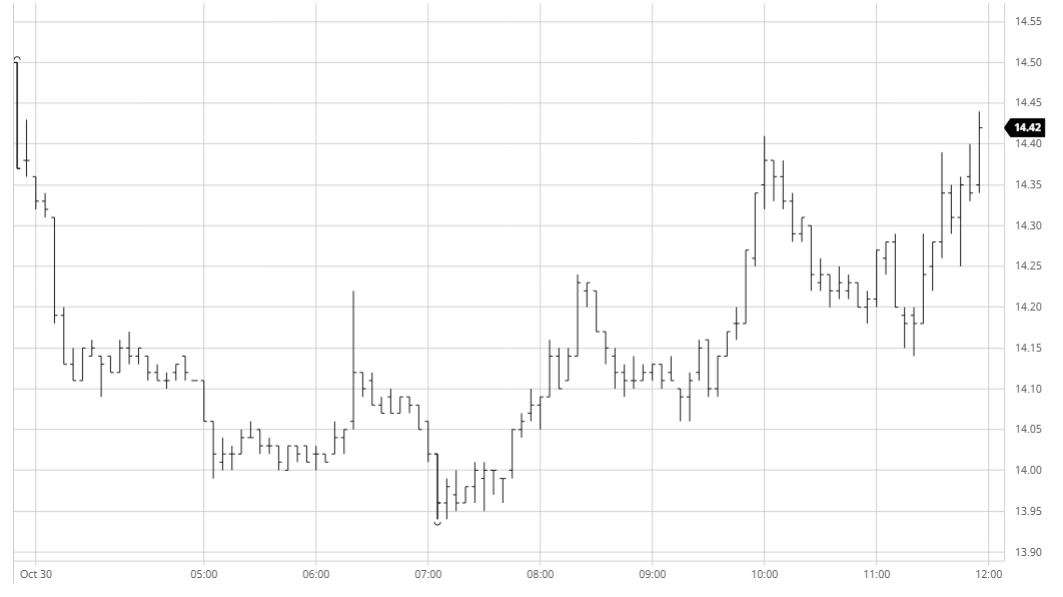

Mar 21 – Sugar No.11

Yesterday’s weak performance prompted an immediate continuation with opening selling soon sending March’21 through yesterday’s lows. Buying remains rather thin on the ground and within the first two hours we had a brief foray through 14c with the 13.99 print providing a stark contrast to the 15.04 high mark seen just three days ago. The Macro was more neutral than for the last couple of days however that did not deter further spec and algo selling as we probed beneath 14c once again to make a new daily low of 13.94 before finding some support. Nearby spreads were also weakening significantly on the fall with March/May’21 narrowing back to 0.78 points, though these then found support which aided the efforts to try and stem the decline and turn the market back upward. A couple of waves of buying led March’21 to wipe out all of the daily losses and reach 14.41 however the move seemed to be driven by spec activity and when their buying eased so we slipped back downward. The only exception was the March/May’21 spread which was now punching back into positive ground to reach 0.95 points, contrary to the flat price and so raising questions as to the nature of market weakness when so often the two would be linked. Having fallen back into the range the specs returned with a final burst of defensive buying ahead of the close which took March’21 to a new session high and also the March/May’21 spread all the way back to 1.02 points (possibly also fund buying?), though settlement remained a few points lower for the day at 14.36. Consensus is that tonight’s COT may show the funds around 265,000 lots long and though there has been some reduction of their holding over the past two sessions there can be no doubt that most of it remains and that they will be keen to try and defend it as we move forward.

Dec 20 – Sugar No. 5

The market began on the back foot and we gapped lower with early selling continuing yesterday’s downward momentum and leading Dec’20 down to $380.40. A little light consumer support stemmed the decline initially but a further wave of selling followed to send us to a new low of $378.50 before stabilising. The market then began a slow and steady recovery which was far calmer than that seen for the No.11, leading to some price movement within the nearby white premiums along the way (March/March’21 ranging between $78 and $72.50) while more particularly supported the Dec’20 spreads. As the Dec’20 rose to a session high of $391.70 heading in to the close so the Dec’20/March’21 had erased much of its recent losses and was trading back to just -$0.30 discount and while unable to pull the rest of the board into credit it certainly mitigated a good deal of the earlier technical damage to provide a better end to the week than may have been anticipated this morning.

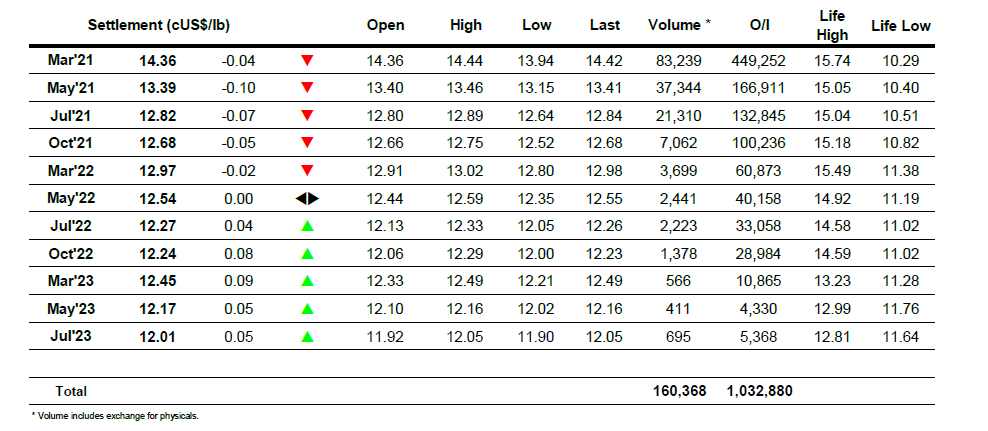

ICE Futures U.S. Sugar No.11 Contract

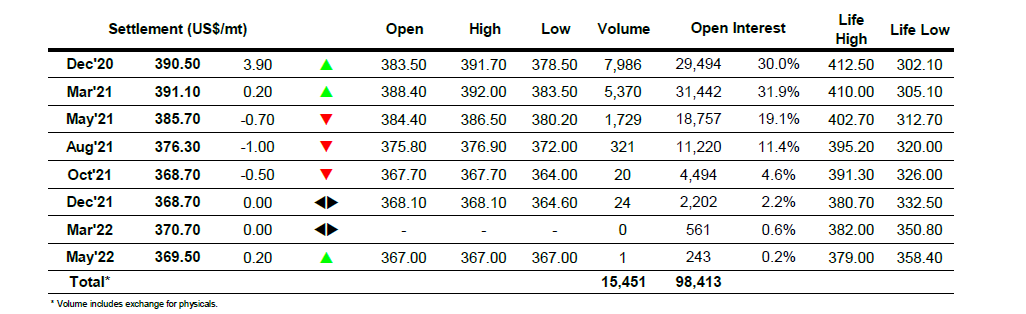

ICE Europe White Sugar Futures Contract