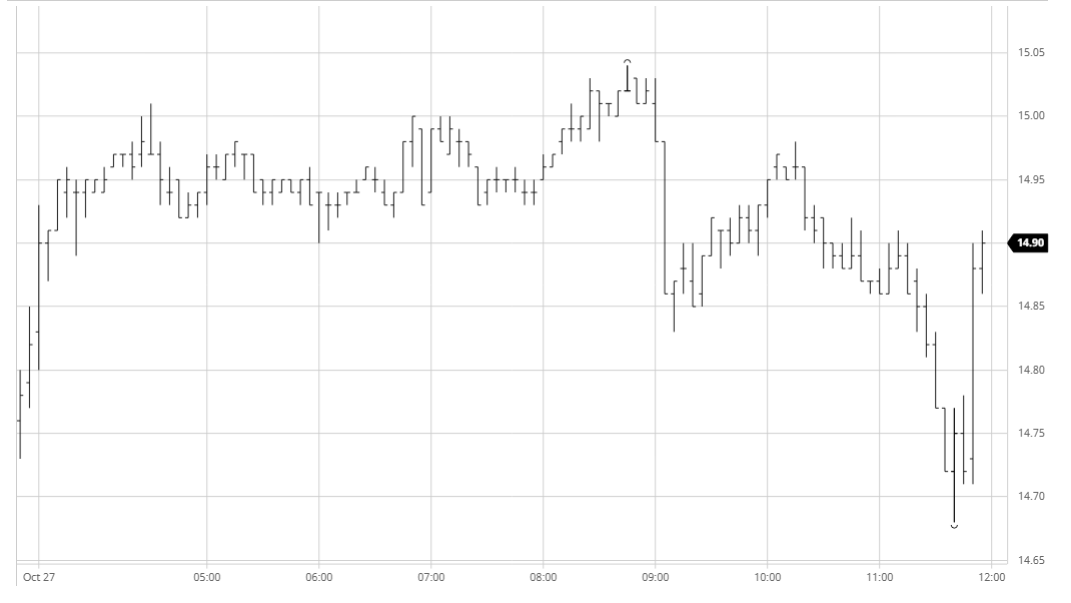

Spec activity continues strong, however each time more restricted to the front prompt (SBH1). After yesterday’s lows of 14.40s, specs engaged in recovering the prices and the market settlement of 14.77 gave momentum for a continued rise to the 15.00s today. At exactly 6:30 am (BRT) we had the first high of 15.01, in a movement that gave the impression that specs wanted to survey the market and assess how many stops and resistance would be triggered after crossing this border.

Market eased and traded flat in the mid 14.90s through the day until a second attempt was made and H1 reached 15.04 at 10:47 a.m., the daily high, shortly after which a wave of profit realization took the market down to 14.85. Further recovery was slow, and as soon as market reached 14.99 after the third upward attempt in the day another selling spree drove the market to 14.69.

On the close however, a large market order appeared and pushed H1 all way from 14.73 to 14.90, effectively dictating today’s settlement price of 14.83.

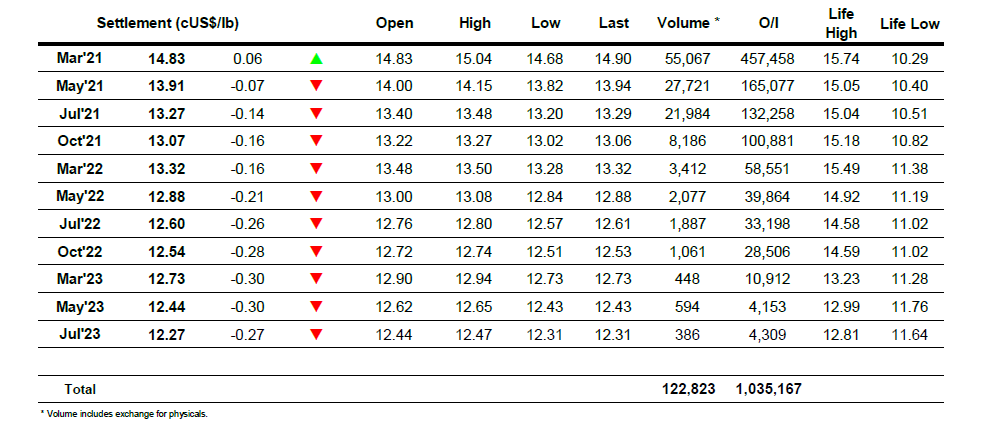

All other prompts closed down, from 0.07 to 0.30 c/lb in relation to the last session. H1K1 spread reached an incredible high of 0.96 c/lb backwardation, settling at 0.92, which suggests that H1 might be entering into overbought territory.

Mar 21 – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

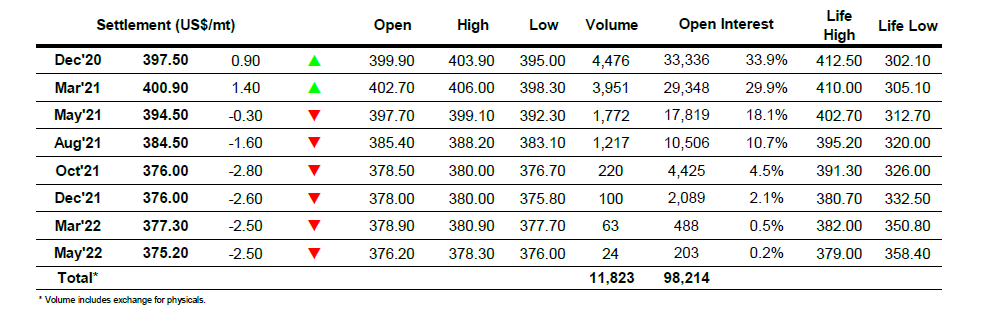

ICE Europe White Sugar Futures Contract