Mar 21 – Sugar No.11

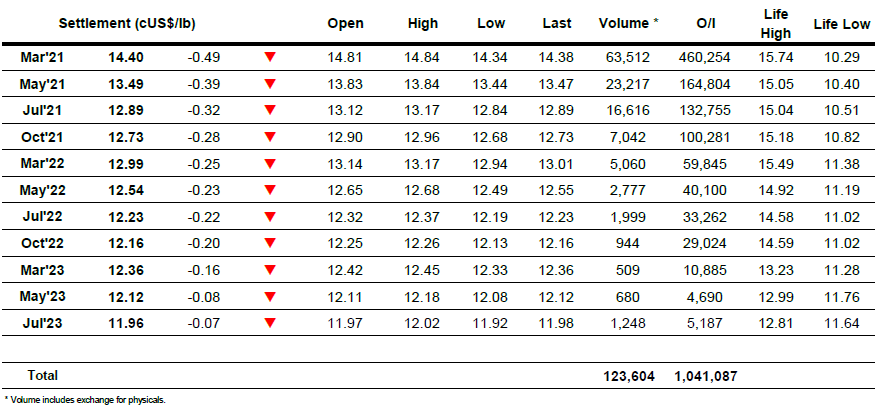

The day began with nearby values finding some light selling pressure to trade around 15 points lower before stabilising throughout the morning and to all intents and purposes it seemed that we were merely consolidating ahead of the US morning in anticipation of further testing of the 15c area. This assumption proved to be misguided as the early afternoon instead brought with it an acceleration of the decline as spec and algo selling sent prices falling rapidly towards Monday’s 14.37 low, in fact trading briefly below this level to register a new weekly low mark of 14.34. Buying was thin on the ground for both the outright and the March’21 spreads which led March/May’21 to give back some of the recent gains and narrow back to 0.90 points. Attempts were made to haul prices back upwards but on each occasion we struggled to work beyond 14.50 and so proved unable to match the resurgence of Mondays performance, most likely due to the wider macro weakness influencing the sentiment from the speculative community. The BRL was also weaker once again and moved to 5.78 to aid overhead sellers, potentially discouraging longs from pushing too hard for fear that there would be resistance in place anyway. A final defensive push from longs sent March’21 back to 14.52 ahead of the call however aggressive MOC selling sent it back down to settle at 14.40 to post the weakest performance seen for several weeks. It will be interesting to see how the market reacts from this.

Dec 20 – Sugar No. 5

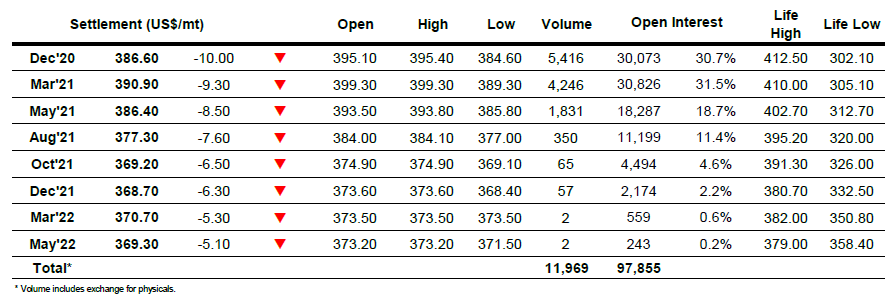

Lower No.11 values prompted a weaker opening today with Dec’20 losing almost $4 over the early part of the session, dragging the rest of the board downwards while also placing the Dec’20/Mar’21 spread under more pressure as it moved back beneath -$4 discount. With buying rather limited and the wider macro picture under pressure the market pulled in more selling as we entered the afternoon which accelerated the decline and sent Dec’20 downwards to two week lows at $386.10. This pressure also had a slight ripple effect into the white premium values with March/March’21 nudging down towards $72 while across the rest of the 2021 positions we gave back a little of the recent gains. In largely quiet trading we continued at the lower end of the day’s range throughout the afternoon with and brief recoveries petering out quite quickly and by late afternoon had recorded fresh session lows. Defensive buying efforts over the final hour looked to pull values back towards mid-range to negate some of the technical implications of today’s fall, however MOC selling then emerged to force prices back downward and establish settlement just $2 above the low at $386.60.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract