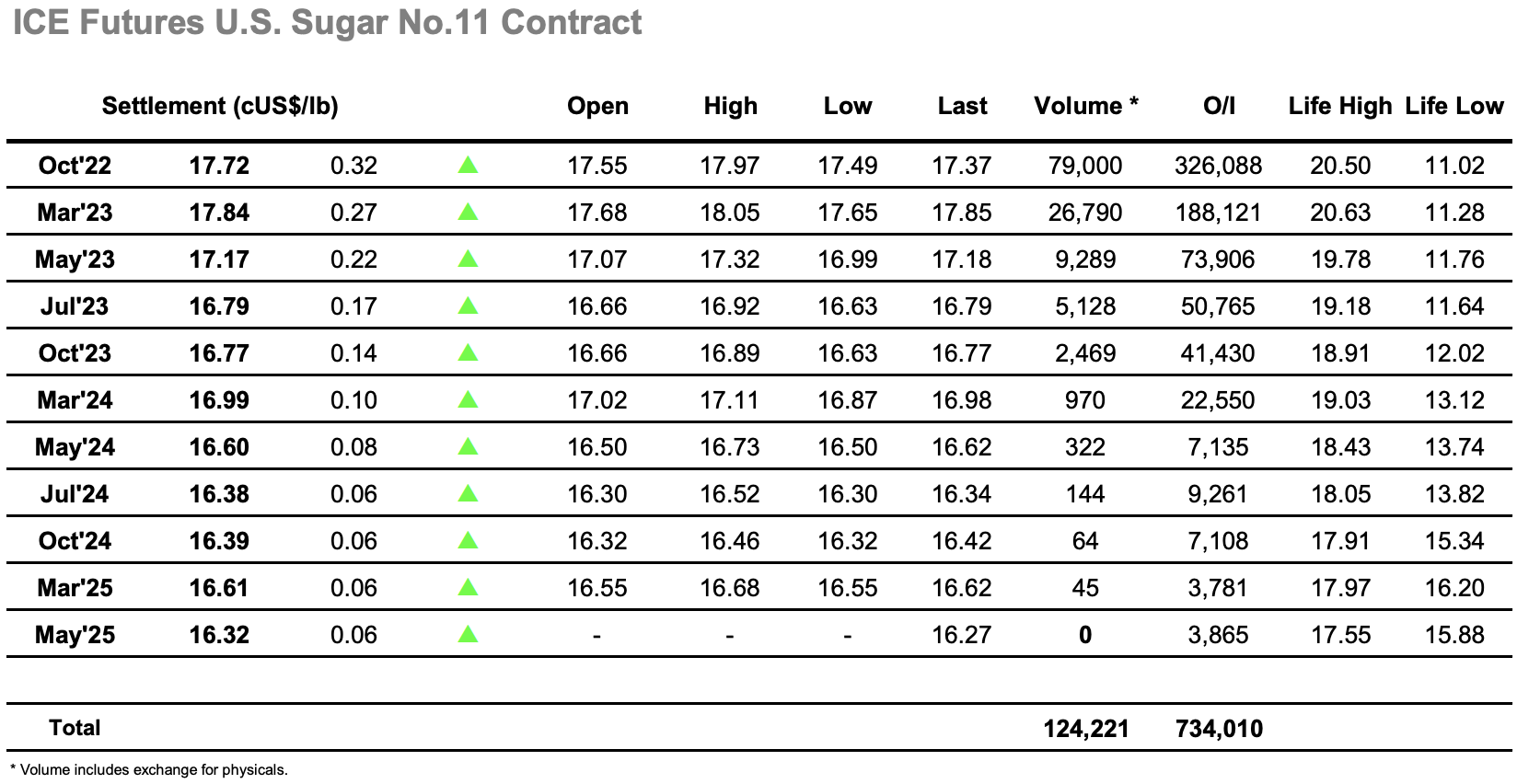

The market popped higher on the opening as once again some hedge lifting took place versus overnight physical activity, and with the specs taking more of a back seat the market was largely able to maintain the gains throughout a quiet morning. There was barely a ripple until the Americas day got underway, and when movement did appear it came from some spec short covering that extended the rally up through an illiquid board to reach 17.81. A small pause followed as the gains were absorbed before another push led to additional short covering in achieving a daily high at 17.97. The movement was mirroring macro gains for the first time this week (the macro has been higher for the past three days) and price action remained buoyant for a period with huge white sugar gains helping to lend support as buying entered the No.11 against premium activity. As that buying eased and with so much of the day’s activities having been spec driven the market slipped back doe to some long liquidation/profit taking which left price action back to the centre of the range as we reached the final hour. Despite easing from the highs, the Oct’22 spreads remained firmer with Oct’22/March’23 holding around -0.12 points having earlier reached a high at -0.08 points, while March/May’23 was trading near to 0.70 points. The closing stages saw no significant movement with prices tracking sideways, leading to an Oct’22 settlement value at 17.72. This further stabilises the market after the sharp recent losses, though questions remain as to whether it could lead to a sustained push higher with such a move requiring the trade to join alongside specs if it is to be successful.

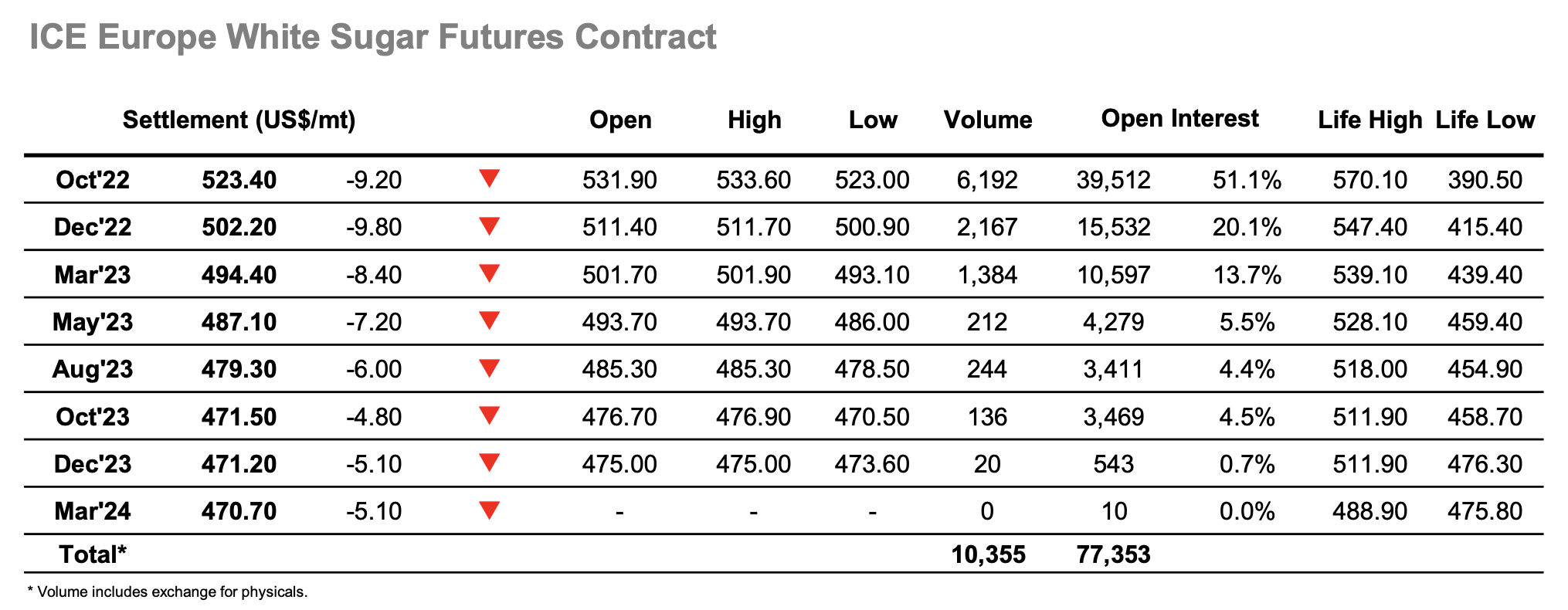

A mildly positive opening attracted some trade/consumer buying into the Oct’22 contract, and while activity was rather mundane the market was able to hold the gains through the first few hours with sellers hard to come by. The picture showed no change until the afternoon when the gains extended a little further as a little more spec buying/short covering entered the Oct’22, possibly in reaction to the macro which was enjoying another day of positive movements. The picture then changed dramatically as some increased buying volume sent Oct’22 above $520.00, soon triggering spec buy stops which punched though the limited selling in place to take the price all the way to $534.00 before pausing to consolidate. It was not just the flat price which showed sweeping gains with The Oct/Oct’22 white premium extending out towards $138.00 in the process while the Oct/Dec’22 spread reached an incredible $33.30. Prices eased back a few dollars on some profit taking however despite the inflated Oct’22 position in comparison to its counterparts the specs returned ahead of the call to bid it back towards the highs and ensure a settlement value at $531.60 with the white premium trading beyond $140.00. A remarkable turnaround leaves Oct’22 having almost completed a 50% retracement of last weeks collapse in a single effort. This pace surely cannot be maintained, particularly if the No.11 doesn’t find the momentum to join at the same rate, and it will be interesting to see what reaction (if any) there is from refiners tomorrow to the white premium movement.