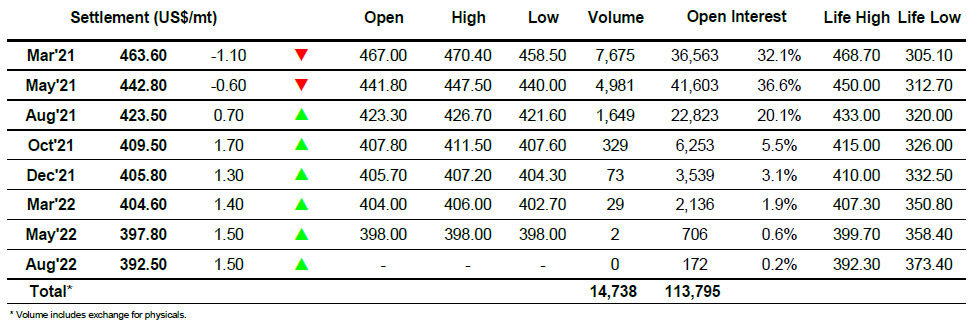

Sugar #11 Mar ’21

A strong burst of early buying sent March’21 immediately up to 16.35 however despite a lack of resting scale selling the continues to aid volatility within the large recent range we soon slipped back towards unchanged levels where we seemed happy to quietly consolidate throughout the rest of the morning. With the start of the US day failing to yield any significant fresh buying we saw a further slide take place to a session low mark of 16.08 and despite the lack of upward momentum there emerged decent interest in holding ahead of the psychologically important 16c level. This paid dividends for the longs as a mid afternoon push sent nearby values rapidly upwards to a session high 16.48, though again there was limited resistance on a move which only really involved the front two prompts and led to a sharp widening of spread differentials to 0.96 points for March/May’21 and 1.58 points for March/Jul’21 which represented a 23 point daily gain. The highs were only seen fleetingly before a slip back into the range and continuing fall which during the final hour saw us match the 16.08 morning low. Though the flat price was struggling there were no such issues for the spreads which continued to send out a positive message by remaining only a few points shy of their widest levels and whether it was this that acted as motivation or merely a desire to defend long positions we saw the market come to life again during the closing stages with another push upward. The aggressive move ensured that March’21 settled the day positively at 16.29 and continued through the post close with final trades at 16.37 as the longs attempt to line up a continuation of the upward momentum tomorrow.

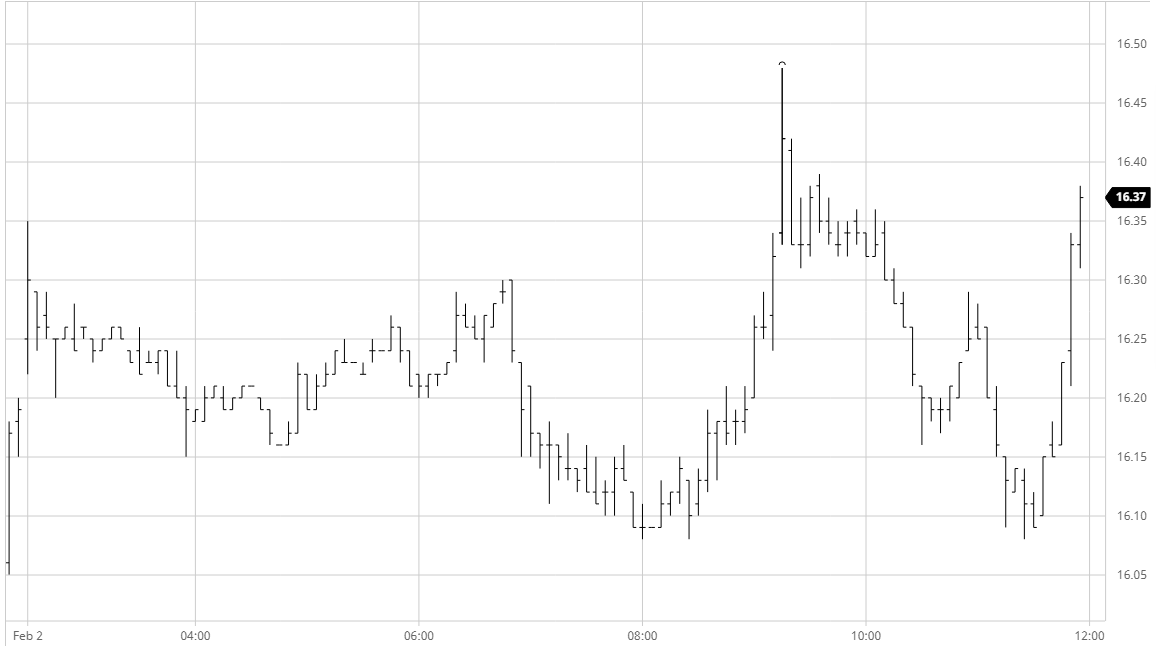

Sugar #5 Mar ’21

There was some early buying around this morning which was no great surprise following on from the barnstorming performance yesterday however we stalled in front of the $468.70 contract high mark and subsequently eased back to spend the rest of the morning either side of unchanged. The slow sideways action was broken in spectacular fashion early in the afternoon with a burst of buying that punched to a new contract high mark of $470.40, aided by a lack of selling depth as we made the move from $465.00 on fewer than 500 lots of volume. The move stretched out white premium values once more due to the No.11 lagging behind and we reached $112 for March/March’21, $108 for May/May’21 and moved above $98 for the Aug/Jul’21 as the middle months held on to the coat tails of the nearby buying. The March/May’21 spread remained steady but was struggling to build upon the sweeping gains made during yesterday’s session with fresh buying now moving towards the May’21 as the March’21 gets nearer to expiry, though as we moved further into the afternoon some selling emerged (possibly spec rolling) which pushed the value south of $20. Having eased hold to unchanged levels once again a brief push upward in reaction to No.11 strength proved short-lived and the later afternoon then saw more rapid losses with the front month below $460 and May’21 reaching $440 during the final hour. Any thoughts that this may lead to a weak conclusion were banished by some very aggressive closing buying which led March’21 back above $466 heading out, though settlement was lower at $463.60.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract