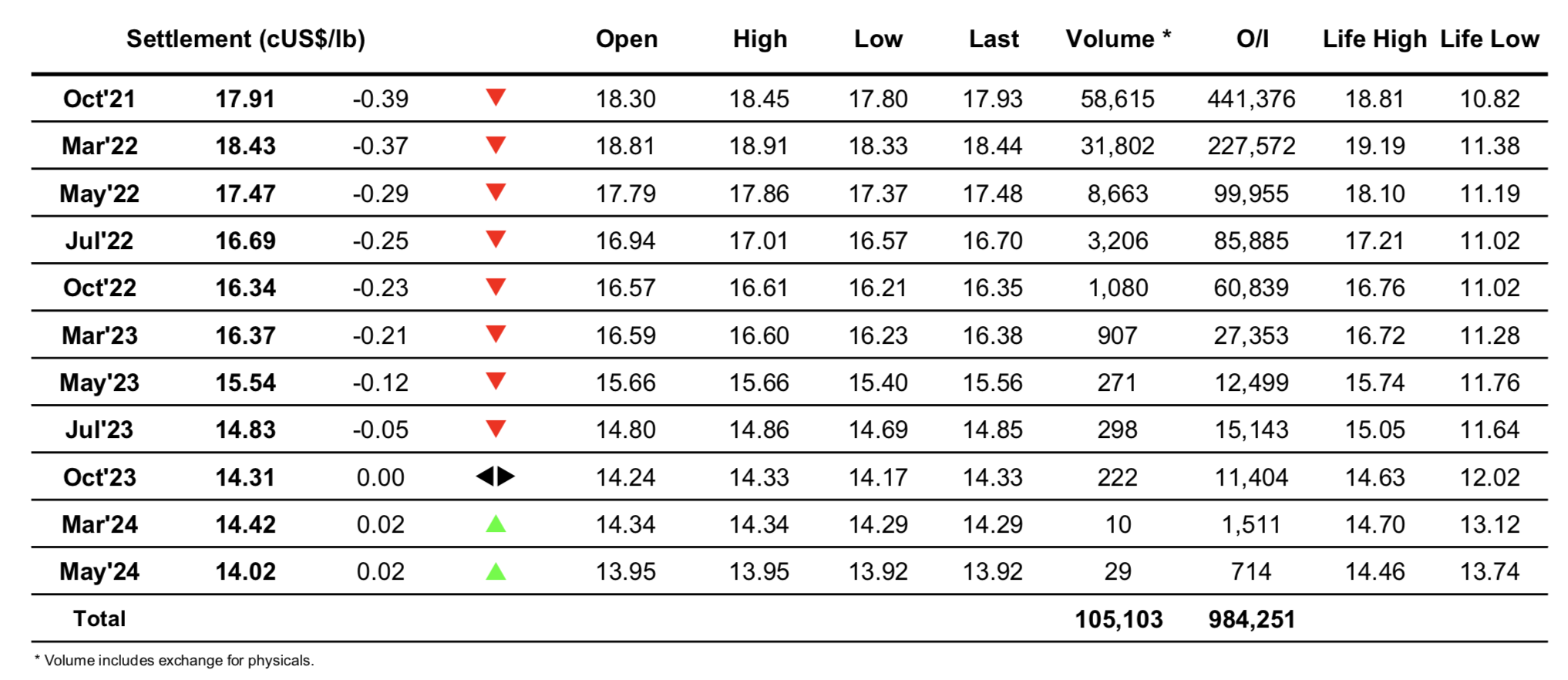

Sugar #11 Oct’21

A mixed opening saw Oct’21 trading either side of unchanged levels though defensive buying was the more dominant factor and we worked up to 18.45 as hedge lifting combined with spec activity from those looking to reverse yesterday’s decline and maintain the recent upward trajectory. The early ammunition was fairly limited and following an easing back to unchanged levels the market ran into some light stops as these longs hit the exit button with a spike back down to 18.03 before regathering and entering a period of consolidation either side of 18.20. The signs were worrying for the bulls with the macro showing weakness across the board and in particular coffee which was giving back another significant chunk of last weeks gains with the worst of the Brazilian frosts now seemingly behind us. Recent Indian activity has also shown that the market may struggle to push beyond the recent highs without fresh reason as spec buying eases and the potential for further sales should the levels become attractive remains, and with this in mind we seemed content to chunter along in the range well into the afternoon. Specs would still have been hoping to hold above 18c to maintain some psychological positivity however that possibility also deserted during the final couple of hours as a delve lower found more sell stops which extended the day down to 17.80 while also weakening nearby spreads with Oct’21/Mar’22 reaching -0.54 points. Some closing volatility left Oct’21 ending the month at 17.91 and while the fundamentals are by no means bearish should the specs stand aside we could well ease back further into the broader recent range. Maybe tonight’s COT will provide a pointer as to how vulnerable the shorter term spec position could be.

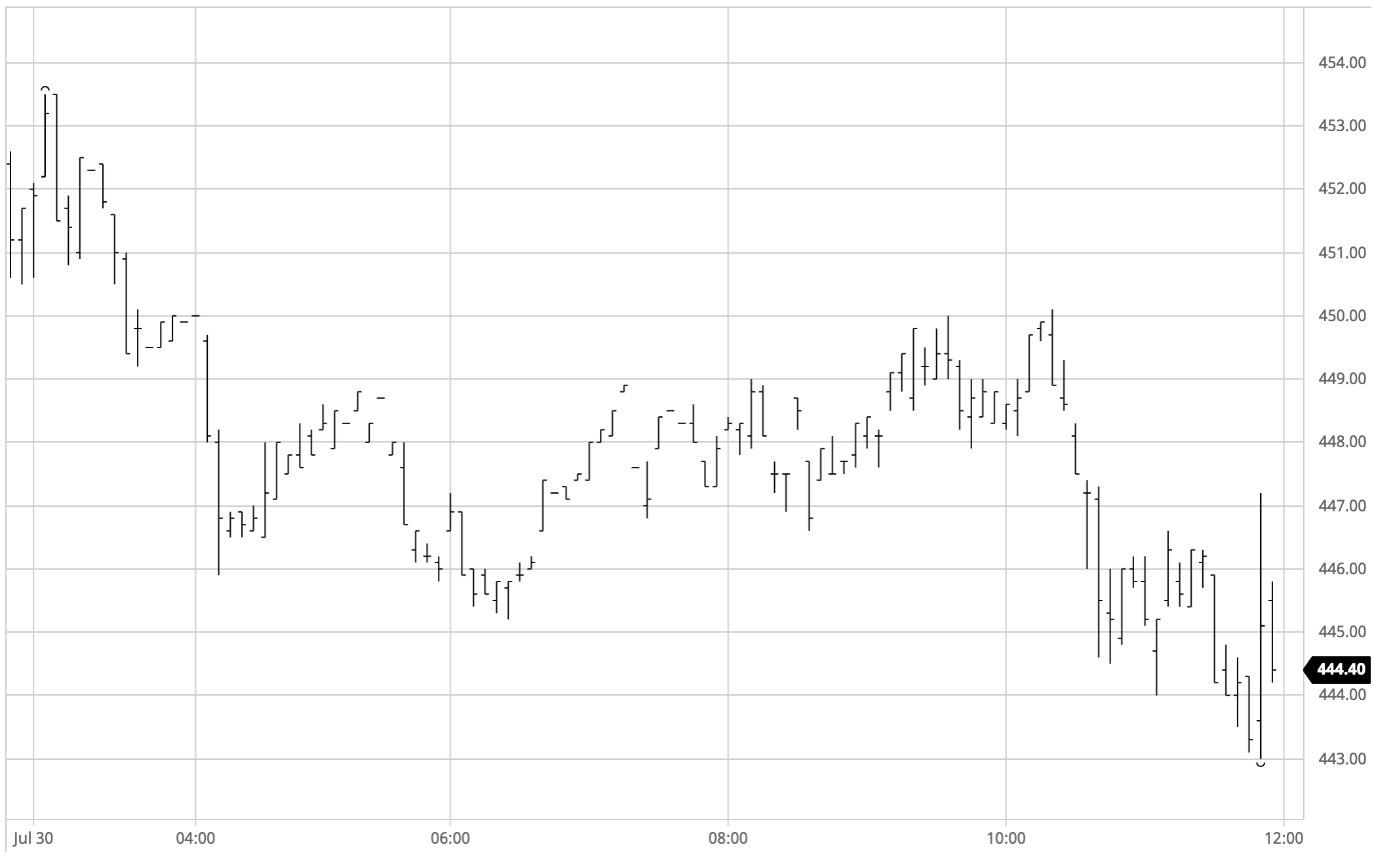

Sugar #5 Oct’21

Opening buying picked the market up a little with some hedge lifting against overnight physical activity taking place, however the volume was limited and as the buying soon dried up so the price slipped back to the $450 area and brought the feeling of vulnerability back to the surface. With the macro having cooled and coffee in particular retreating following the excitement of the Brazilian frost led rally there was little reason to hold and the absence of buying allowed prices to slide back to the mid $440’s by the end of the morning to bring the whole $443.50/$442.00 support area firmly back into view. As with the middle of the month some better buying continues to be seen from consumers in this area and this allowed values to consolidate through the afternoon while simultaneously bringing some relief to the white premium values which recovered against weakening No.11 values to send Oct/Oct’21 up towards the relative height’s of $52. All appeared calm during the afternoon with Oct’21 trading to $450 with a couple of hours remaining however we were pulled back downwards into the support area by renewed No.11 weakness and ultimately recorded a low at $443.00 heading into the close. Such was the volatile nature of the call that we settled away from the lows at $445.70 though with the overall picture remaining vulnerable the $442 level seems set to be tested as we begin the new month.

· As mentioned there was a recovery for the white premiums today, pulling away from the lows to end the month with Oct/Oct’21 valued at $50.90, March/March’22 at $67.90 and May/May’22 at $86.70.

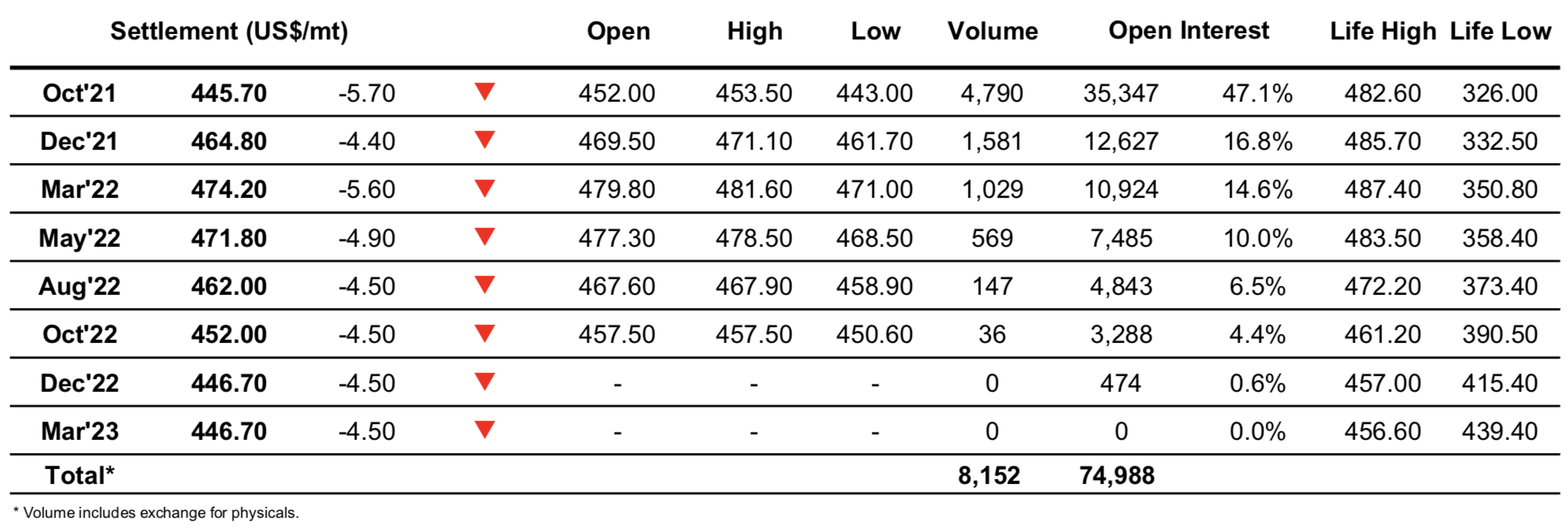

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract