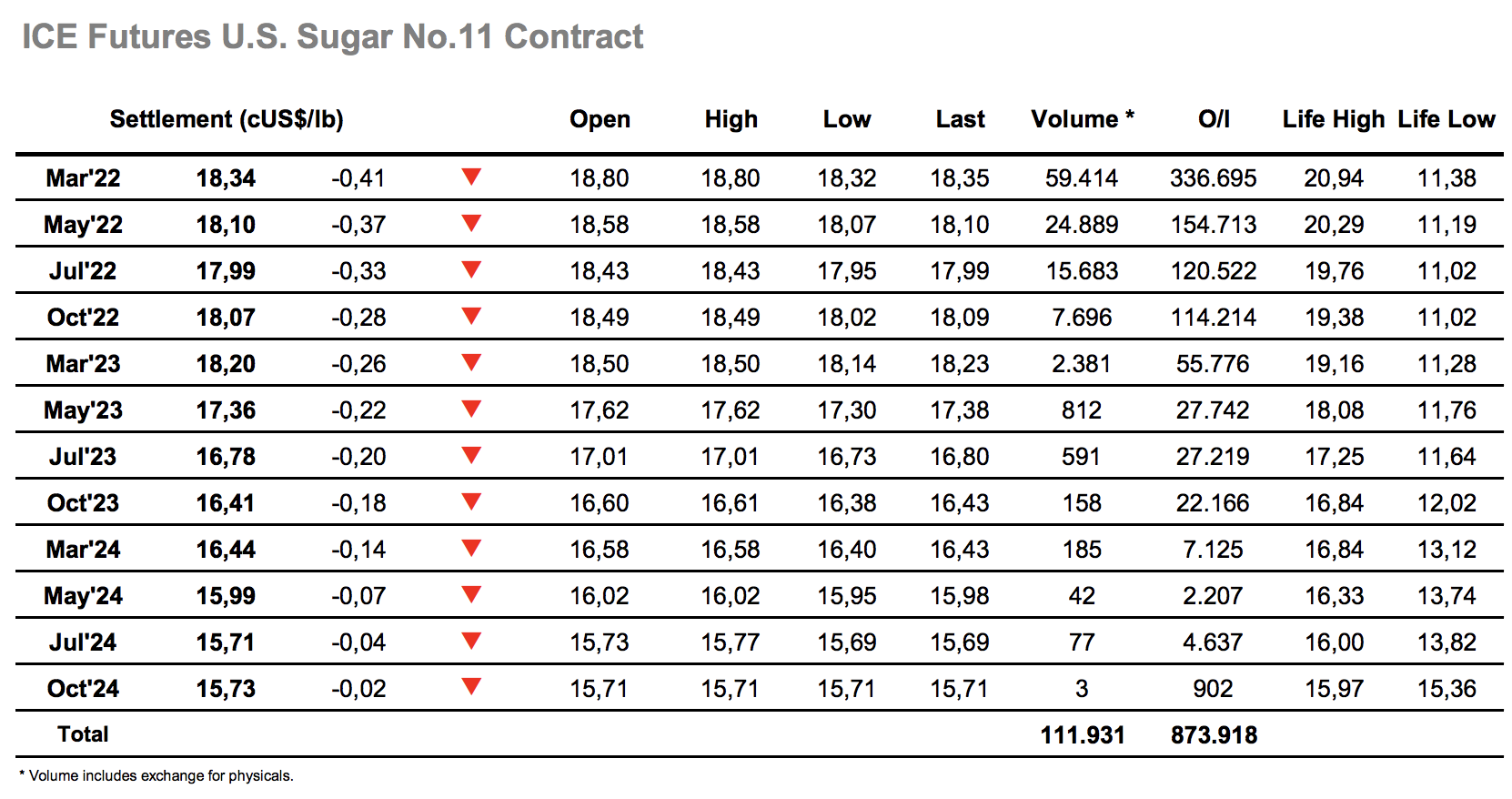

Sugar #11 Mar ’22

The tone for the day was set on the opening as March’22 was sold down from 18.80 to 18.63 on just 800 lots of volume, illustrating the lack of underlying consumer interest ahead of 18.50. As better buying then started to emerge in the 18.50’s things began to settle down and the rest of the morning became rather calm as we settled into a tight range wither side of 18.60. Recent times have seen the speculative sector continuing to reduce their net long position and their absence from the long side is having a significant impact with no other interest in taking up the mantle despite some increasingly vulnerable technical. Moving through the early afternoon the price edged closer to 18.50, drawing attention towards the 18.46 low of early December, and this level was breeched by some aggressive selling that quickly nudged the price to 18.41, though the impact of any sell stops was limited due to ongoing scale buy orders. There proved to be no way back for the flat price as the final three hours played out at the bottom of the range, occasionally extending the losses to touch 18.32 late on. In contrast to the flat price weakness the spreads were more robust with only moderate losses for March/May’22 as it settled at 0.24 points, while March’22 closed a mere 2 ticks above the low at 18.34. On such a poor technical showing we appear vulnerable to further losses however that is by no means certain with the lowest price since last August having the potential to raise some physical interest. Either way it will be interesting environment to see whether we are leaving the range or merely extending the parameters.

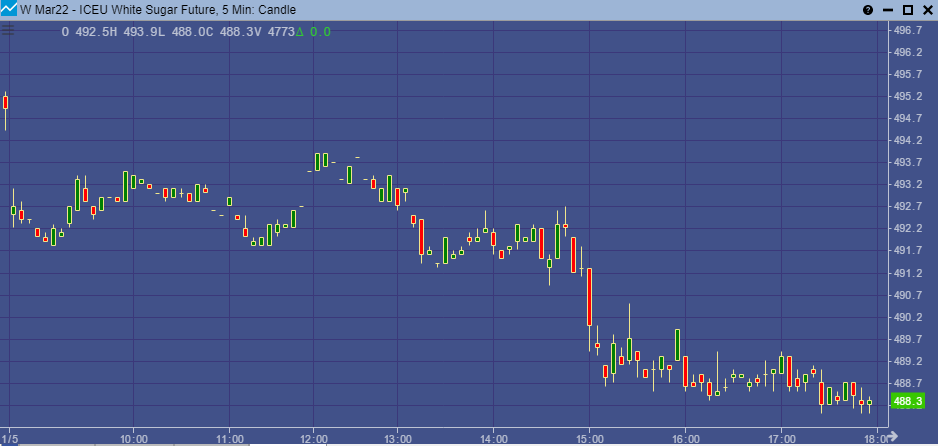

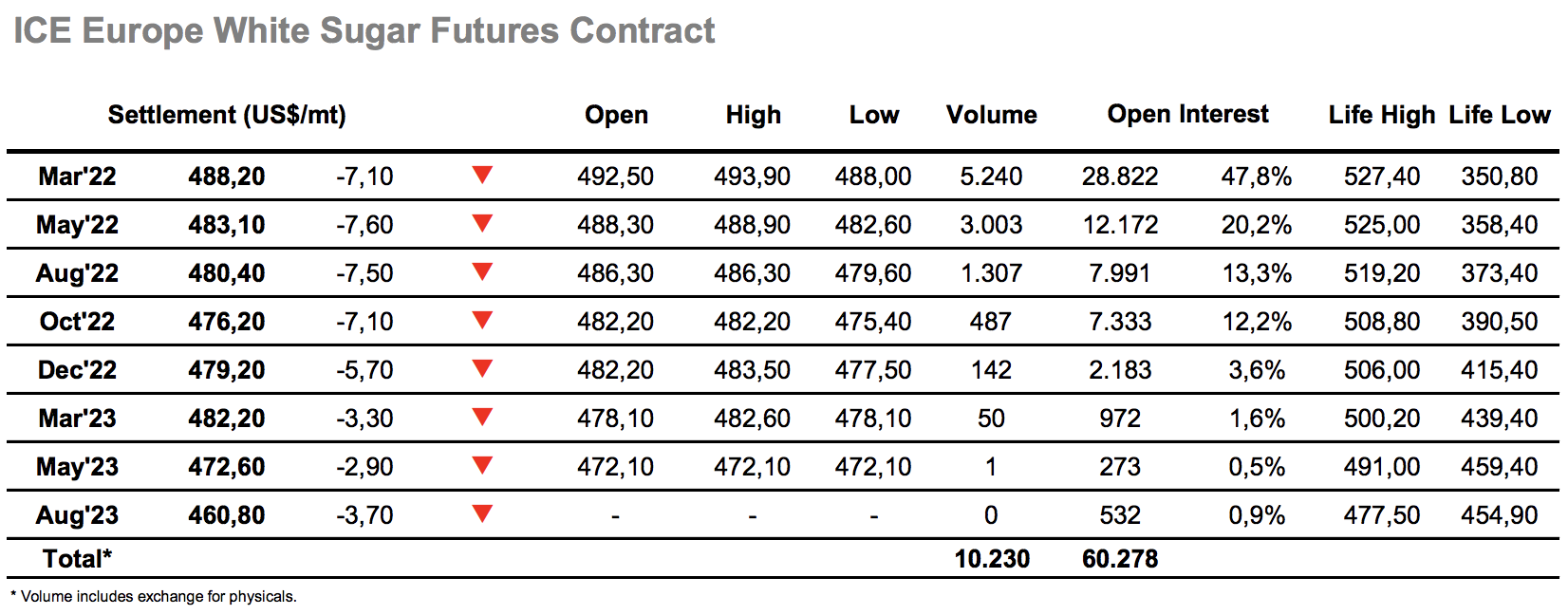

Sugar #5 Mar’22

The weak start to the year continued as the opening saw the intra-day chart gap lower on the back of weaker No.11 values. Finding support in the lower $490’s the market made efforts to consolidate and performed reasonably well over the course of a quiet morning in pushing back up a touch and partially fill the overnight gap. There was little change to the picture until mid-afternoon when the next round of selling kicked in to push the front of the board down beneath $490, though as with recent action we performed marginally better than the No.11 which allowed white premiums to edge up by a dollar or so. The relative performance of the spreads was also positive with March/May’22 holding flat neat to $5, and though the flat price was edging closer to the support provided by December lows at $486.50 and $482.50 at no point did it seem likely they would be challenged. Volume was better than recent weeks as scale buying continued to be filled in, and the day concluded right above the lows with March’22 settling at $488.20. Moving forward the No.11 is showing greater technical weakness than the whites, providing an interesting dilemma as to which way things move and also as to how much it may sway the premium values.