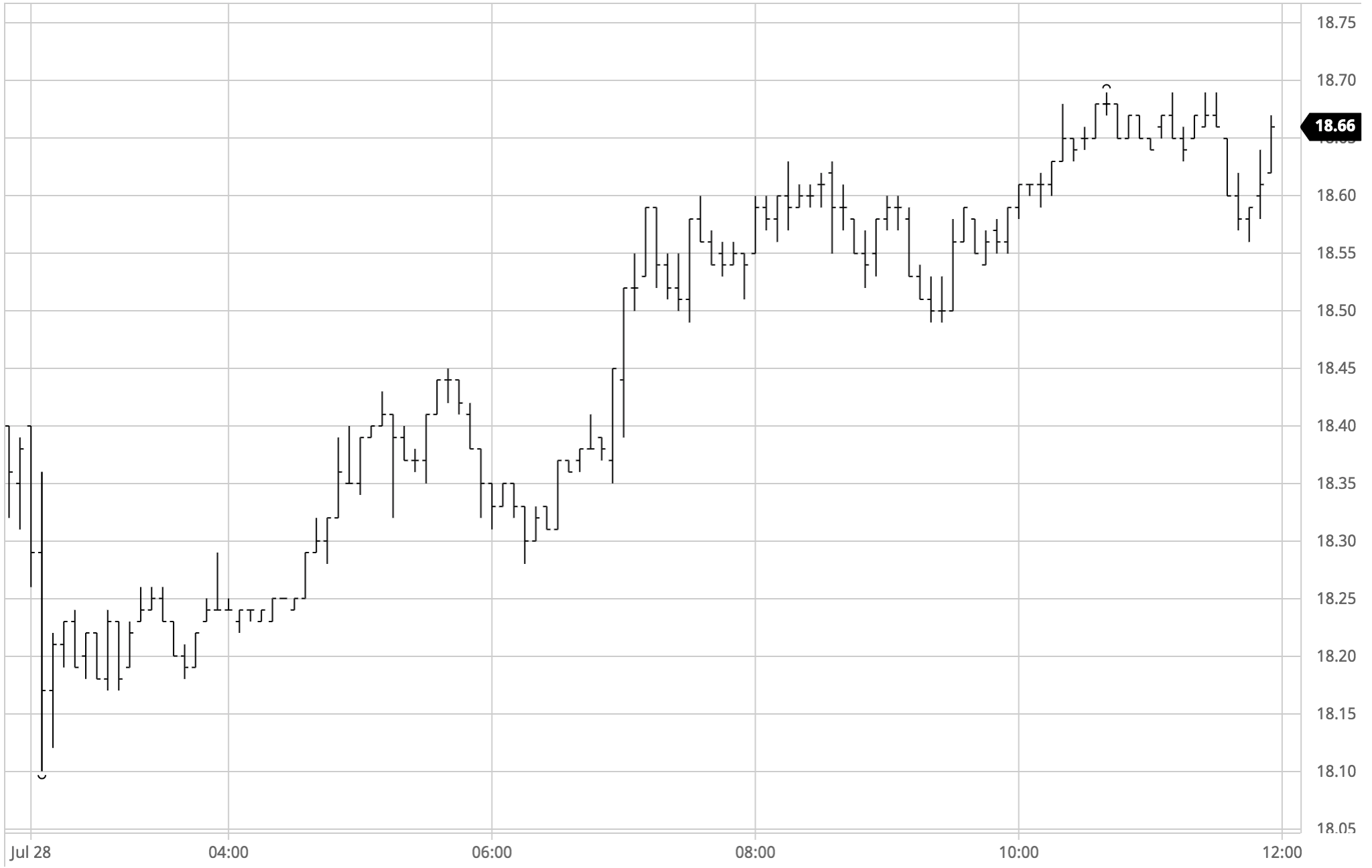

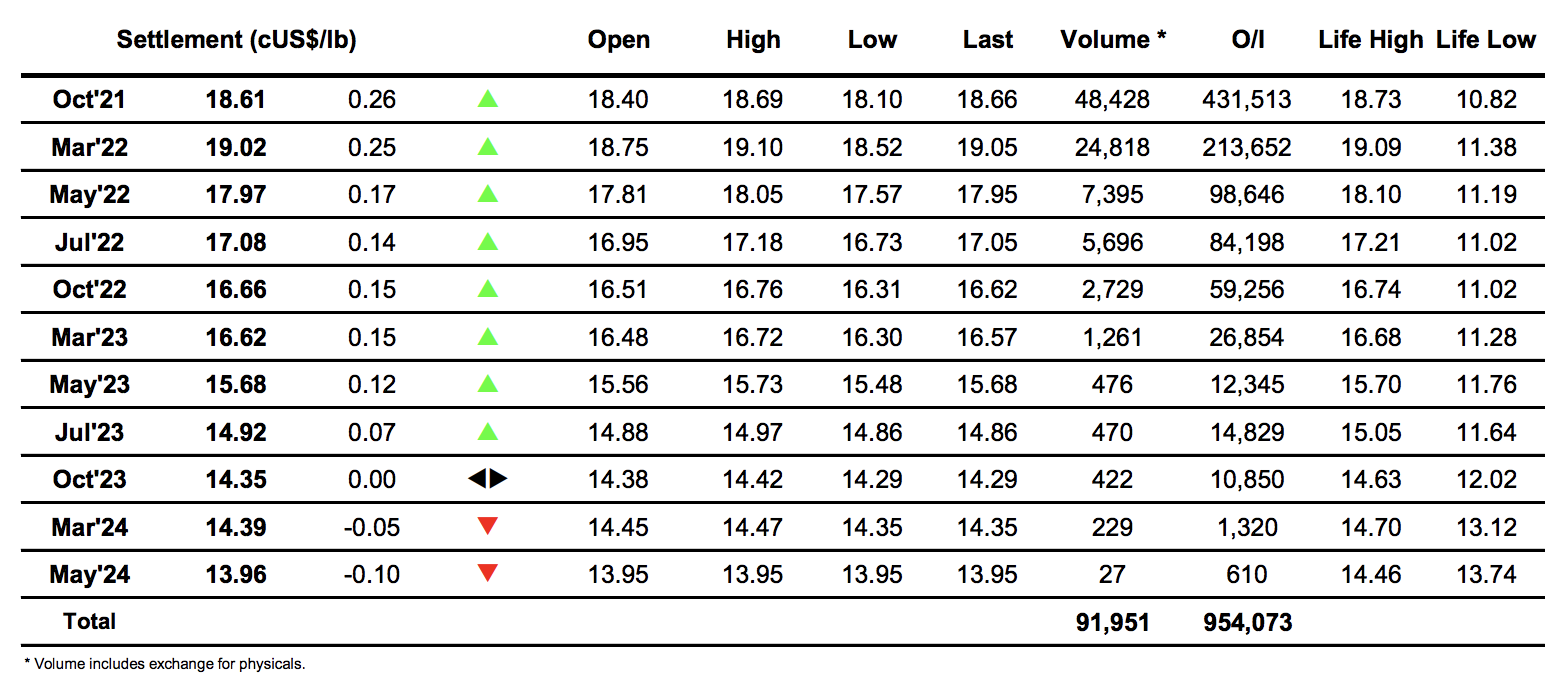

Sugar #11 Oct’21

Having commenced the day slightly higher at 18.40 Oct’21 came under very quick pressure and slipped all the way to 18.10 within the first 10 minutes of trading. This could easily have led to a more significant fall however buying soon crept in to stabilise prices in the 18.20’s for a while prior to pushing back into positive ground late in the morning. Though today was seeing a far more neutral macro position with crude showing little change and the sharp rally in coffee having cooled (at least temporarily) we found some solid buying kick back through during the early afternoon, showing that the specs are determined to maintain the recent technical strength and renew the upside as they look to challenge the 18.94 continuation high. The rise to 18.60 was straightforward but as seen over the past couple of days there is a little more scale selling in place from here upwards and with the spec buying still lacking the kind of size required to get things pumping aggressively the afternoon then became a steady grind up through the 18.60’s, maintaining the strength in the most passive of ways. Stalling at 18.69 through the final couple of hours we saw a few of the longs lighten the load ahead of the closing call, though others stepped in when the time came to ensure that we settled at 18.61. The signs are there that the spec longs wish to continue the recent technical momentum with 18.73 and 18.94 the targets, while to the downside this mornings action again served as a warning that should we stall a sharp correction could easily occur.

Sugar #5 Oct’21

The day commenced with Oct’21 on the backfoot, following No.11 downward to $451.50 and continuing to tick along in debit for the first couple of hours. As has been the case now for a while the pressure upon nearby whites values has made it difficult for us to rally significantly without outside interest and today proved to be no different as values only began to pull away from the lows as No.11 found renewed interest against its own positive technical picture. This enabled some momentum to build which extended the price up through the $450’s to retrace a good chunk of yesterday’s lost ground, though the $460 mark proved a step too far as selling crept in and reapplied pressure to the front month. The selling had only limited impact upon the spreads with Oct/Dec’21 remaining between -$16 and -$15 throughout, however the white premium remains vulnerable and the latest decline sent Oct/Oct’21 down through $50 to yet another new set of lows. The second half of the afternoon saw prices dragged upward once more by the raws though still giving away ground on the white premium, eventually reaching a session high at $461.40 before falling back ahead of the close. Settlement at $458.50 was net positive though nothing has really changed and the whites market still feels vulnerable should macro factors cool.

· Nearby white premiums lost yet more ground though things were flatter down the board. Closing values leave Oct/Oct’21 struggling at $48.20, March/March’22 at $64.60 and May/May’22 at $84.20.

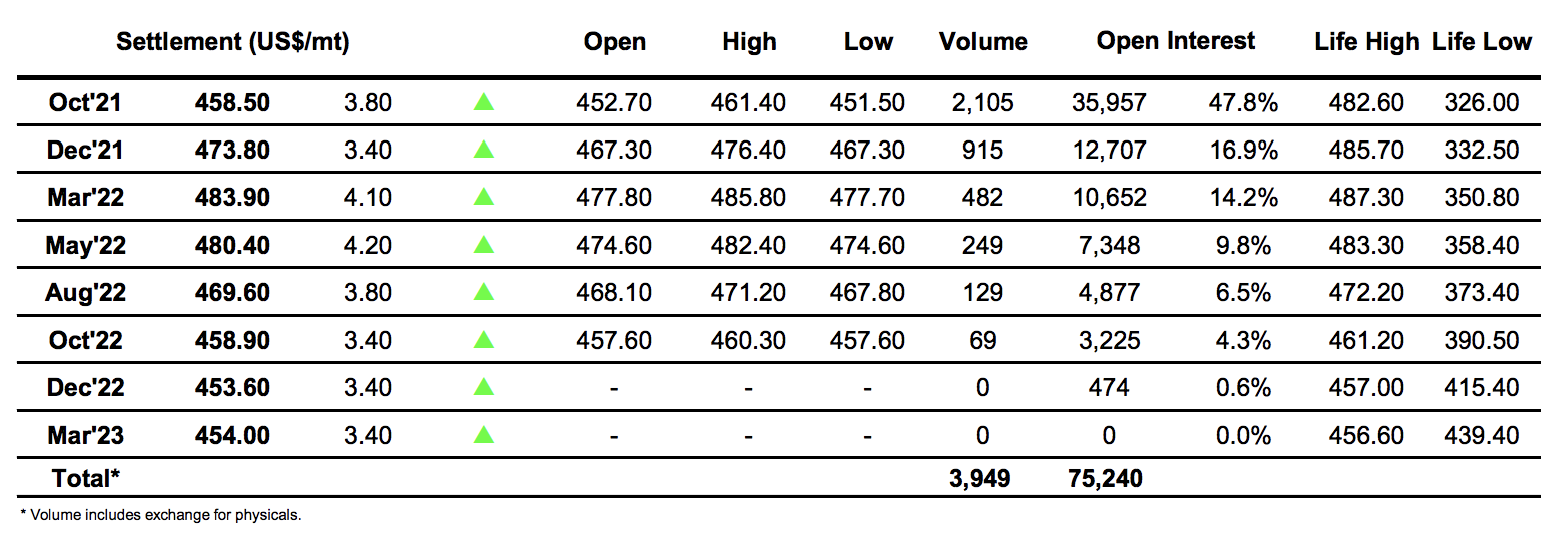

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract