Sugar #11 Oct’21

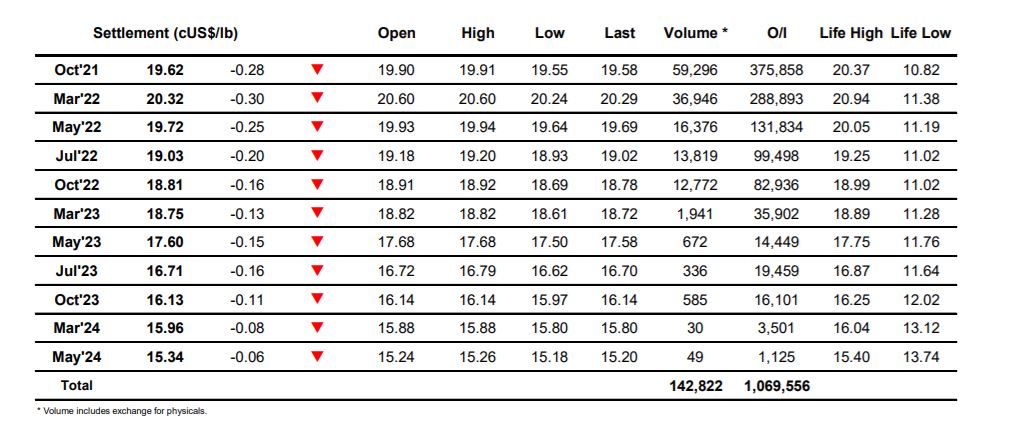

In the NY, the index roll continued, with quite a bit of selling pressure throughout the day. The downward trend on the NY was steady, and the market went slowly from the 19.91 high to settle at 19.58, only 0.03 above the daily lows. The commodities world in general traded mixed, with grains and Iron Ore edging higher and softs losing terrain.On the whites front, spread trading kept dominating todays volume, with a very interesting buying action from commercials on the longer term (22/23), which are taking advantage of the low premiums and heavily backwardated curve.FX in general had gains from the US jobs report, however the Brazilian internal tensions had the say and both FX and Swap rates edged higher, with a particularly strong steepening on the longer tenors, suggesting fears of inflation will last for much longer than expected.

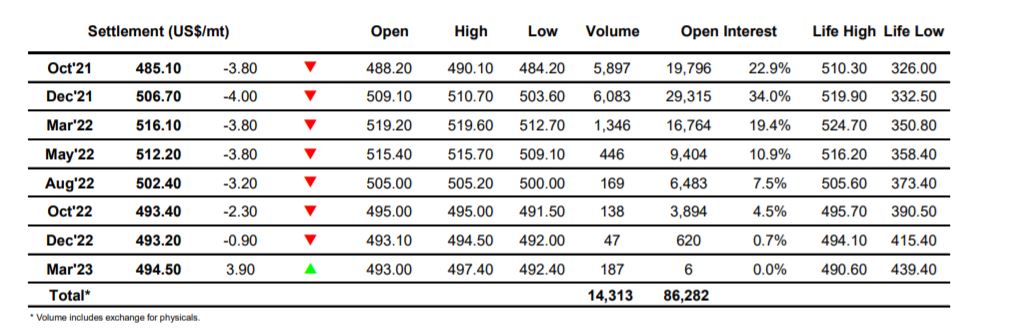

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract