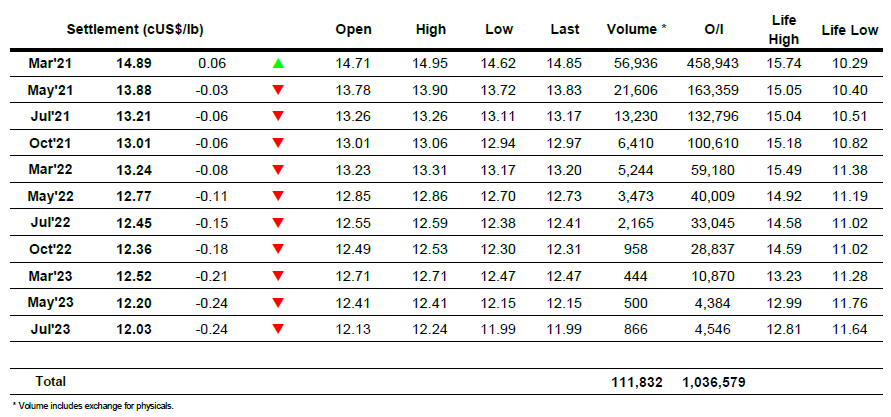

In a day dominated by bearish sentiment throughout the markets, the NY#11 sugar market eased yesterday’s momentum in the morning and retraced back to 14.65.

Specs however didn’t seem to care and after 9 am (the quintessential hour in the sugar market these days) we saw a 10 point jump on H1 right from the start, followed by producer selling and yet another 20 point jump that drove the market all the way to 14.85. After a flat end of morning, specs resumed pushing the market all the way to 14.94 before a wave of realization came to the market and drove it back to 14.80, closing however at 14.89.

The H1K1 spread reach an astonishing 1.05 backwardation, settling at 1.01 and the rest of the board saw the usual low volume and strong depreciation up to 1.96%. It is indeed a very puzzling situation, especially when coupled with the recent news of additional sugar coming from CS Brazil.

Proponents of the H1 at 16.00 and HK going to +1.15 (which at this point is not that far away anyways…) argue that China’s interest is still strong, and there might be a lot of short covering from mills and trading houses due to the increased margin pressure, and Thailand’s poor crop. Proponents of a bearish market cling to the Indian subsidies but in the end the market is always this freight train ready to run over everyone’s fundamentals. Let’s wait and see.

Mar 21 – Sugar No.11

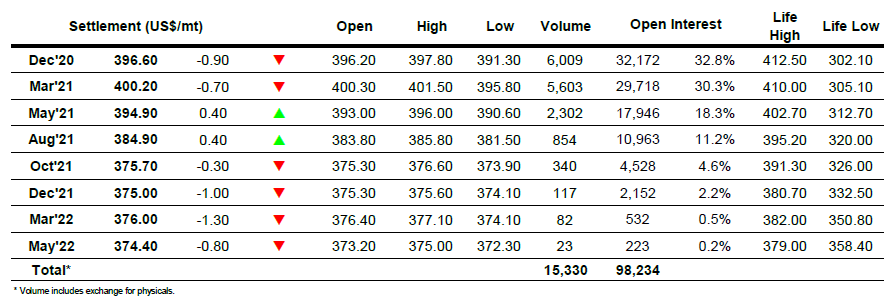

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract