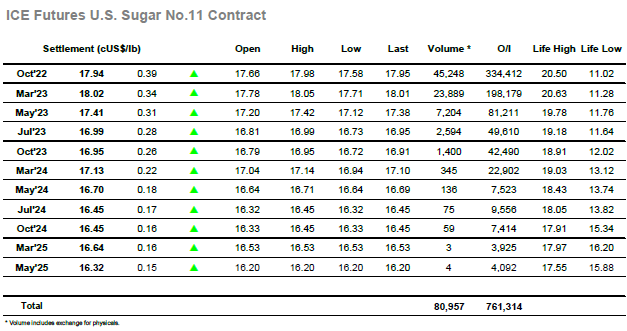

There was some light buying around for the opening today and while the initial gains were not fully maintained the prevailing quiet conditions made it easy for Oct’22 to drift along in the 17.60’s. There was little movement generated by the arrival of US specs with a majority disinterested by the current range, and so it was rather unexpected when a mid-afternoon push higher sent Oct’22 quickly to 17.84, some light spec activity providing the movement into a vacuum of selling. The movement came despite a mixed macro which continues to have little significance over our own daily activities, and while the movement was lacking the extreme strength of the whites it remained constant to eventually see a daily high at 17.98 in the final moments. This still left the market below Wednesdays 18.03 high and suggested that unlike the whites market which ran away to the upside there has so far been a reluctance for specs to swing back long against No.11 at the present time. Settlement at 17.94 does at least provide a platform from which to challenge this recent mark, and despite the lack of trade/consumer interest above 18.00 should the COT report / whites movement provide continued positivity a foray back beyond 18.00 may well follow

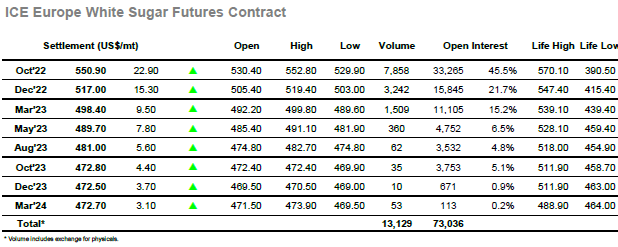

There was precious little to get excited over this morning as the market maintained early gains to trudge along sideways on exceptionally light volume. Recent apathy continued through into the afternoon with the arrival of US traders barely making a difference and the narrow band being maintained, providing a feeling that the market was sleepwalking towards the weekend. Mid afternoon saw the situation change significantly as Oct’22 broke higher against spec buying to reach $538.00 on fewer than 700 lots, in the process sending Oct/Dec’22 back out to $30.30 and the Oct/Oct’22 white premium all the way to $146.00. This did not prove to be the end of the move as additional buying for the front of board extended the white premiums values further still, eventually reaching above $156.00 for Oct/Oct’22 and $102.00 for March/March’23. Refiners scale selling was filled along the way and more should be expected for Oct’22 in particular at such lofty levels which provide a great opportunity for them to price existing commitments / further refine. Ending the week Oct’22 settled at $550.90 and Oct/Dec’22 at $33.90, an incredibly strong close which didn’t seem possible just three hours prior. With the move being spec driven it will be interesting to see whether it can be maintained next week, though it seems certain that any sustained progress will require the support of fund buying for No.11 which has so far been limited.