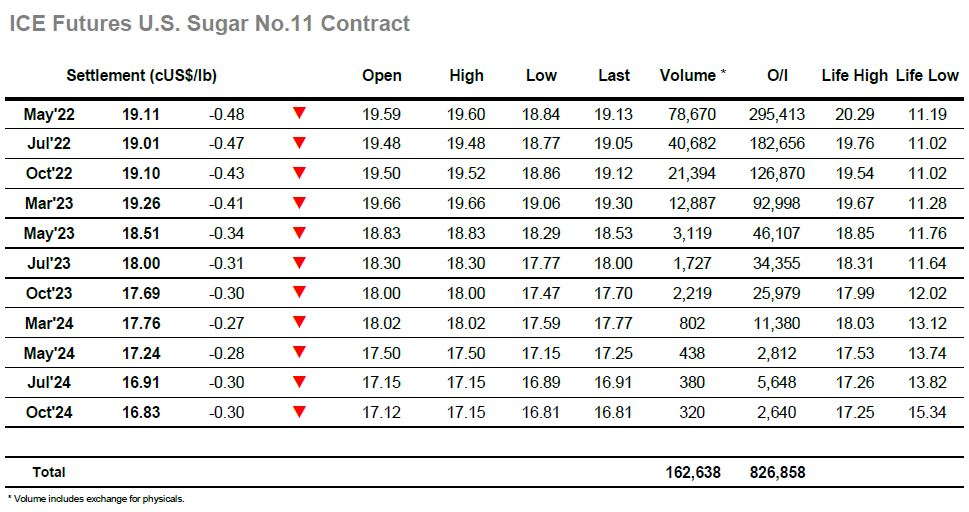

Sugar #11 May’22

We woke to a more mixed macro picture however crude values had continued to suffer following our close last night and so in eyes of some this painted a negative bias to start the day. In the event prices were only marginally down with single digit losses showing across the board against very light volume, a pattern which maintained throughout a quiet morning period. There seemed little on the horizon to break this pattern when news broke that an agreement has been reached to temporarily reduce some Russian military operations in Ukraine, bringing spec selling to the macro which triggered a price plunge. May’22 fell sharply to a low at 18.84 over the course of the next hour though spreads held up reasonably well as losses were felt down the board. It was only sub 19c that a combination of short covering and some opportunistic consumer pricing provided the basis from which process could consolidate, something the proceeded to do comfortably for the rest of the session. Most markets performed similarly, seemingly acknowledging that the news merely represents a step forward but with no guarantees the progress will continue, and by the close we had meandered to a May’22 settlement value at 19.11. Today serves to remind us that the Ukraine conflict is key to the current macro movements, and in turn our own as this retains precedence over the fundamental picture for the time being.