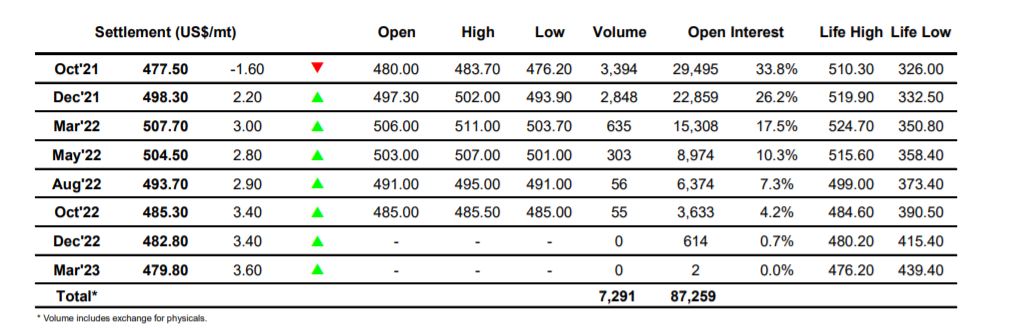

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract